It’s no secret that nowadays, customers expect and demand a more personal touch from companies they do business with. That’s why e-commerce personalization is essential for the success and growth of your business. Whether you’re looking to get started with personalization or to improve its effectiveness, this guide is for you.

In the age of the “For You Page” and “Based on your previous interaction” messages, a one-size-fits-all approach to e-commerce simply won’t do. Because the modern consumer doesn’t just want personalization – they demand it.

According to McKinsey, 71% of consumers expect companies to deliver personalized interactions, and 76% get frustrated when they don’t get them. That’s why companies that can deliver personalization generate 40% more revenue than those that can’t.

The bottom line?

In today’s commercial landscape, personalization is a must for e-commerce companies that want to capture market share and grow their revenue.

Those who don’t offer personalization will fall behind.

But those who do will reap the rewards.

This article will offer a complete guide for companies who want to get familiar with personalization and for those that seek to improve it.

We’ll share insights on what it is, why you need it, and how to do it, along with inventive e-commerce personalization examples.

Let’s dive in.

What is e-commerce personalization?

E-commerce personalization is the practice of using real-time zero and first-party customer data to display dynamic content specific to the customer.

A range of user data can be the basis of e-commerce personalization, including their:

- Demographics.

- Browsing history.

- Past purchases.

- What device they’re on.

- And more.

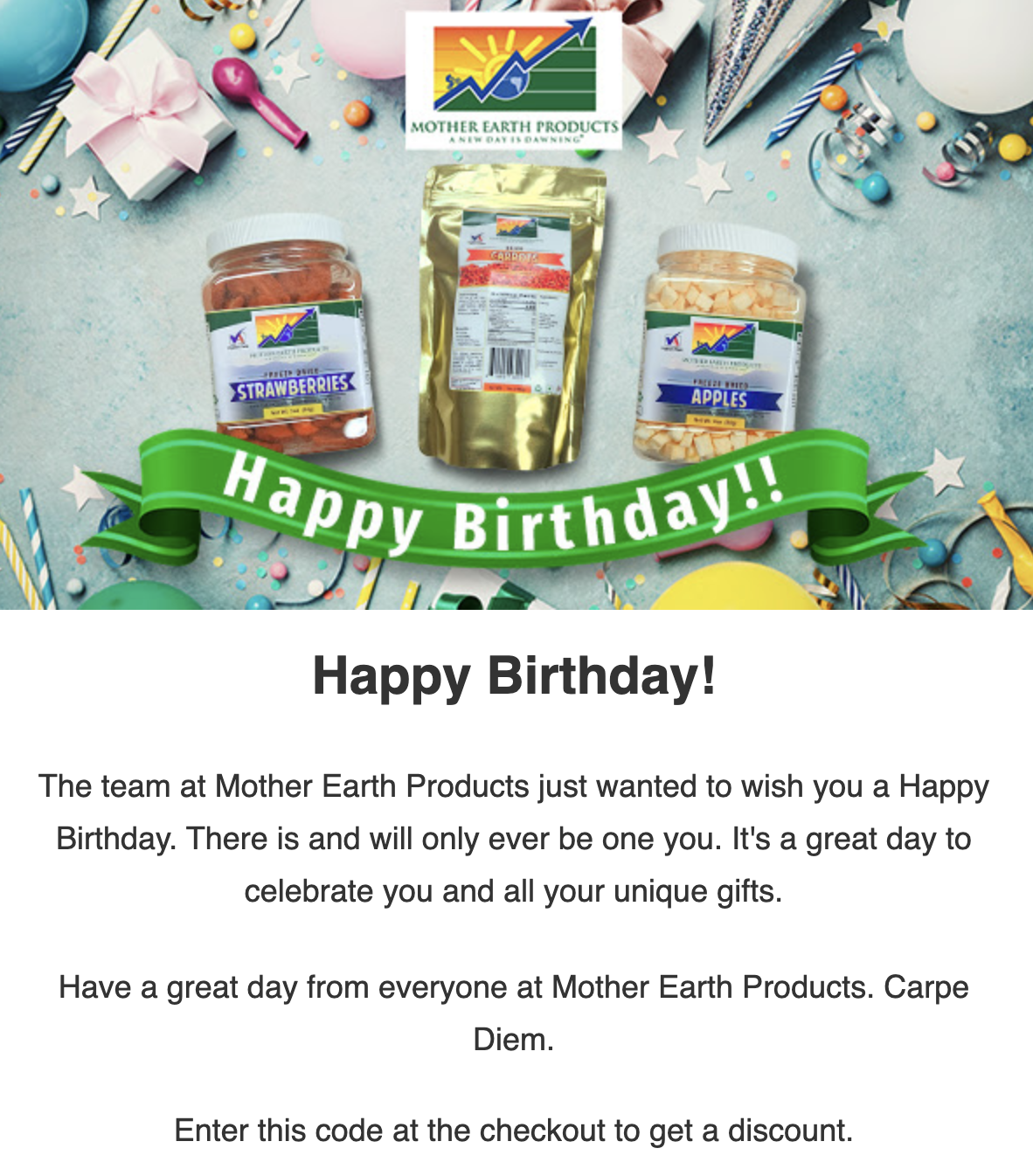

In this personalized example, Mother Earth Products uses subscribers’ date of birth to offer discounts on their special day

E-commerce personalization can be delivered across multiple channels, including on a website, in an app, and through emails and text messages. Further, it can be presented to any lead, no matter where they are in the sales funnel.

The truth is that personalized e-commerce is already pretty dominant, and you’ve most likely seen it all over the place, like in:

- Personalized site layouts.

- Personalized product recommendations.

- Personalized messages.

- Redirects to a geographical site with geo-located offers.

- Cart abandonment emails.

- Reminders to re-order a product.

- Personalized offers.

When done well, a personalized e-commerce experience can feel like magic.

Each customer is given a VIP treatment customized to their needs, leading them on a journey from brand awareness to product discovery to repeat purchasing.

Seven benefits of personalization in e-commerce

E-commerce personalization offers many crucial benefits to both customers and businesses. It’s an incredibly effective tool that it has become an absolute must-have for any company.

Let’s review what it can do for you and your shoppers.

Sales and conversions

First and foremost, e-commerce personalization can help you generate more sales than ever.

A whopping 88% of online shoppers are more likely to continue shopping on an e-commerce website that offers a personalized experience.

This means that personalization is a key tool that can be used to convert visitors into paying customers, with everything from personalized recommendations to special discounts helping to increase conversion rates.

Indeed, it’s reported that conversion rates increase considerably with the number of personalized page views, with conversion rates doubling from 1.7% to 3.4% when a visitor views three pages of personalized content as opposed to two.

Customer experience

E-commerce personalization also has the added benefit of improving the e-commerce customer experience.

By using data to get a clearer picture of your customers’ needs and pain points, you can better cater to individual customers, meeting their preferences throughout the entire customer journey.

Creating an experience in which customers only see what’s relevant to them, don’t have to re-input their payment information each time they make a purchase, and are notified about relevant promotions they’d want to know about – just to name a few things – all contribute to a more seamless, enhanced customer experience.

Songkick uses personalization to notify subscribers about relevant events based on preferences and location.

Insights about customers

All of the data and important insights about your customers that you collect for the purpose of e-commerce personalization are valuable far beyond your personalization strategy.

Remember, customers will be happy to share their data with you if treated with care. Use these data-collection efforts and leverage them into insights that will serve customers – all the way from improving your products to personalized marketing tactics.

Customer service

That’s not to mention the fact that all of the data you capture can also be used for customer service to resolve issues more quickly and offer better solutions to any problems that might arise.

For instance, you may choose to offer special offers and rewards to VIP customers with a particularly high customer lifetime value, or you can use a customer’s location data to give them more accurate shipping time estimates.

The latter can help avoid the issue that 42% of online customers face, where a product takes longer to be delivered than what was promised at the time of purchase.

Brand loyalty

By giving your customers the kind of tailored experience they want and showing them that you know who they are and what they need, you’re able to capture their loyalty.

If you can provide a more personalized, seamless customer experience, you can expect your customers to stick with you and continue choosing you over the competition, boosting brand equity.

Customer retention

That improved customer experience and increased loyalty that personalization can help you achieve? It also does wonders for customer retention.

And holding onto your customers is incredibly important as it costs between six to seven times more to get a new customer as opposed to keeping the customers you already have.

Competitive advantage & market share

As we mentioned above, customers don’t just expect personalization anymore; they demand it.

By successfully implementing e-commerce personalization, you’ll be able to deliver the experience your customers are looking for, allowing you to keep up with the modern digital landscape.

To put it frankly, e-commerce personalization is essential to maintaining relevance and market share in today’s climate.

Brands that don’t deliver will be left behind and passed over in favor of competitors that do.

How to implement e-commerce personalization

Okay, we’ve made our point. E-commerce personalization is the new frontier, an undeniable necessity. The next step is implementing it, and to do so successfully, you’ll need to follow these steps.

Set your goals

As a starting point, begin by defining what you want to achieve with your e-commerce personalization efforts.

Not only will this help guide you when you’re making choices about which tools and strategies to use, but it will also help you assess the success of your efforts later on.

Some potential goals include:

- Boosting conversions by 0.5%, with the average e-commerce conversion rate being 3.65%

- Achieving an 80% customer satisfaction rating, with the average customer satisfaction rate in the retail sector being 77% in 2021

- Increasing customer retention by 5%, with the average repeat customer rate for e-commerce being 28.2%

Map the customer journey

Next, you’ll need to decide which parts of the user experience you want to personalize.

In order to do so, you’ll need to understand what your users’ journeys look like. From first learning about your brand to making a purchase and leaving a review, what interactions do your customers have?

Make a map of all of the channels and touchpoints.

Here is an example of a customer journey map template (well, a table) from Venngage that you can use to get started.

With that in hand, you’ll be able to decide where to implement elements of personalization throughout the customer journey.

Ask yourself: which moments would benefit from a more contextual experience?

For example, perhaps you have a high bounce rate from your front page. This might motivate you to try to add more personalization to the homepage of your website to create a customized experience right from the beginning.

Further, maybe you see that customers are generally unhappy with the payment experience leading to a high cart abandonment rate.

This can indicate that you may need to add an element or personalization to the payment stage of the customer journey. Alternatively, maybe other actions are needed, like reducing form friction or adding trust badges.

Decide what to personalize

Now, you should be ready to decide which personalization methods you want to start with. As we mentioned above, there are a large variety of options for you here. Some popular personalized elements include:

- Product recommendations – Use a user’s purchase history, location, and demographic information to deliver them recommendations for products they’re likely to be interested in. These can be delivered through email or on various pages on your website.

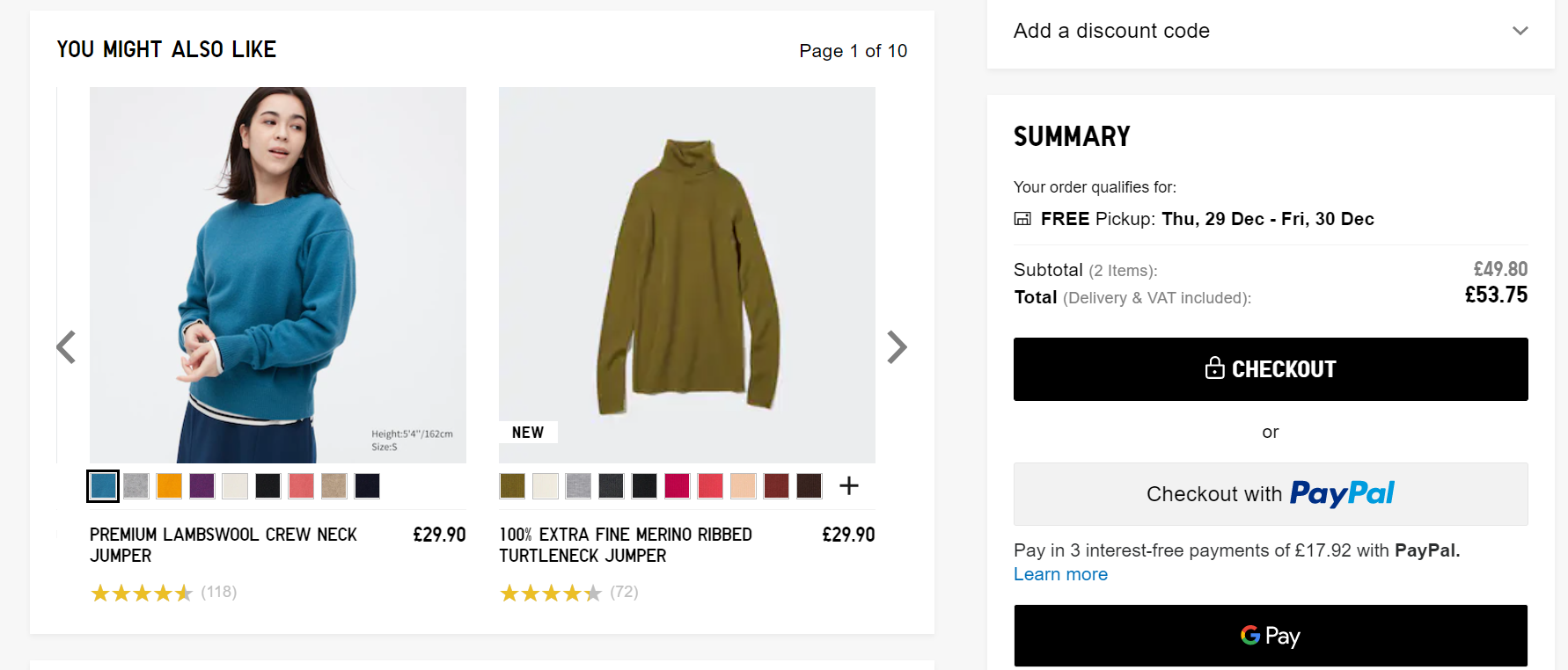

While proceeding to checkout, Uniqlo offers shoppers various products they might like based on their current purchase.

- Targeted offers – From first-time purchase discounts to deals on items abandoned in a cart, targeted offers are a highly effective way to get customers to make a purchase. This example from Golden Village displays a Women’s Day promotion exclusively for female users, making this important day even more special.

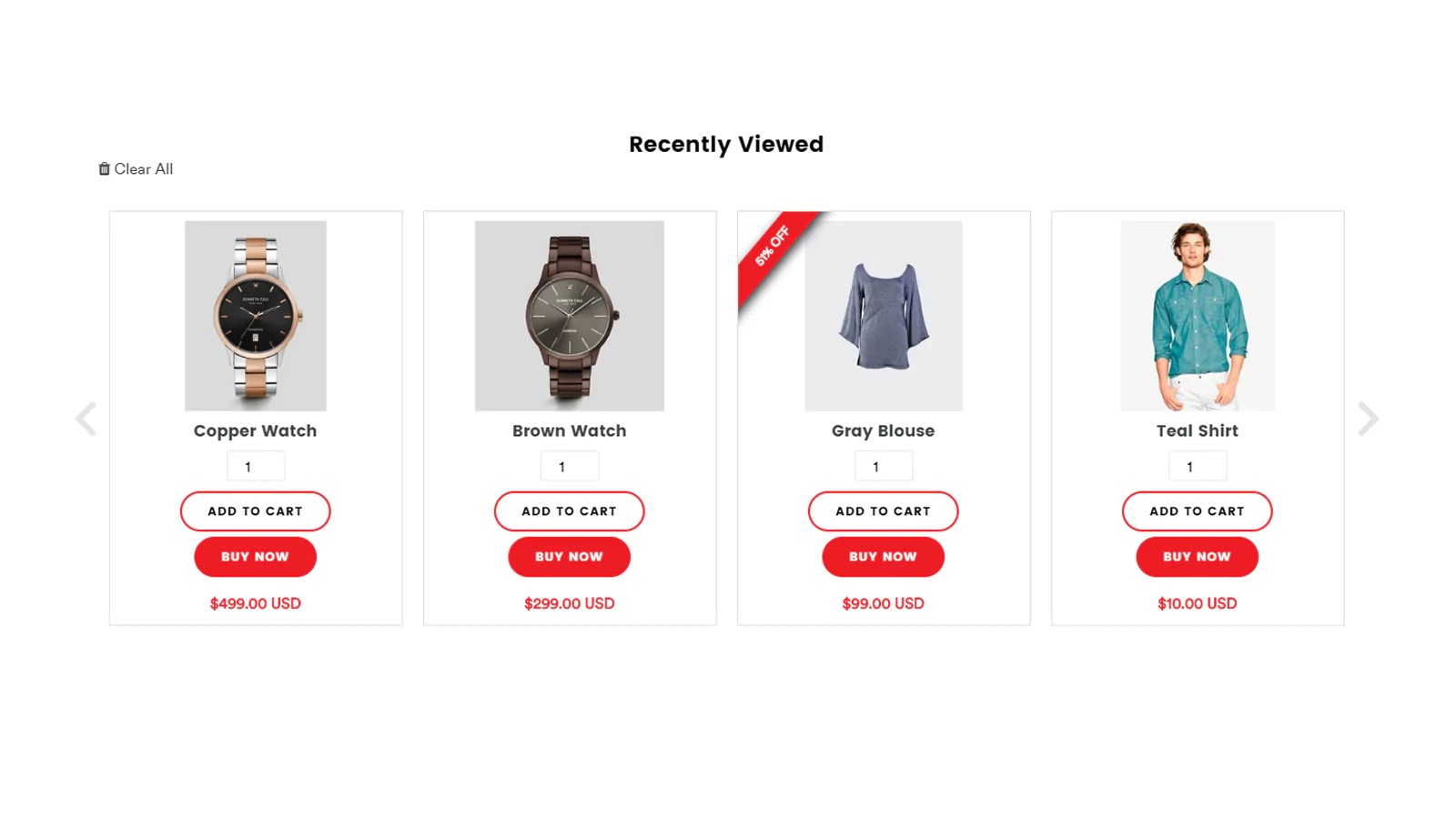

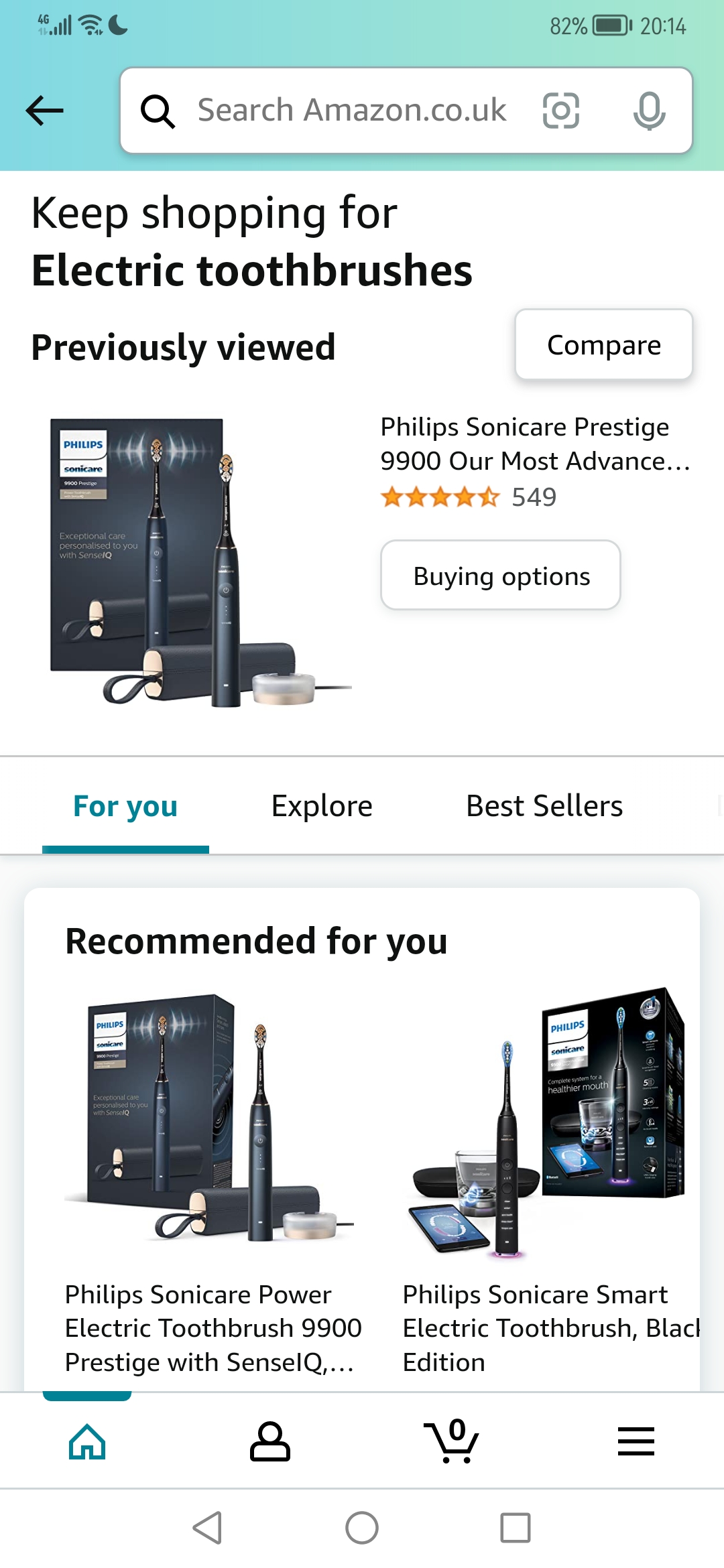

- Continuous shopping for return customers – Help a customer pick up right where they left off by displaying items they were previously looking at. In this Shopify example, you can see how continuous shopping would appear through its platform.

- Dynamic pricing – 21% of e-commerce businesses use this strategy to adjust prices based on a buyer profile, demographic information, purchase history, and browsing history.

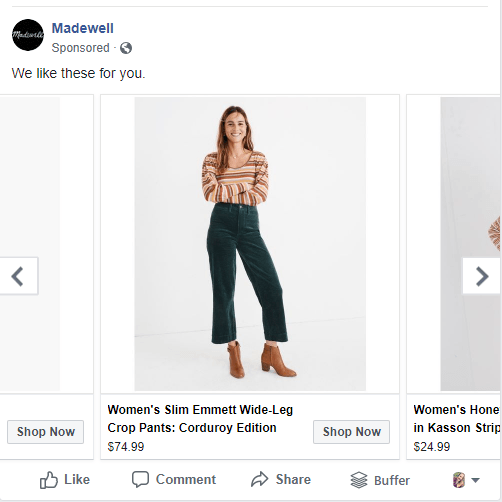

- Personalized retargeting – Create a more specific retargeting campaign by reminding users of the exact products they were looking at. This Madewell Facebook ad presents shoppers with previously seen products.

Collect data

E-commerce personalization is built on your ability to capture key information about your website visitors. You’ll need to track data points such as:

- Pages viewed.

- Time on site.

- Items favorited.

- Items added to cart.

- The last page viewed before leaving the website.

- Email open rate.

- Email click-through rate.

- Past purchases.

- Average order value.

- The time interval between purchases.

- Customer lifetime value.

- Prior email or social media interactions.

- Bounce rates.

- Customer retention rates.

- Abandoned cart rates.

- Customer acquisition costs.

- Sales conversion rate.

- Net promoter score.

- Time on site.

- Transaction path length.

For each personalization method you’ve chosen to implement, think about the data you’ll have to capture and how you might be able to access that data. This can be via a CRM, website analytics, data captured during purchases, etc.

A note on privacy

While on the topic of data collection, it’s important to broach the topic of the ethics that come with it.

Although 65% of consumers are willing to share their data to enable a personalized experience, some have gotten increasingly savvy about and even wary of having companies collect, store, and use their data.

For customers that want to keep data for themselves, there’s a solution. They can simply opt out.

The General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) require websites to get users’ consent to have their data tracked.

That’s what that “cookies” pop-up that you see on any new website you visit is all about. Asking for permission to gather data.

Not only is complying with these data privacy laws required, but it also helps you build trust with your customers. Those who opt into personalization know that they are willingly volunteering their personal data so you can give them an optimized experience.

Five e-commerce personalization tools that will drive your growth

Successful e-commerce personalization requires the use of a variety of tools to help with data collection and analysis, as well as personalization campaign implementation.

Most major e-commerce platforms like Shopify actually offer a relatively robust suite of personalization options for you to play around with.

But there are other options out there for e-commerce personalization software. In fact, there are so many that it can be tough to know what tool to start with.

When on the lookout for such a tool, keep an eye out for ones that have:

- Customer segmentation.

- Multi-channel support.

- A/B testing.

- A modern AI engine.

- Compatibility with the e-commerce platform and any other tools you are using.

- A strong customer success team to help you make the most out of the product.

Ultimately, like with any other tool, trying out a few demos is a good place to start to help you choose the software that best fits your business and its needs.

To help you get started, here are a few popular tools you should know about.

Insider

Insider is an easy-to-use e-commerce personalization platform that connects customer data across multiple channels, uses AI to predict future customer behavior, and creates personalized experiences. Insider can be used across multiple channels, including web, app, email, SMS, and more.

Bloomreach

Bloomreach offers a “Commerce Experience Cloud” with a number of tools powered by a customer data engine, including a content platform, AI-driven search and merchandising, a customer data platform, and marketing automation solutions.

Clerk.io

Clerk.io uses an e-commerce-specific AI technology called ClerkCore to help businesses personalize product recommendations, implement a behavior-based search engine, and integrate email marketing. It also integrates with all of the most popular e-commerce platforms.

Yieldify

Yieldify is another popular end-to-end personalization platform helping businesses deliver personalized experiences to customers no matter where they are in the funnel. They offer a variety of tools, including lead capture forms, social proof campaigns, personalized upsell experiences, and more.

OptiMonk

OptiMonk is a personalization tool with advanced targeting features leveraging pop-ups to do everything from personalized product recommendations and special offers to stop cart abandonment while boosting upselling and cross-selling.

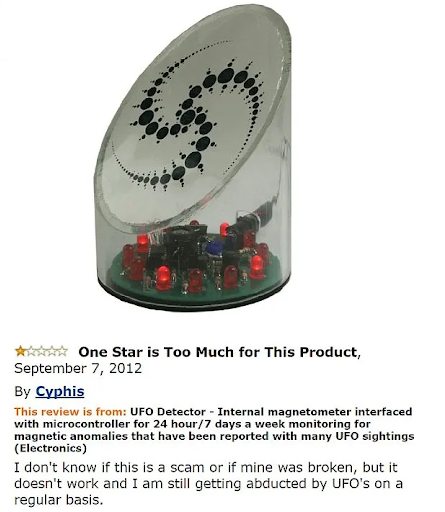

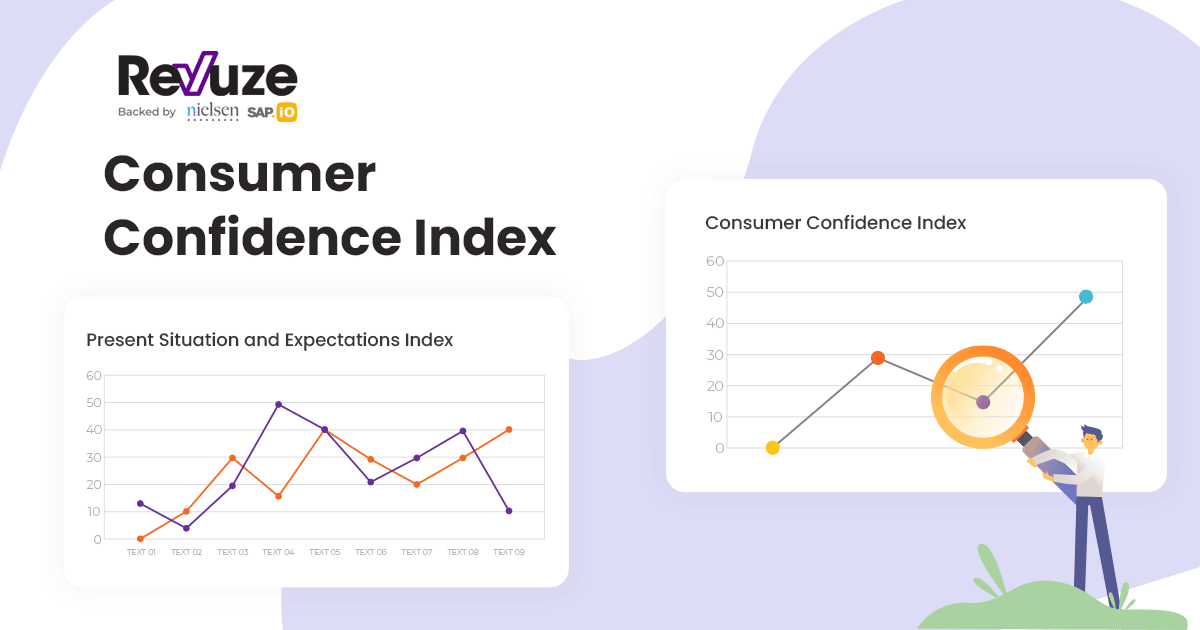

Revuze

Revuze is not a traditional e-commerce personalization platform, and we don’t claim to be one. That said, the insights you get from the Revuze dashboard will help you better understand what your customers want and need. This, in turn, will help with the development of future personalized products that align with customers’ expectations.

E-commerce personalization examples

To help you understand what e-commerce personalization can look like in practice, let’s review a few examples of companies successfully using it to create a superior customer experience.

Special offers

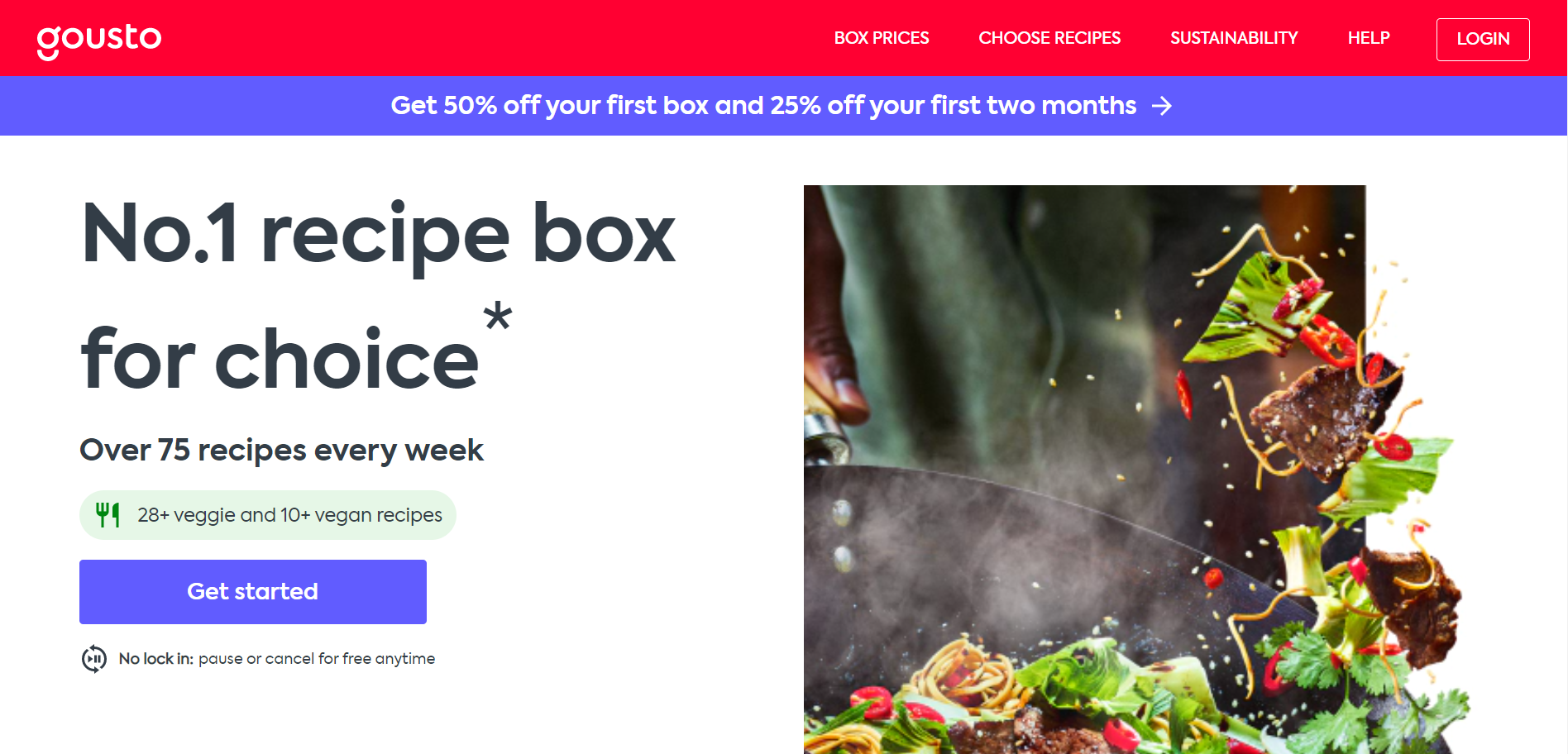

By tracking data and identifying which customers are visiting your website for the first time, you’re able to offer a special discount to first-time visitors, like recipe box company Gousto is doing for first-time visitors.

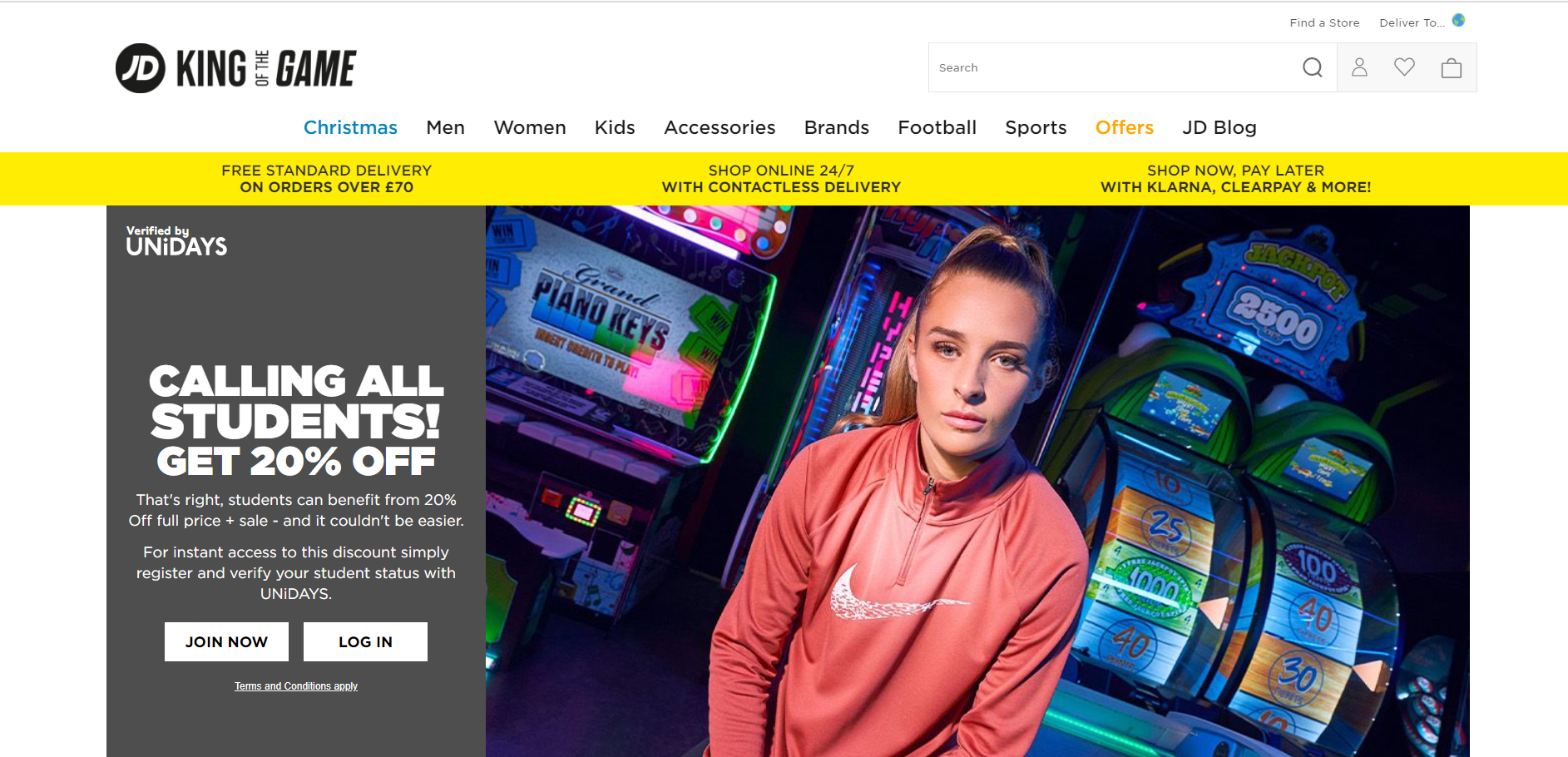

You can also create special offers on the basis of other useful information. For example, the sporting brand JD targets students with a unique promotion.

Personalized product recommendations

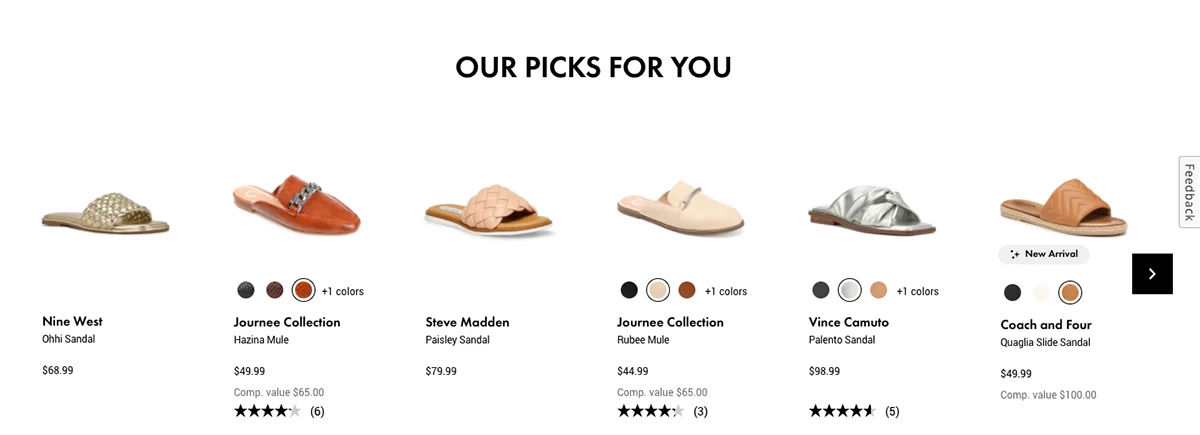

Perhaps one of the most popular and effective applications of e-commerce personalization is to deliver personalized product recommendations.

For example, you might offer personalized product recommendations on the basis of demographic information such as age or gender. Or you can personalize on the basis of customers’ prior interactions, showing them products similar to those they have looked at or put in their cart in the past.

Here, Zappos displays personalized shoe recommendations based on items the customer was previously looking at or searching for. By showing other shoes in similar styles, Zappos increases the likelihood of finding a shoe the customer fancies, increasing conversions.

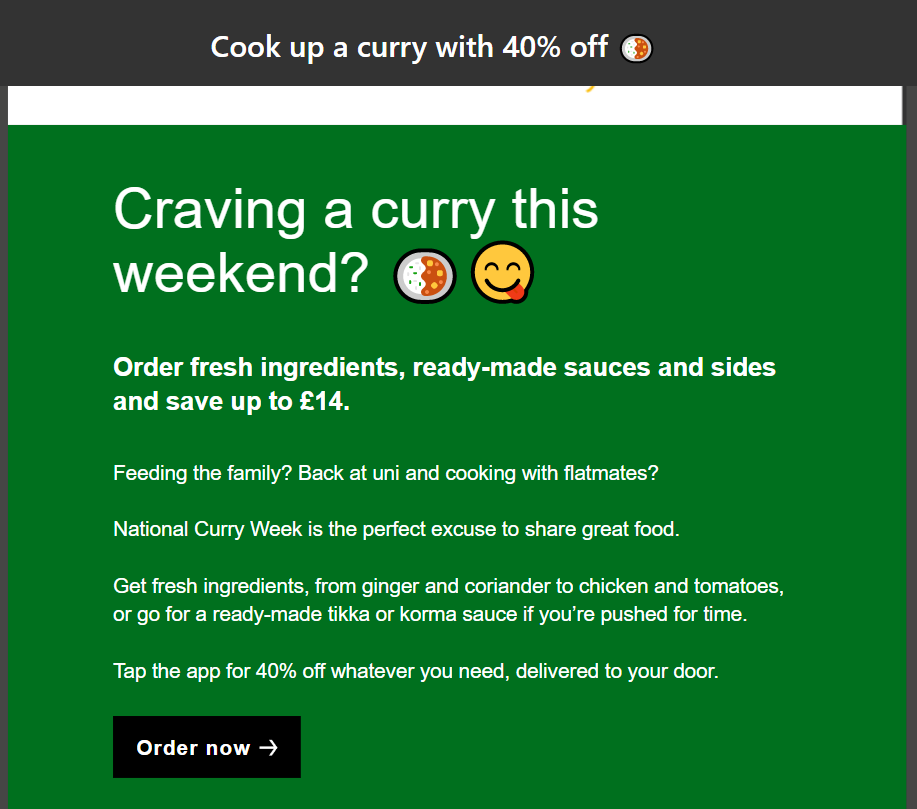

In this email, Uber Eats sends a personalized product recommendation based on food orders the user has made in the past. Can’t blame them for loving their curries.

Suggesting complementary products

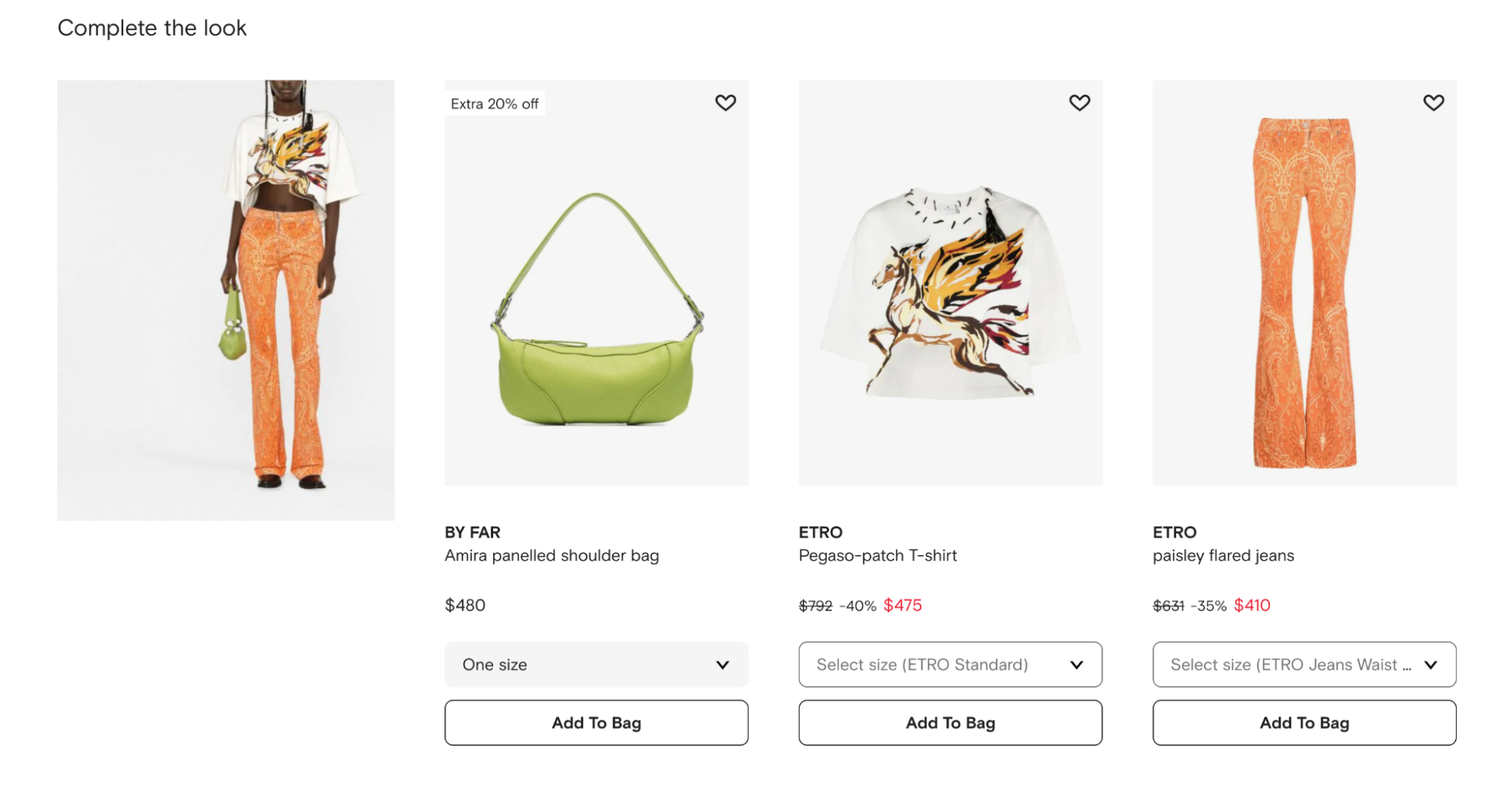

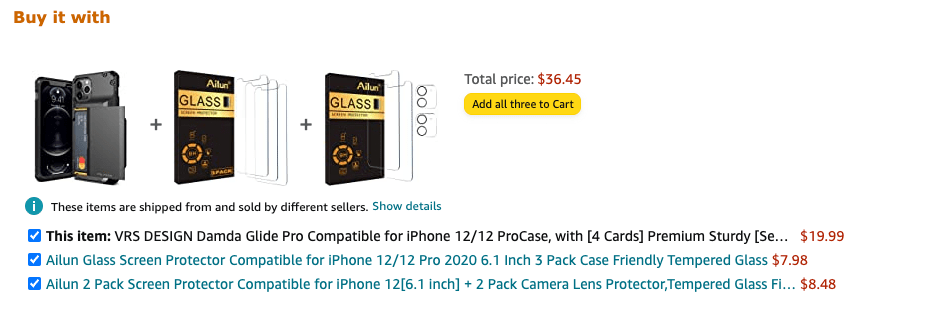

Knowing what products your users search and purchase can help you upsell and cross-sell by displaying other products that are similar or could help them “complete the look.”

A shoulder bag will definitely go nicely with these jeans. Job well done by Farfetch.

Amazon is the master of upselling, as can be seen in the following example. The e-commerce giant shows other items that a person might want to buy along with the iPhone case they are looking at, namely two different types of screen protectors.

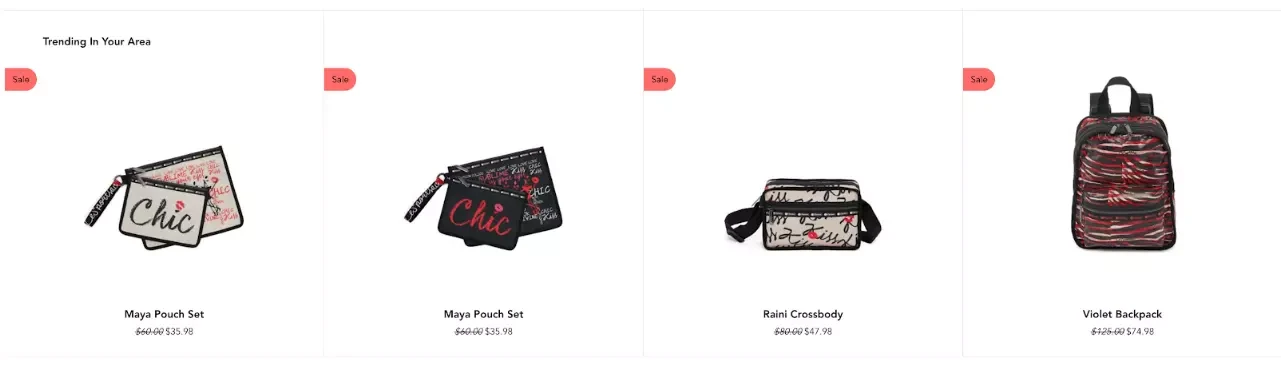

Geo-targeted offers and product recommendations

A user’s location is a powerful piece of data that can enable you to provide personalized offers and recommendations that are especially relevant to them. For example, you can show users items that are currently trendy in the state or country they live in.

Or maybe you use somebody’s location to make sure that you are displaying the correct items for the correct season.

While you may be featuring coats and scarves on your front page in December, this wouldn’t be relevant to people in the southern hemisphere. Using geographical data, you can personalize your website, so shoppers can browse summer hats and bathing suits instead.

In the following example, Lesportsac displays more graphic, bolder designs for customers located in Hong Kong, where data analysis revealed that those types of styles are more popular.

Continuous shopping

Similarly to how you’d leave a bookmark in a book to help you know where to pick up from when you continue reading, you can make a sale even more seamless by showing shoppers the items they were looking at before.

Here, Amazon once again provides a great e-commerce personalization example, this time for continuous shopping recommendations.

Electric brushes are all the rage for this hygiene-savvy customer.

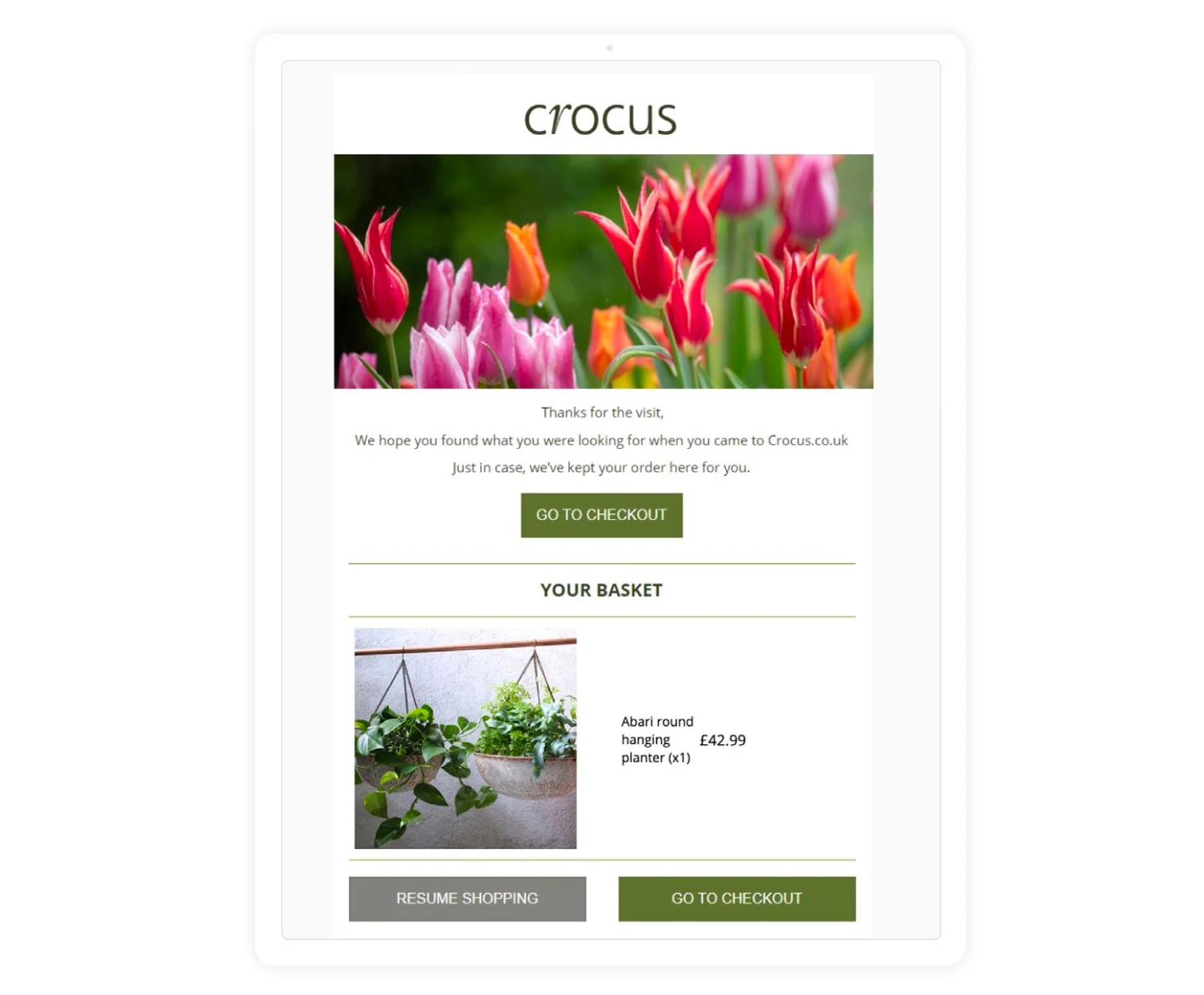

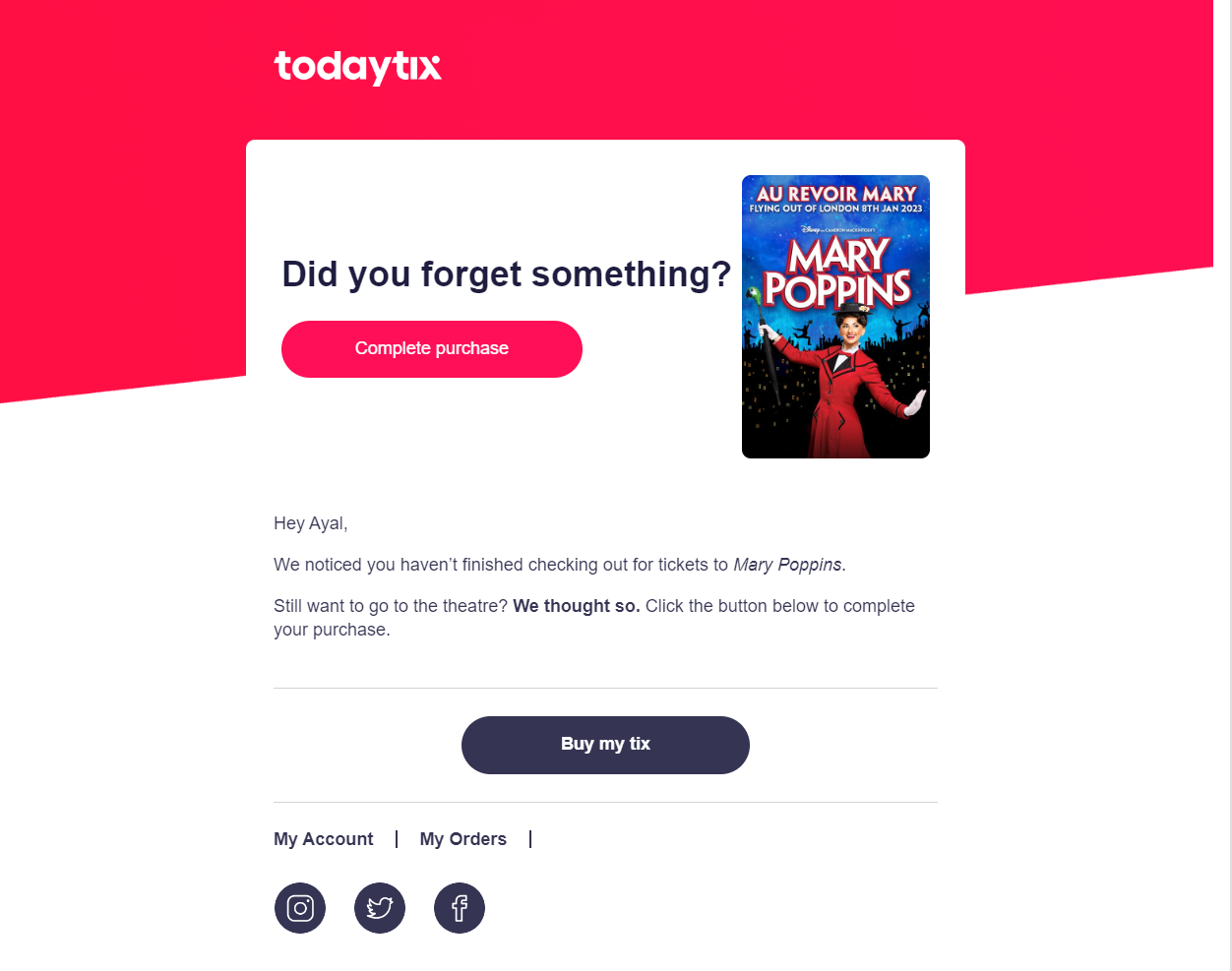

Cart abandonment emails

Win back users who you may have otherwise lost by sending emails to people who put an item in a cart and then exited your website. Remind them of the item they’re almost missing out on and/or offer a special discount to make the deal even sweeter.

Here, Crocus informs the user that the planter they were looking at before is still available and saved in their cart for purchase. This way, all the customer has to do to complete the purchase is to click the “go to checkout” button.

In this email, TodayTix reaches out to the customer, reminding them to grab the tickets for Mary Poppins they left in their cart, making it easy to complete their purchase.

E-commerce personalization trends

While it may be more popular now than ever, e-commerce personalization has proven to be more than just a temporary fad. It’s a new standard for e-commerce companies, helping to deliver an improved customer experience while boosting sales.

Within the practice, however, there are plenty of trends that can come and go as companies discover new and interesting applications of the data they are collecting. Below, we outline some of the most popular trends in e-commerce personalization today.

Headless personalization

The term “headless personalization” refers to the practice of personalizing content without using a traditional web CMS. Instead, companies can work with a headless API to separate their front-end and back-end systems so that the customer data collected in the back end can be used to personalize the user experience on the front end.

Essentially, headless personalization allows you to customize each individual user’s content without having to change the design of the entire website. This flexibility is highly useful, if not necessary, for creating the kind of personalized experience today’s customers expect.

Omnichannel e-commerce personalization

The average person spends almost seven hours a day looking at a screen, including phones, tablets, computers, and more.

Between websites, apps, all of the social media platforms, emails, texts, and chatbots, customers have no shortage of channels through which to shop and interact with a business. What’s more, 90% of customers expect their interactions across all of these channels to be consistent.

This is why personalizing only one channel, like your web store, isn’t sufficient.

An omnichannel approach to e-commerce personalization aims to create a personalized experience across all channels including online, in-store, mobile, and more.

This is the only way to deliver the personalized experience your customers expect.

Privacy-first and anonymous personalization

With the GDPR making it illegal to use users’ information without their permission, privacy has emerged as a major concern for customers, with a whopping 96% of users choosing to opt-out of allowing apps to track their data in iOS 14.5. This has led to the rise of two important trends in e-commerce personalization.

Privacy-first personalization focuses on collecting only the data that is absolutely necessary to provide an improved, personalized customer experience. It aims to protect customers’ security and win their trust through a genuine interest in respecting each user’s privacy.

Anonymous personalization is the practice of personalizing the e-commerce experience without requiring a user to create an account or log in first. This is especially useful for first-time visitors as well as visitors who opt out of having their cookies tracked, allowing you to create a personalized experience with less data.

Dynamic pricing

While price personalization is still not one of the most common applications of e-commerce personalization, it is rising in popularity as 17% of companies who were not already using it reported plans to implement dynamic pricing in 2021.

The practice of personalizing prices on the basis of purchase history, browsing behavior, and other data points has the potential for a major boost to revenue.

But while no customers will balk at receiving a special discount, dynamic pricing does carry the risk of angering customers who feel like they are being charged more than others.

Businesses who decide to try it out should tread carefully, but price personalization certainly has a lot of potentials.

Wrapping up

When it comes to e-commerce, personalization is the way forward. It proves to have a number of major benefits for businesses, among them, increasing sales and maintaining market share and relevancy as digital transformation quickly ushers us into a personalized future.

Successfully implementing personalization into your e-commerce business requires a lot of research, trial-and-error, strategy, and analyses.

This means the next natural step after implementing eCommerce personalization is to understand how to put all this data into action. And this is what our product performance analysis guide is here to do.

All

Articles

All

Articles Email

Analytics

Email

Analytics