Staying ahead of the competition requires innovative products and a deep understanding of the market and consumer behavior. However, you can’t do that with in-house data alone. Many cosmetics and fragrance companies, for instance, have their own internal data solution at the category level. However, relying solely on internal data is simply not good enough to lead the way in your industry. To complete the picture of what’s really going on in the market, companies must use solutions like Revuze which provides full category-level data for online review analytics from verified buyers. It is a game-changer, allowing cosmetics companies to understand if they’re at the top of the food chain or not.

This blog will explore the different ways that category-level data can support a range of needs for cosmetics companies. This includes identifying up and coming brands that may pose a future threat, emerging trends, product development and more!

Get Granular: A Closer Look

The cosmetics industry is eclectic, boasting a wide range of beauty products. The magic of full category-level online review analytics powered by generative AI is the ability to aggregate ALL the data. That eliminates tunnel vision since it includes your own cosmetics offerings and your competitors. Ultimately, the comprehensive cut of the market allows you to drill down the brand and product level.

Moreover, you can further divide the category into subcategories for eye, lip, face, and nails. A company that may stand out in the overall cosmetics market may not be the leader in the lip or eye sub-category. Revuze’s generative AI dives into each subcategory to provide an accurate picture of the market. This level of detail is invaluable for cosmetics brands that specialize in specific areas, ensuring that their strategies are informed by the most relevant, timely, and precise data.

Benchmarking: Know Your Position

In the competitive arena of cosmetics, knowing where you stand is half the battle. You may have a sense of your consumer sentiment, but how do you measure up with your competitors? Are you above or below the average for the entire product category? These questions can only be answered with category-level data from online review analytics. Consumer sentiment and discussion volume is calculated for each brand and product in the category giving an all-encompassing view of the cosmetics industry.

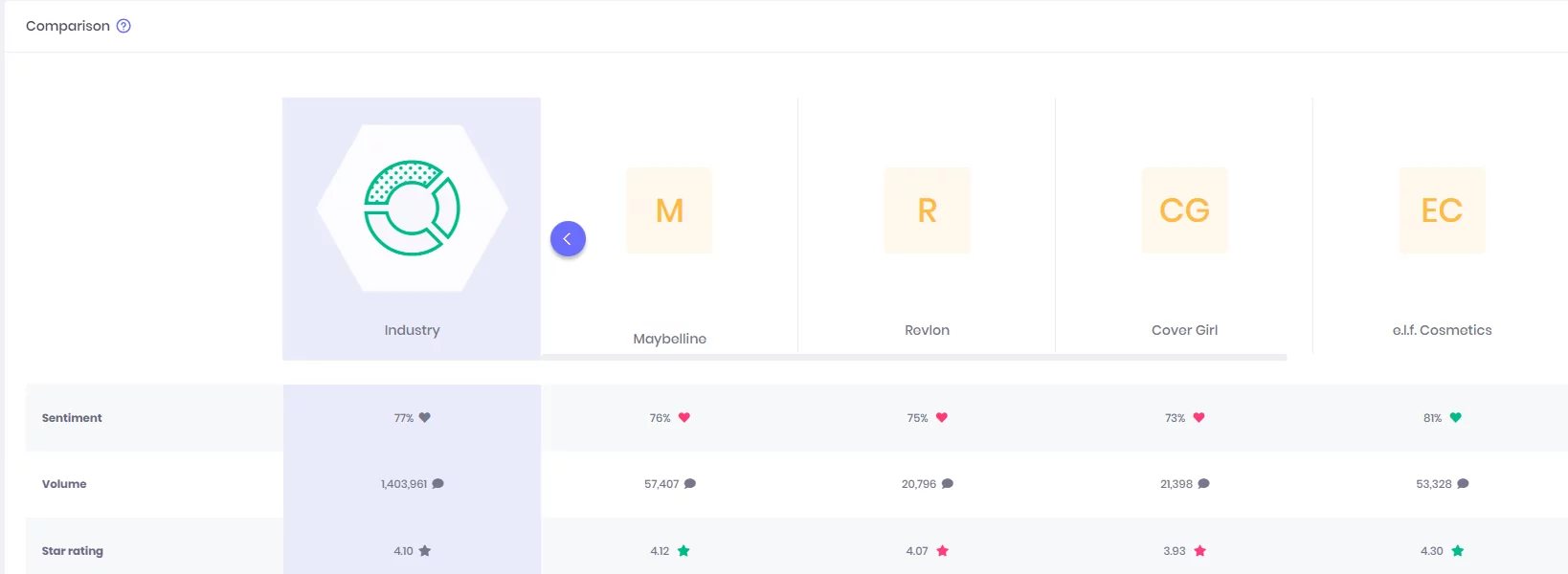

The display below shows the discussion volume, average sentiment, and star rating in the cosmetics category, with four selected brands (Maybelline, Revlon, Cover Girl, and e.l.f. Cosmetics) compared to the benchmark. You can quickly see which brands are above or below the industry benchmark. Maybelline is slightly below the average sentiment but has a star rating that is above average. E.l.f. Cosmetics stands out because it exceeds the average sentiment and star rating. The share of discussion of both brands is significantly higher than that of Revlon and CoverGirl.

This data paints a picture of the cosmetics market and of consumer behavior allowing your own brand to dig deeper to make more strategic business decisions. Beyond this, you can also view the variations by ecommerce channel which can help optimize your online retail strategy.

Trending Topics: Reflecting Consumer Sentiment

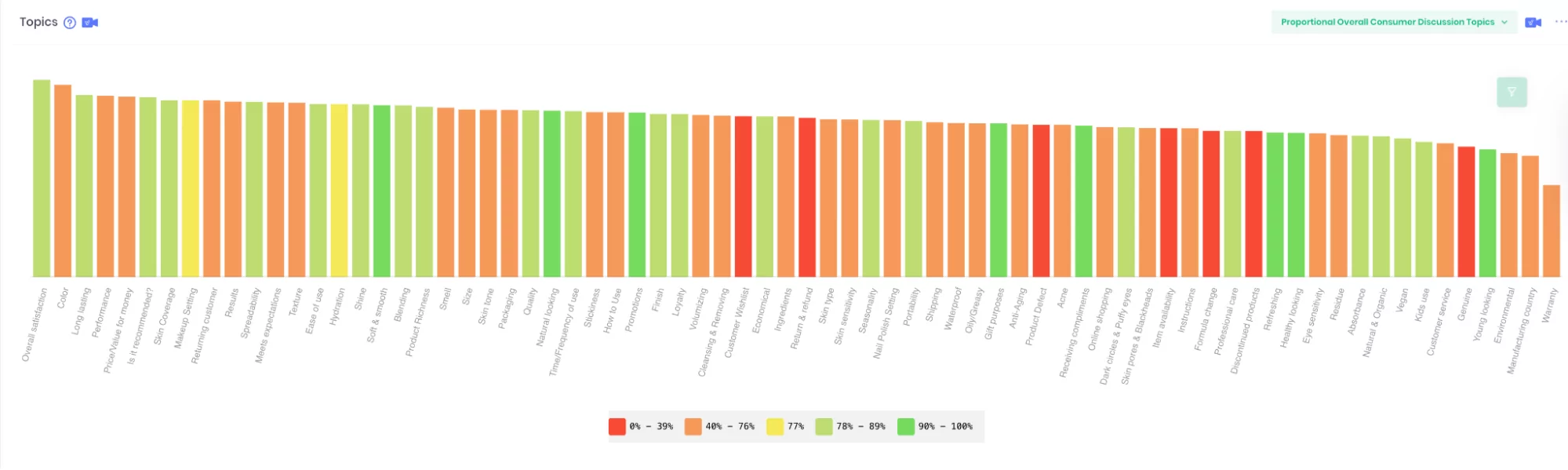

So what are consumers buzzing about? Is it the new lipstick color or a foundation that doesn’t blend well? The generative AI engine dissects reviews revealing topics that are important to cosmetics consumers. You can see a snapshot of all the overall topic trends with their respective sentiment.

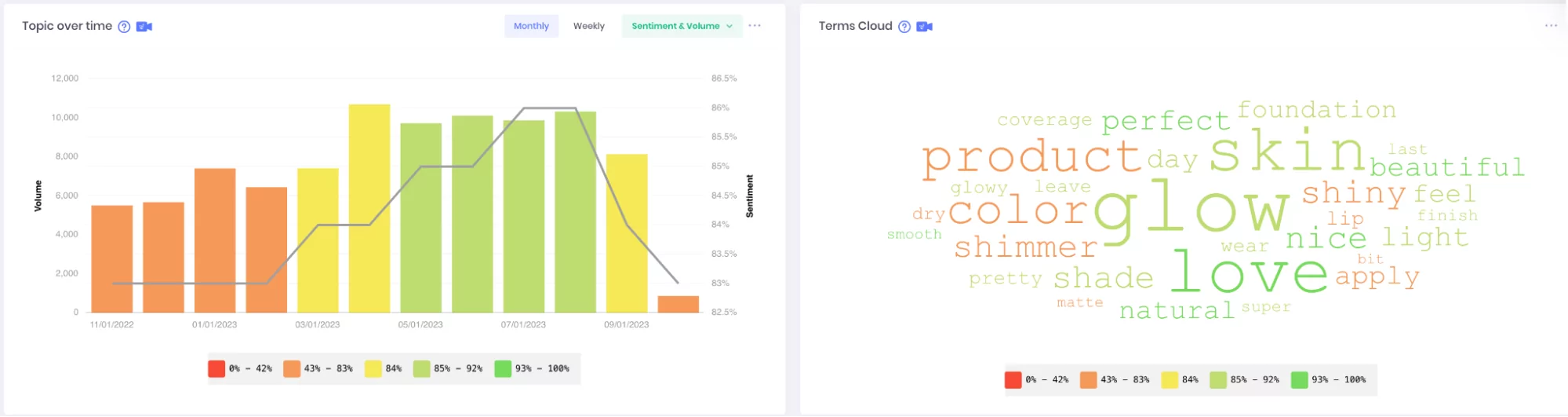

Beyond the overall picture of what’s important to consumers, cosmetics brands have the ability to delve into particular topics. For instance, if you’d like to understand what consumers are saying about a particular aspect of a product, you can discover everything with a click of a button. In the screenshot below, we’ve selected the “Shine” topic for the overall cosmetics category. The chart on the left highlights the overall trend of the topic for the last 12 months including the evolving sentiment and share of discussion. This is also displayed in the term cloud to the right.

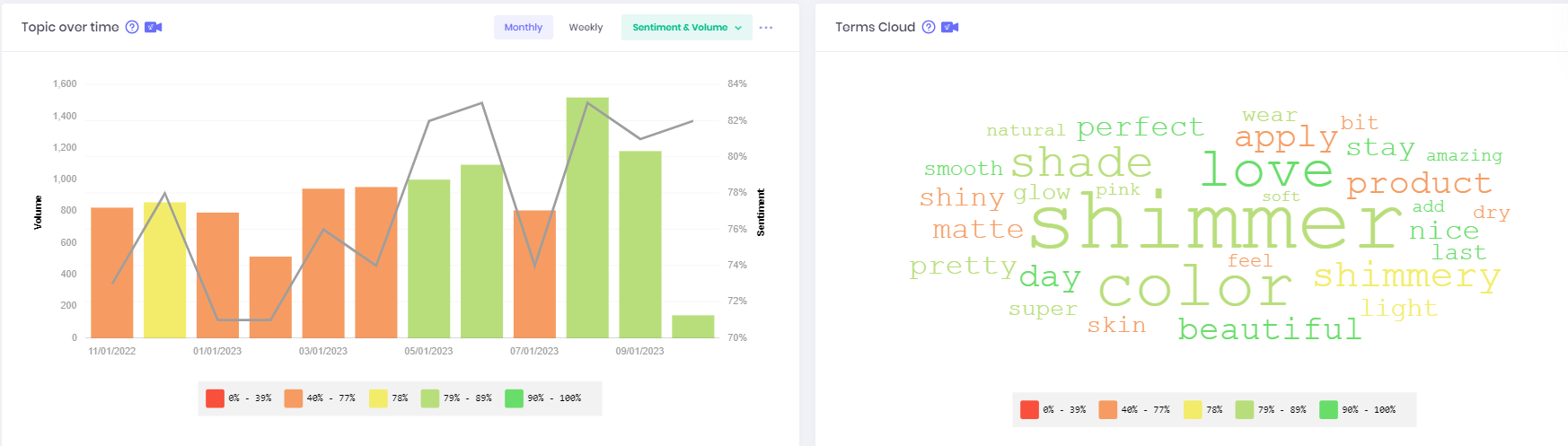

If we look at the same topic for the eye category, we have a completely different cut of data. Here we see different variations of consumer sentiment over time that don’t correlate with the overall cosmetics category. There were also other words that emerged in the term cloud like shimmer which pops among the other words.

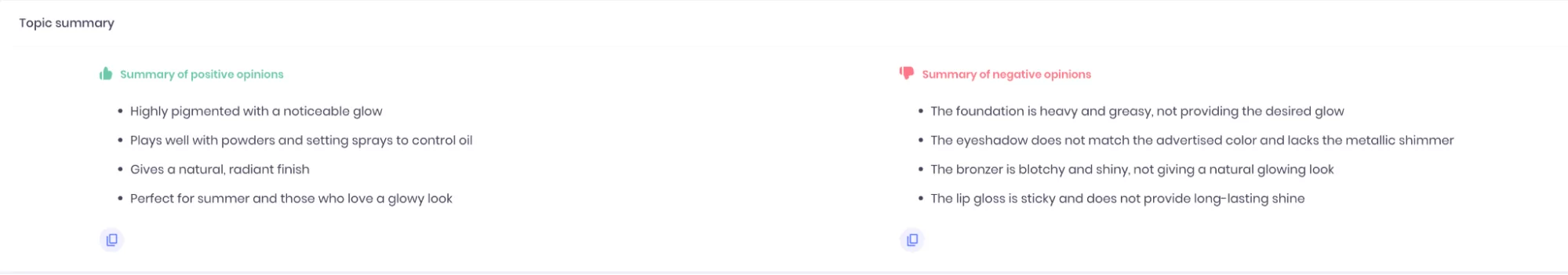

For additional insights into the data, quickly use the Topic Summary feature to generate a summary of positive and negative reviews around the individual topic for the lipstick. This gives you the most comprehensive information around the trends and topics so you can make strategic decisions about your brand.

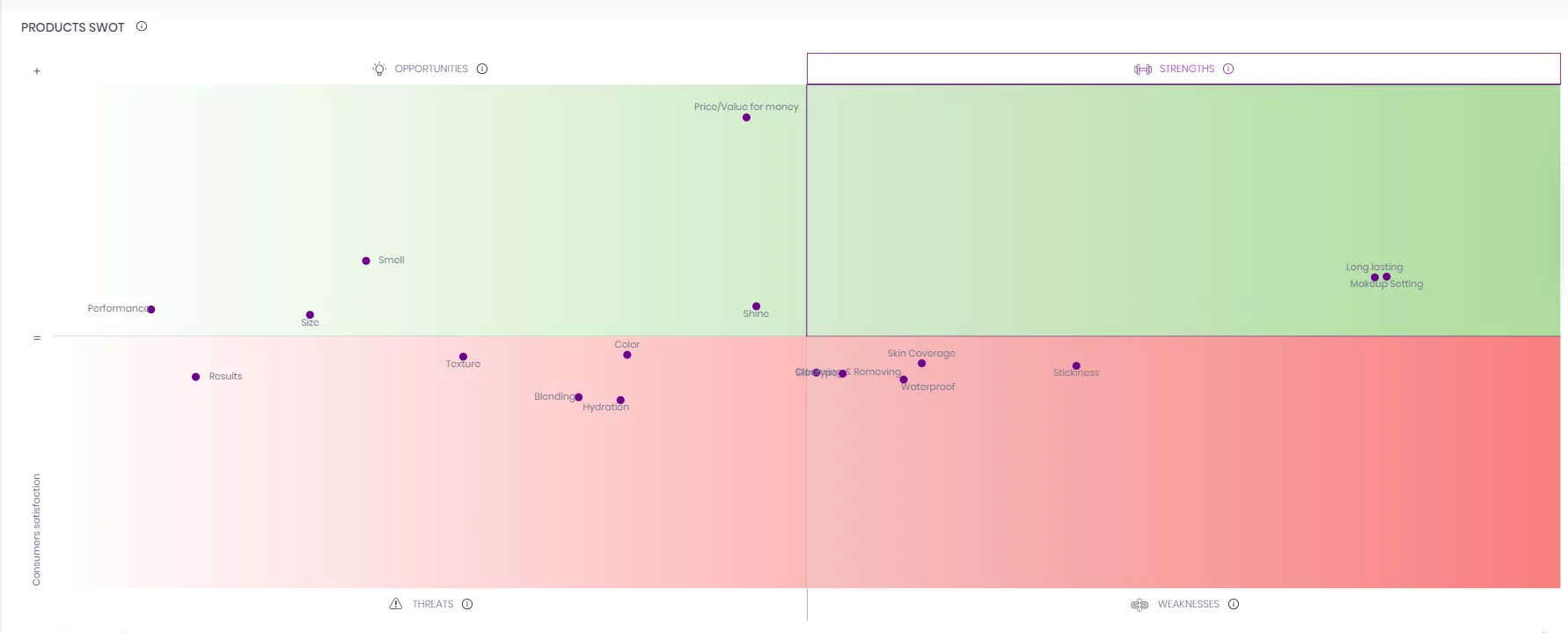

SWOT Analysis: Strategize with AI Intelligence

After spending a considerable amount of time understanding the marketing and leading brands in the cosmetics industry, we find that category-level data once again provides brands with SWOT analysis powered by generative AI. This view gives you access to an unparalleled perspective of your brand and competitors. Where is your brand excelling and what are areas of improvement? What are opportunities to overtake rivals and threats coming your way? The SWOT analysis in this visual is for the four aforementioned brands, however you can quickly isolate your own brand or a competitor’s brand to better understand consumer behavior and sentiment.

The SWOT analysis has numerous applications for both innovation and marketing. It can be used for optimizing brand positioning or a marketing campaign. Similarly, identify white space opportunities to create products with guaranteed product-market fit or simply integrate improvements in the roadmap of your current product offerings.

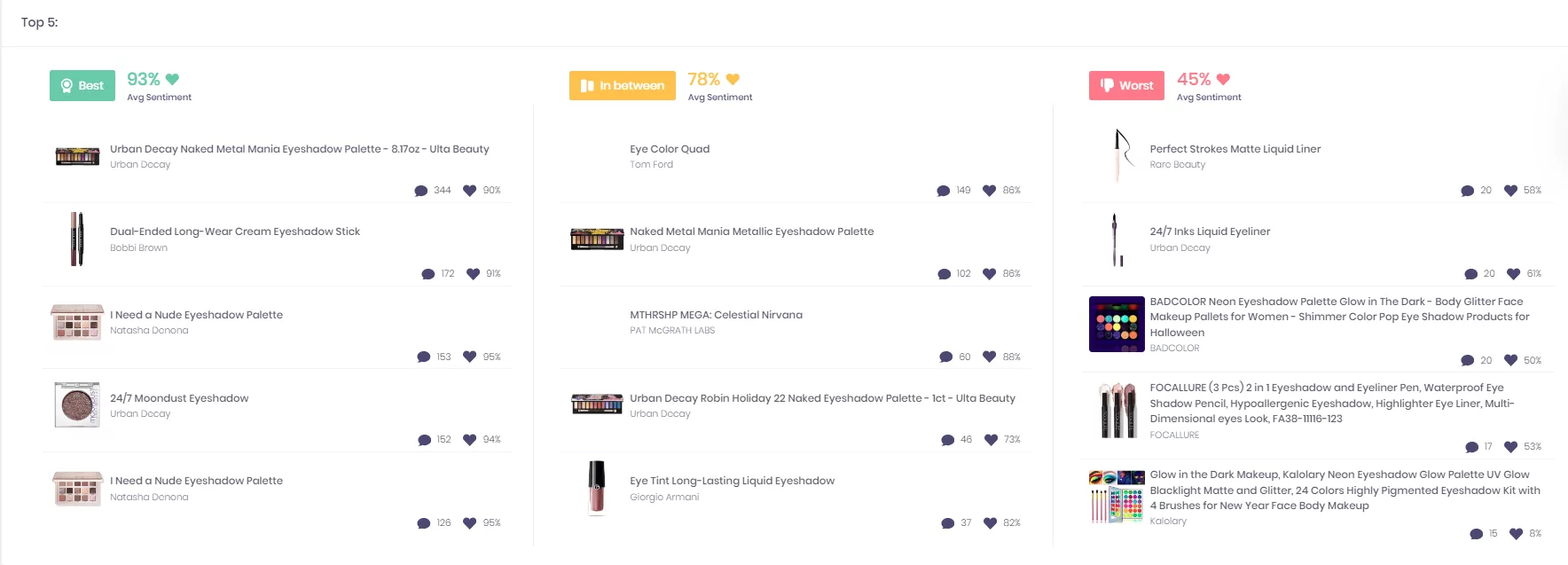

Best and Worst: Learning from the Market Leaders

Finally, Revuze’s AI analytics can show brands what the Best or Worst brands or products are by topic. This insight is crucial for learning which brands and products are dominating the market and why. In the example below, we see the Best, Worst, and In Between eye products for the overall eye category. These calculations are based on the products’ consumer sentiment. Quickly identify the top products that you’re competing against. Drill down into each one to understand what consumers love about them. This data empowers you to integrate the data into your own product road map.

Conclusion

The applications of category-level data from online review analytics are endless. The most obvious and critical use is understanding your brand’s sentiment and overall positioning in the cosmetics landscape. Competitive benchmarking and understanding market position is the foundation to building your brand and product strategy. Go deeper by diving into a SWOT analysis or Best | Worst visualizations to learn more about opportunities to topple rivals or simply understand why your products may be lagging behind. With a few clicks, you’ll be able to prioritize your innovation, marketing, and ecommerce plans. Learn more about how Revuze can transform your marketing and innovation strategy with online review analytics by clicking here.

All

Articles

All

Articles Email

Analytics

Email

Analytics

Agencies

Insights

Agencies

Insights