Businesses don’t exist in a bubble. Competitors always try new tactics to gain market share, leaving you behind. That’s why performing competitive intelligence isn’t optional these days but a must. This guide will walk you through the details of competitive intelligence, from basic definitions to actionable strategies explaining how to perform it and gain the upper hand.

Imagine, if you will, that you’re a baseball player who’s up to bat.

You’ve no idea what pitch the pitcher is going to throw.

You’ve got no clue where the catchers are planning to move to.

All you can do is make your best guess, right?

Well, not exactly. Each pitcher has their preferred throws, and there’s a good chance they’ll use one that they think you’re weak to. If you prepare for such a pitch, you’re more likely to score a home run ????.

In a way, the world of business is just like the game of baseball. Being able to predict what’s going to happen next will give you a huge advantage. You’ll be able to see your competitors’ latest moves to try and squeeze you out of the market and counteract them.

That, quite simply, is competitive intelligence.

What is competitive intelligence?

Competitive intelligence is data collection and analysis by your organization on its competitors. This is done using openly-available sources, such as:

- Press releases.

- Patent filings.

- Whitepapers.

- And more, which we’ll cover later on.

Public companies are much easier to gather data on, as they are lawfully required to publish their quarterly earnings. Private companies are a little bit more difficult to examine, but there are methods you can use. Legal ones, that is.

Competitive intelligence vs. industrial spying

When we say competitive intelligence, you might think that you’ll be aiming right for the target and getting ahold of your competitors’ strategies directly.

This is not actually the case.

You see, competitive intelligence is done legally.

Every business has a right to keep its inner workings a secret, especially concerning its information. Stealing that information is highly illegal as it would involve either breach of contract or hacking into their servers.

Information gathered illegally can, of course, be used to make decisions, but that’s not competitive intelligence – it’s industrial espionage, which we strongly discourage.

How do you get competitive intelligence?

Competitive intelligence has many sources.

Which ones you turn to will largely depend on your intentions when performing your research. Nevertheless, all of them can provide valuable data if analyzed correctly.

Blog content

The content that your competitors write about on their blogs is a gold mine of information. Not only does it tell you what type of consumer they’re hoping to attract, but how they’re hoping to attract them.

Just like our blog, you’ll find a variety of topics based around the general market that your rivals are in being written and posted. Some of them might seem to have little relevance, but when you analyze them fully, you’ll find ways in which they link back to your competitors’ game plans.

We wouldn’t be writing about competitive intelligence here at Revuze if our software couldn’t help in that regard, now would we? Our AI can help you obtain competitive intelligence in real-time, so feel free to book a demo if you’d like to learn more.

Social media

Social media often has a news component for businesses, whereby they keep their stakeholders updated with their new and ongoing dealings.

Thanks to this, they’re prime information sources. New product launches, new deals, and customer responses, you can find a lot of data on these platforms.

You might think that a lot of social media information can only be used in reactive responses rather than proactively, and in a sense, you’re both right and wrong.

You can only respond to each individual piece of information, however, they may reveal a trend that shows your competition’s ongoing strategies.

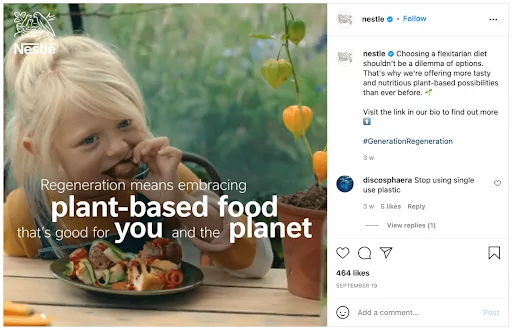

Take, for instance, the example below from Nestle.

Taken individually, each advertisement gives off a different message. The first one showcases the benefits of plant-based food, the second promotes involving children in your cooking.

When looked at together, they tell a different story. Nestle is promoting healthy eating, presumably because they want to boost sales of their healthy eating product lines. This is a bold new direction for a company known mostly for its chocolate and confectionary sales.

Reviews & feedback

Whenever your rivals launch new products or services, the first thing you should look at is their reviews.

Not only will they give you insight into what your competition is trying to achieve, but they’ll tell you the audience’s response to it.

There’s no use creating the perfect egg scrambler if your customers want their eggs fried, after all.

Reviews are useful for existing products too, with any changes reflected in the feedback they receive.

Job boards

While not the most intuitive of places to look, job boards can nevertheless be a valuable source of information.

Imagine for a second that your main rival has suddenly posted a lot of job openings in their R&D department. This is pretty unusual since they typically have a low personnel turnover rate.

So what’s going on? Well, there are several options:

- They’re looking to expand their R&D department permanently.

- They’re starting an experimental project which they aren’t sure will succeed.

- They’re feeling behind on their research and want to hire more staff to catch up.

In the case of the first option, the job listings would be permanent posts. In the case of the other two, they’d likely be temporary.

The second option might also be listed as “temporary with a possibility of becoming permanent.”

Just like that, simply by keeping an eye on the job boards, you’ve gained valuable information on what your rival is up to.

Financial statements

As mentioned previously, public companies have to release their financial statements quarterly. With this data in hand, you can see:

- Where they’re earning the most money, in essence, what areas they rely on.

- Where they’re earning more money than last quarter, therefore growing their operations.

- Where they’re investing their money, what they’re buying, and what they’re not.

- Which strategies of theirs are working, and which aren’t.

Press releases

Business news is absolutely full of valuable information. There will be announcements about new products, new hires, expansion moves, and more.

Some businesses even have a News section on their websites or apps, which coalesces all this information in one place.

Local information

If you’re part of an industry that has brick-and-mortar stores, you can look at the local information surrounding said stores in order to gather information.

What times do your competitors open and close? What area of the town or city are they located in? Do they have a decent amount of floor space dedicated to customers? Do they keep their stock on hand in a back room or a nearby warehouse?

All these little details can tell you what might and might not work in your own stores. Of course, copying your rivals exactly isn’t ideal as they might be constrained by circumstances and not able to operate as they would ideally, but it’s a start.

Legal papers

You can look at legal papers filed by your competitors as they are typically publicly viewable.

For instance, a planning permission request for a large industrial building would indicate that your competitor plans to build a new manufacturing plant or similar establishment.

This tells you that your competitor is trying to expand their manufacturing processes, and if it’s in a new location, you can assume that they’re trying to expand into a new market.

Another great source of information is patent filings. These will tell you not only what your competition is doing but what they plan to make legally exclusive.

It’s sometimes said that there’s not an original thought under the sun that someone hasn’t already had at one point. That’s true in R&D as well.

You might have to end up abandoning your projects or adjusting them not to break copyright law if your competitors patent what you’ve been working on.

Industry conferences

Conferences are similar to news reports, except more detailed. They’re designed to showcase all of the best aspects of a business to others within their industry, whether that’s to attract new customers or collect new talent.

Conferences are often the most detailed sources of information on this list, and that’s for one simple reason. You can actually talk to participants and get their opinions and perspectives.

All news, legal papers, and social network content are heavily moderated by those who release the information. When talking to someone face to face, you can often get far more information.

The downside is the unorganized nature of gathering data at conferences. You also have to factor in the ability to get to the conference, accommodation, etc.

So are conferences worth it to attend? It’s up to you, but we’d say definitely. The rise of virtual conferences is also making attendance easier, so keep an eye out for these opportunities.

What are the goals of competitive intelligence?

So, you might be thinking, why use competitive intelligence?

If it’s all indirect information, is it really going to give me an accurate picture of what my competition is up to?

Competitive intelligence is akin to following footprints in the sand. You might not be there to see the person walk it, but you can see which direction they’re going in, and when they shift or double back on themselves.

You can infer a great deal from indirect information. If you want an example from history, look no further than when Kodak accidentally discovered the Manhattan Project, simply by noticing that they were getting reports of radioactively-contaminated film in the area around the test site.

Anticipating your competitor’s moves

“Know thy enemy, and know thyself,” said Sun Tzu in the Art of War.

While not quite a battle between armies, business is no less competitive. If you know your rivals’ moves before they begin, you will be able to counter them with great effect.

Let’s say that both you and your competitor are in the e-commerce business.

You know from experience that your competitor has put on a Black Friday sale every year, thus you can anticipate that they’ll do the same this year and develop a strategy that accounts for this.

There’s also the option to take a look at their past sales, as well as current hot items, which will give you a clue as to which products they might put on sale this year. If you know which categories they plan to target, you can sidestep or counteract them.

All in all, the best way to counter an opponent’s strategy is to never let it get off the ground in the first place.

Driving your innovation

You always need innovation in order to keep your business fresh and on top of things. This goes doubly so for those dealing with the ecommerce market, where trends and habits change faster than anywhere else.

Competitive intelligence can uncover what it is that your competition has, but more importantly, it can also reveal what they lack and what consumers are after. No one can cover all bases, after all, and by keeping an eye on new opportunities, you can really get ahead in the game.

Keeping track of market conditions

Markets change, and you need to change with them in order to survive.

One of the greatest examples of decision-making in business is Netflix, which in 2007 launched a streaming service alongside its video rental one. This proved a huge hit and allowed Netflix to become the giant that it is today.

Netflix saw which way the wind was blowing as music consumers turned more and more to digital media and decided to follow it. It allowed them to survive a major upheaval in the industry, which many, including Blockbuster, did not.

Netflix’s changes showcase a great example of strategic intelligence in action. Video rental was still popular back in 2007, after all, and they could simply have stuck to it.

Instead, they took account of trends that showed a shift towards online streaming and were able to adapt and weather the storm.

Blockbuster, on the other hand, continued to have faith in their traditional methods and failed to take into account the long-term implications. There’s only one Blockbuster left in the US now, and for a good reason.

Growing your brand to customer expectations

Times change, and so do people. Nobody would say that applying the same business tactics that worked in the 1950s is appropriate in today’s world, but few realize just how fast expectations can change in the age of the internet.

This is something that e-commerce-based businesses especially need to be aware of, what with the internet being an ever-evolving pace.

Payment options, fonts and colors, images – especially if you try to use internet humor to sell your brand – links and plugins, all these can have a massive effect on your ability to sell.

If you use unusual plugins, for instance, you’ll turn off most customers who won’t want to install one to use your store.

If you’re given the option between two sites, one of which requires you to download extra features to use while the other is free of such inconveniences, which would you choose to use?

Links can also break or be archived over time, meaning what worked perfectly one day won’t the next. Relying on other websites to grant information is a tricky business.

If a certain brand that you’re displaying prominently has bad press, you may want to decrease its visibility on your store lest you get a bad reputation by association. Conversely, you can increase the visibility of other brands that have a surge in popularity.

Competitive intelligence will help here, telling you what customers expect from you and what you need to do in order to meet those expectations.

A good example of growth meeting customer expectations is Amazon’s adoption of Venmo as a payment option, allowing those who don’t want to use their bank accounts directly a more secure way to pay.

Credit and debit card fraud has been on the rise over the past few years, making more and more consumers wary of using their cards online.

When using Venmo, your bank information is never directly given to the vendor, meaning that phishing attacks or breaches in Amazon’s security are unlikely to put consumer data at risk.

The COVID-19 pandemic showed just how fast brands needed to be able to change to survive, with plenty of businesses not making it through 2020 intact.

While not exactly a typical event where markets are concerned, it does nevertheless highlight how much circumstances can change in short periods of time.

Knowing your position within the market

Another great example of where competitive intelligence can help you is in finding your market position.

You see, it isn’t always obvious from sales figures and other such indirect data exactly where you stand nor how you are perceived by the consumer base.

Data sources such as reviews, ratings, etc., can give you an insight into the consumers’ minds and how they perceive your brand, letting you assess your standing.

Are you seen as a first-pick, top-rate seller? Are you just a reliable alternative when the usual options aren’t available? Or are you seen as someone niche who fulfills specific demands that only a few consumers would have?

By using this information and comparing it to your strategies, you can see if you’ve achieved your targeted market position. If you have, great! If not, you’ll gain insight into why this is the case and how you might resolve that in the future.

Remember, Spotify was able to alter its position from merely a simple music player to a content creation platform in just a few years, proving that anything is possible if you have the right intelligence.

Staying ahead of your rivals

Let’s go back to the baseball metaphor. Your biggest rival has started upping their game by purchasing new players specifically to beat you.

You can’t stop them from doing this as the people selling the players aren’t going to stop just because you ask nicely. So, what can you do?

Well, there are several ways in which you can undermine them, all above board.

For starters, you can either coach your team in strategies that counteract theirs, or you can hire new players yourself to counteract their changes.

If one pitcher they obtain is known for their difficult-to-hit fastballs, you can hire a hitter who’s known for being able to knock them out of the park.

Secondly, you can put in bids yourself.

Not only can you stop your rival from obtaining certain players that way, but by entering into bidding wars with them, you can potentially limit the number of players they can buy.

An organization only has so much money to throw around, after all.

Following on from that, if you take a look at their team and the players they’re placing bids on, you might be able to see dazzling combinations that would work very well together and disrupt them.

For instance, if you split up a pitcher-catcher combination that is known for doing great together, you can disrupt their seamless play by having their players have to adjust to each other.

In short, just because your competition plans for something to happen doesn’t mean that they will be able to pull it off.

Helping decision making

Finally, we get to the main point that underlies most use of competitive intelligence, that it helps you decide what to do next.

All of the previous examples we’ve mentioned today allow you to make better choices, ultimately helping you make data-driven decisions that will elevate you in the market.

The more information you have, the better a decision you will be able to make.

If the British had known that Washington planned to cross the Delaware, they wouldn’t have simply let him slip through their fingers.

Knowledge is power and some would say knowing your competitors is a superpower.

Types of competitive intelligence

Now that we’ve mentioned why you want to use competitive intelligence, it’s time to take a look at what it is in more depth.

We’ll start by defining the two types, strategic and tactical.

Strategic intelligence

Strategic intelligence is all about long-term thinking. It’s information that could affect the business’ direction over long periods of time.

This type of intelligence isn’t something that you need to worry about right away. However, you shouldn’t let yourself be lulled into a false sense of security.

Some examples of strategic intelligence include how consumers use the internet, for instance, which social media sites they use, which plugins are considered essential, and which browsers are in favor.

Tactical intelligence

Tactical intelligence deals with things that alter your plans in the short term.

This type of intelligence demands an immediate response if you’re going to act on it, and in some cases, you may have to act without having the complete picture.

That said, you shouldn’t let that stop you from making a decision.

In business, it’s often best to make a decision with the information that you currently have rather than miss the opportunity.

Examples of tactical intelligence include new product launches by competitors, new government regulations being introduced, new stores being opened in your area, and disrupted supply chains due to road accidents.

How do you perform competitive intelligence analysis?

If you’ve read this far, you’re probably convinced that competitive intelligence is the right type of analysis for you.

So, how do you go about performing it? We’ve laid out the seven crucial steps below that will assist you in undertaking your analysis.

Decide what you want to achieve

The first step, as with many a project, is to determine what exactly it is that you want to achieve with this analysis.

Do you want to know your position within the market? Perhaps you’d like more information on what your rivals are up to? Or maybe you’d like to scour the market for a gap that you can fill?

Your aims will determine everything, from your information sources to your analysis methods. If you don’t make a firm decision here, you’ll be floundering about during the entire process.

Remember, your business will likely have several different markets that it stretches into. By segmenting your analysis into different sections for each market, you’ll be able to collect data that’s relevant to each without muddying the waters.

The narrower your field, the more precise your information will be.

Identify your competitors

Once you know what you aim to achieve, you can then identify your competitors. These are those businesses who are:

- Within your market.

- Selling similar products.

- Aiming to appeal to the same audience.

- Able to take away your customers.

This is a fairly straightforward step in most cases since you can simply look at who is selling similar products or services to you. The more similar these are, the more they are a direct competitor.

Determine the data you need to collect

Now that you know what information you want to find, and who you want to find it on, it’s time to determine what data will showcase that information.

Are you looking for information on new products that your rivals are launching? Look to reviews, your rivals’ websites, and unboxing videos.

Do you want to know what your competition is up to with their advertising? You need to look at their campaigns and observe the trends.

You can be more specific too, splitting advertisement into online and offline, email and social media, etc. Remember, the more segmented the data, the more precisely you can guess your opponents’ moves.

Find your data sources

Once you’ve determined the data you want to collect, you can pick your data sources.

Products? Find their reviews, look at their product showcases, and check out the product’s sentiment via sentiment analysis.

You can even go so far as to buy one of their products for more direct comparison and testing, and maybe find a way to get an edge that way.

Pricing strategies? Take a look at price trends offered by Amazon, at past offers and pamphlets, and compare them to your own.

SEO tools such as Semrush and Ahrefs will give you detailed information on a variety of topics, as they’ll easily be able to show you which keywords your competitors are aiming to rank strongly in.

If you know where they’re trying to appear in Google searches, you’ll know what kind of customers they’re aiming to attract.

Analyze your data

Next up is data analysis. There are plenty of methods to choose from, some involving software and some involving doing the number crunching yourself.

Some examples include but aren’t limited to:

- Porter’s Five Forces.

- Driving Forces Analysis.

- Product Life Cycles.

- Porters Four Corners.

- SWOT Analysis.

Remember, while computers might be all the rage, they’re a little lacking when it comes to the emotional side of things.

Sometimes you can simply look at the information you’re presented with and come to a better conclusion than a computer could ever reach.

Convert your analysis into plans of action

Now that you’ve gained your information, it’s time to convert it into plans of action. Or rather, factor it into your existing plans to make them better.

To take the previous baseball metaphor, you need to adjust your stance once you’ve deduced what pitch you’re about to face. In the case of business, however, the pitch is anything that can alter the ideal outcome of your plans.

The direction that you take is extremely dependent on your situation, so for the most part it’s up to you. Your intuition and experience can be excellent tools here, allowing you to see solutions that wouldn’t ordinarily be obvious.

Repeat, repeat, repeat

Competitive intelligence isn’t just a one-and-done type of deal. Your strategies change, so why shouldn’t your competitors do the same?

Competitive intelligence should be a regular habit that you indulge in, not a one-off project.

After all, markets are volatile, consumer expectations change, and you need to be aware of all of this if you want to get ahead in the game.

When should you perform competitive intelligence analysis?

As we’ve previously mentioned, competitive intelligence analysis is something that’s ideally done whenever possible.

However, there are a few specific times in your business’s life cycle that you definitely need to be performing it.

Let’s take a look at some of the best points in time when you can be undertaking this.

When you’re starting out

Analyzing your competition should be one of the first things you do when you’re planning to start a business. Knowing who you’re up against, what they do, and how they do it is crucial to staying competitive.

Understanding the industry you’re in will tell you a great deal about how you should operate.

Is the market saturated with brands that seem indistinguishable? You’ll need to stand out by having a feature that’s unique.

Shopify, for instance, saw the world of ecommerce and decided to create a platform for small businesses to create their own customized online stores easily, rather than having to rely on pre-existing platforms that would limit their design abilities.

Your investors will want to know about the surrounding market too since it gives them an insight into how well you’re likely to perform and how risky an investment you are.

Very few businesses can get off the ground without funding, so this is a top priority.

When you’re developing & launching a new product

William Henry Perkin isn’t likely a name that you know, since he lived in the 1800s. In short, he’s best known for creating the first cheap purple dye, which until those times had been limited to the extremely rich due to the cost of its production.

He also created a red dye in 1869. However, another company beat him to the punch in patenting it by just a single day!

This showcases why you need to perform competitive intelligence both when developing and launching a new product – your rivals might be thinking along similar lines and get their product out before yours, at which point you may have to abandon the entire project due to patenting.

When you’re considering a change in market strategy

Change comes to us all, whether we like it or not. A crucial part of planning for change is analyzing the current market in order to assess whether or not your planned changes will be effective.

One of the most important parts of this is analyzing your competitors in order to make sure they’re not planning the same as you.

After all, it’s no good to plan a pivot that makes you stand out only for your competition to take the same direction.

When you’re seeing a drop in physical business activity

When business stagnates, there isn’t always an obvious reason why meaning you need to look deeper to find the source of your problems.

Of course, foot traffic and physical sales can decrease for reasons other than your competition, but by analyzing them, you can see whether they are stealing your customers or if there’s a bigger problem that you all are facing.

Are you all seeing a drop in foot traffic, but only within a specific area of your city? It’s probably a transportation issue that prevents customers from being able to reach you easily.

Maybe some of your competitors are seeing a boom, whereas others are seeing a bust also. There will be some correlating reasons as to why specific businesses are more attractive right now compared to others, and you will be able to find them.

Maybe everyone sees a drop in business activity. This points to a drop in consumer confidence, indicating that you should be prepared for them to spend less and spend only on products they really desire.

All this information adds up to an edge that lets you see where consumers are engaging with businesses and, more importantly, why. This enables you to adjust your approach and meet their expectations.

When you’re seeing a drop in online traffic

Getting hits on your website is crucial to ecommerce, and a big part of this is search engine optimization to account for organic searches, which are making up a larger and larger share of online traffic.

In essence, hitting the right keywords within your website and meta information makes sure that you’re at the top of the list when it comes to Google searches in your particular field.

The problem with this is two-fold.

First, the inner workings of search engine rankings are secret and will naturally change over time.

Secondly, the searches that consumers perform will change over time as their needs and wants evolve.

Both of these factors add up to one single outcome – you need to keep on top of your optimization to stand out.

If you see a drop in traffic, you likely need to redo your metadata to upstage your competition.

Hitting a home run with competitive intelligence

With this complete guide on competitive intelligence, you should be able to get the edge your need over competitors.

You’ll understand what competitors are after, their plans, and indirectly – what customers want.

The journey doesn’t end here, though. Once you have customers’ attention, you need to provide them with a show they won’t forget. Check out our ecommerce customer experience guide to get up to speed on the topic.

All

Articles

All

Articles Email

Analytics

Email

Analytics

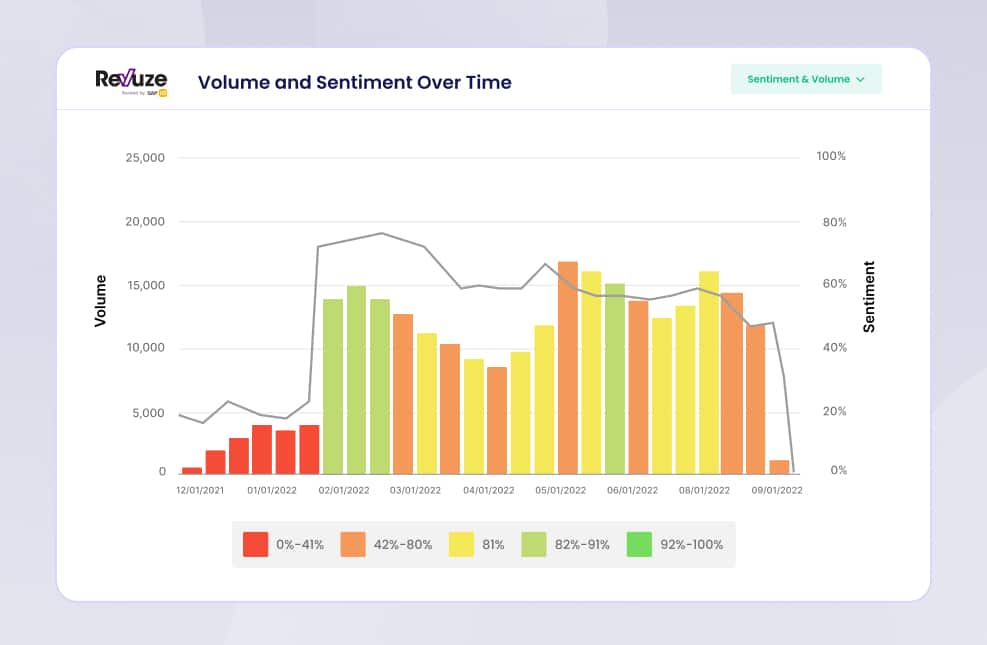

The above is real data taken from our product insights engine, showing the top ten products in the Drones category for April 2022.

The above is real data taken from our product insights engine, showing the top ten products in the Drones category for April 2022.