Brands are always looking for data to up their game and stay ahead of the competition. In today’s digital world it’s more important than ever for brands to be agile to adapt to the ever-changing market landscape. Underlying emerging trends can quickly become a threat to brand or product loyalty. That’s why companies need to stay on top of their category, brands, and product offerings.

So what data source packs a punch for brands? Consumer insights from online reviews.

The breadth of online retailers out there give companies unparalleled access to big data from verified buyers from around the world. Amazon recently shared that 45 consumer reviews are written every second across all their retail sites! That’s just from one retailer. Consider the amount of data when you aggregate from sites like Target, Walmart, Macy’s as well. That’s where online review analytics come in. Survey and focus group insights don’t even come close to the size of the data set from online retailers. It provides unique access to unbiased consumer insights data on the category, brand, and product level.

This blog will explore the different levels of consumer insights, data challenges, and why it’s important for your marketing and product development.

Category Insights

Many consumer brands have category level insights however, they are only for their own brands and products. They don’t have category level insights that include all their competitors. The fact is, online reviews analytics is the way to do it. It provides an overall snapshot of the market from verified buyers, meaning this is post-purchase data.

This entails accessing a range of online retail data sources from around the world. Sounds easy enough, right? Not exactly.

To illustrate, let’s take the cosmetics category. It’s quite broad, and can be further divided into subcategories like face, eye, lip, nails, and more.

Creating a cohesive category is the first hurdle that needs to be overcome. Revuze’s generative AI does all the work behind the scenes by creating a unified product taxonomy. Why is this so critical? Every online retailer has a different way of mapping out the products on their website, but Revuze generative AI is adept in creating a unified category no matter the number of data sources.

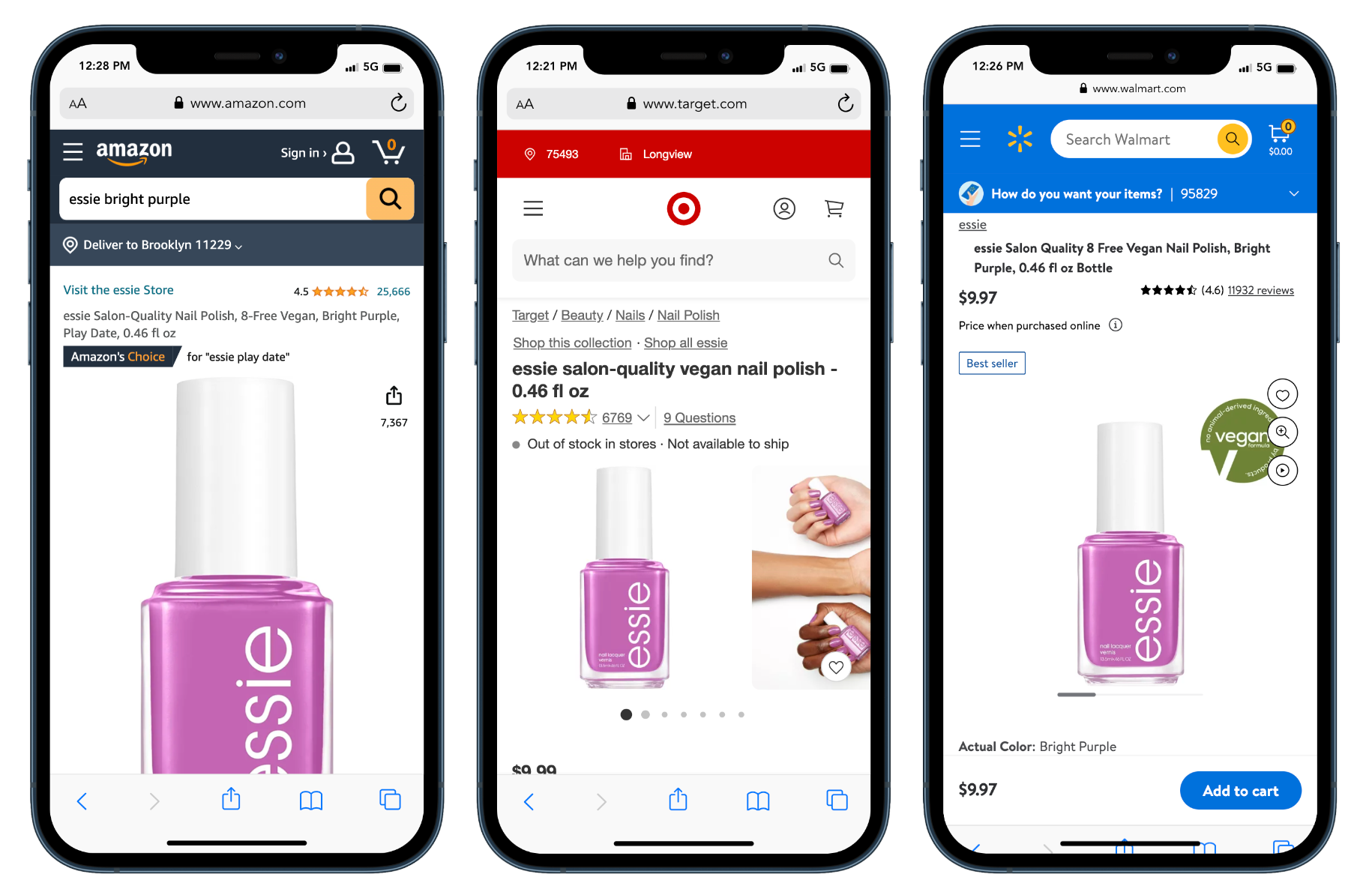

The screenshots below highlight the same Essie nail polish being sold on Amazon, Target, and Walmart. However, each page has variations including the product taxonomy, product name, as well as image variations. For instance, on the Amazon page, the product name is “Bright Purple Play Date” while on the other pages it’s just called “Bright Purple”. Now let’s focus on the breadcrumb navigation at the top of the Target’s PDP. Here we see that Target gets very granular by placing the product in the nail polish category and not just in the overall nail category. Both Target and Walmart have multiple images and Walmart highlights that the product is vegan.

To make sense of the data on the category level, Revuze’s generative AI engine is doing a lot of work behind the scenes. The AI creates a unified category taxonomy, merging the names, and pulling the images and ensuring that it can provide the most accurate insights. The data set is so big, it’s challenging to do this manually.

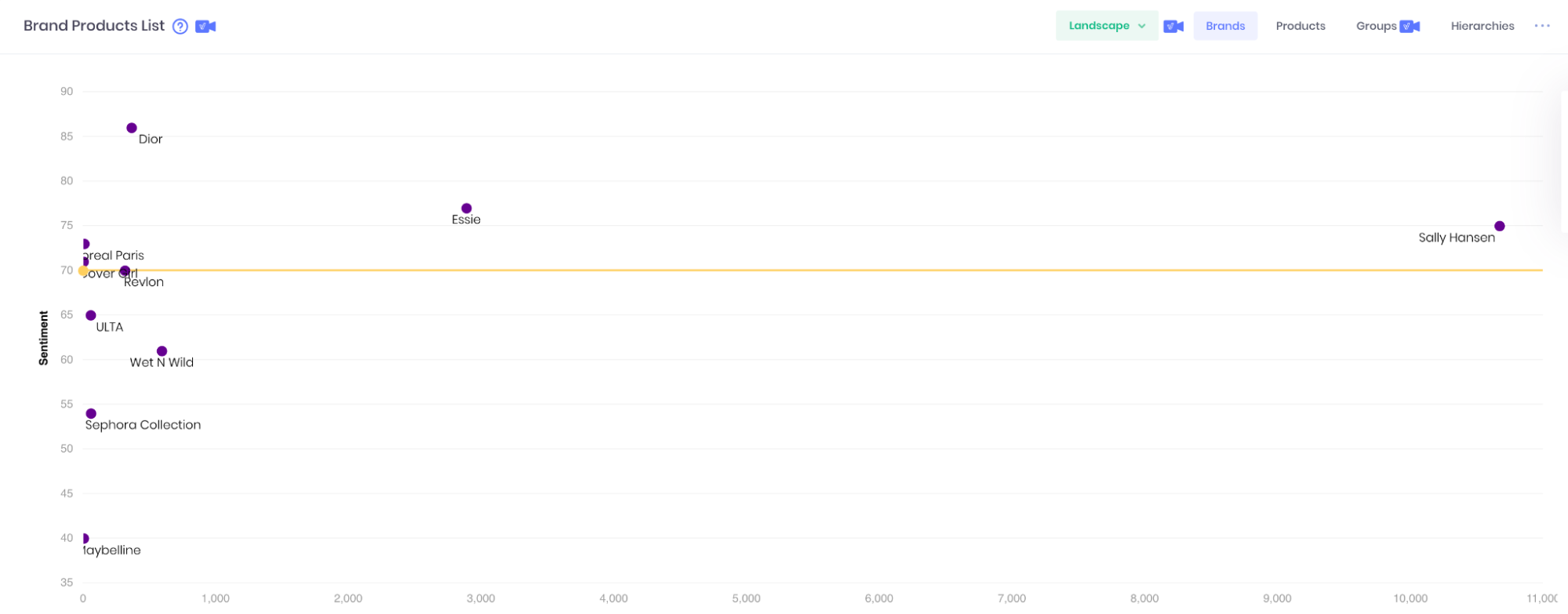

The category data empowers companies to keep their finger on the pulse of their brand and their known and emerging competitors. The screenshot below highlights cosmetics brands that are above and below the average consumer sentiment. This already is an indication of how your company measures up against the competition. Beyond sentiment, the chart highlights the share of discussion for various brands.

You can do the same for a subcategory. The chart highlights the brand positioning for nails. We see that Sally Hansen nail care products have above average sentiment and the highest share of discussion. How does your brand measure up in comparison?

Your category positioning already can provide direction with your marketing strategy. For instance, is your brand sentiment above or below the average among your competitors? Is that indicative of your marketing strategy or should it set off a red light about product issues? The data can be leveraged to do pre-campaign research. Digging through the reviews will allow you to pinpoint opportunities to strengthen your brand positioning and refine messaging using your own consumers’ words.

Brand Level Online Review Analytics

Now that we have a sense of the overall landscape we can delve into the various brands for more granular data. This is an opportunity to do a deep dive on each of your brand competitors. Why do consumers love them? What attributes do they associate with your various competitors?

One place to start is to look at what’s driving the various star ratings. We can see that the Long Lasting topic gives a 10% lift to 5 star ratings, as opposed to texture which is the biggest contributor to 1-2 star ratings.

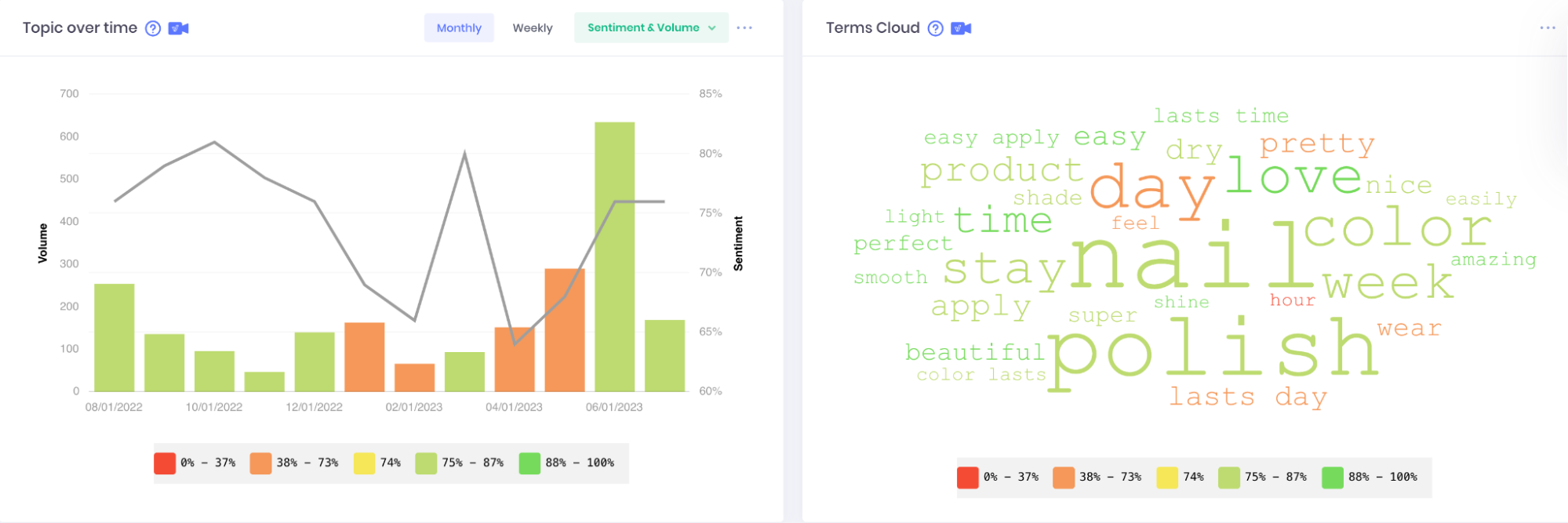

Now let’s dive into both topics to understand what consumers are saying about the various brands. The chart on the left highlights the sentiment and discussion volume for the long lasting topic. As you can see, the share of discussion and sentiment in June 2023 increased. The term cloud also highlights what consumers are associating with the long lasting topics. This is a gold mine of information allowing you to get inside consumers’ heads. For instance, the language from the term cloud can be used for optimizing PDP pages and website content.

The chart and word cloud highlight some topics that are in orange, meaning there is negative consumer sentiment around them. Product teams can leverage this information to make product improvements and conduct quality assurance checks.

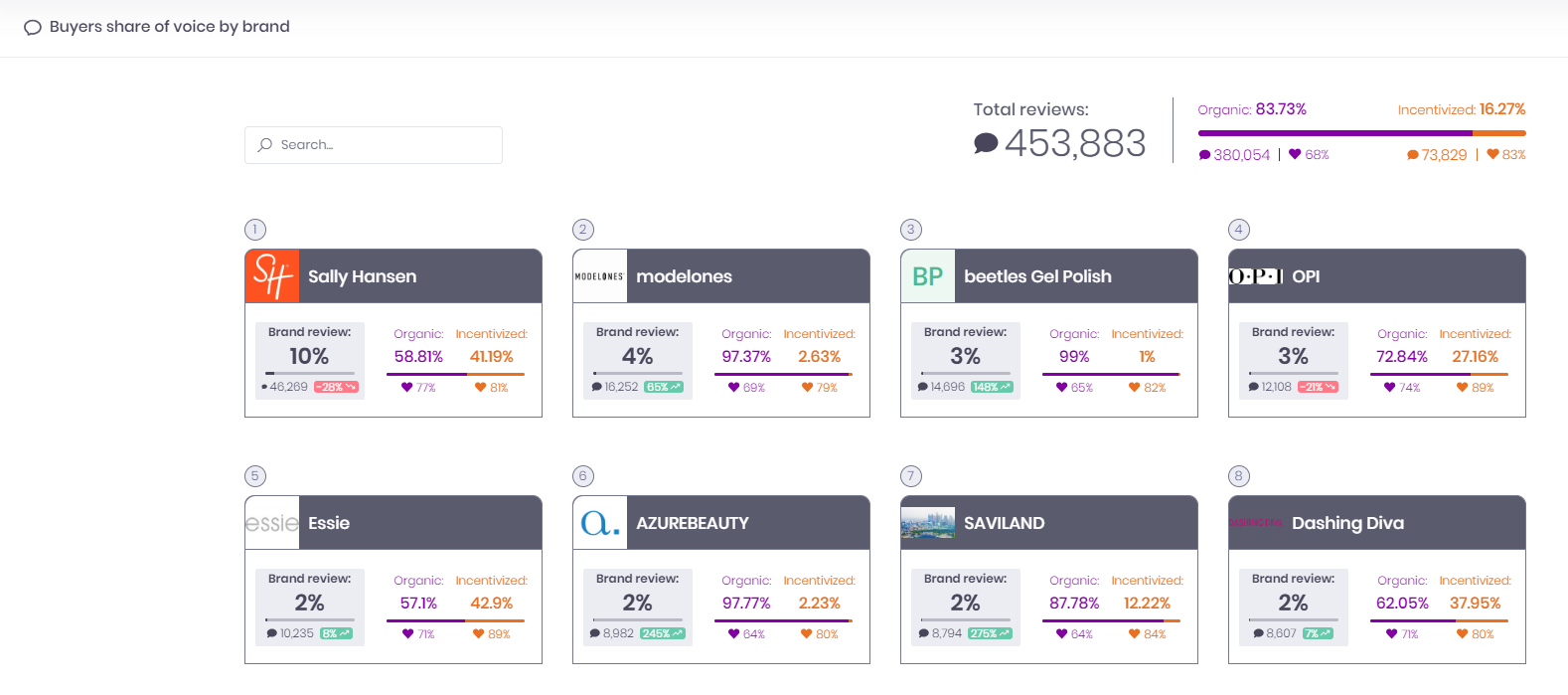

Other ways to leverage the brand data is to understand which ones incentivize more than others and to see the impact it has on their consumer sentiment. In general, incentivized reviews tend to skew data sentiment slightly positive. The screenshot below highlights some leading nail polish brands and the breakdown of organic and incentivized reviews and consumer sentiment. This also provides a quick snapshot of new brands that may be emerging and could pose a future threat.

Product Level Online Review Analytics

Finally, let’s touch on the micro level when it comes to consumer insights–product SKUs. Since Revuze aggregates the data from an entire product category, it’s easy to get granular with your competitor’s products and your own. Keep in mind, we create all the dashboards for you! There’s no need to cut and paste individual product URLs from different online retails. Revuze does the heavy lifting for you.

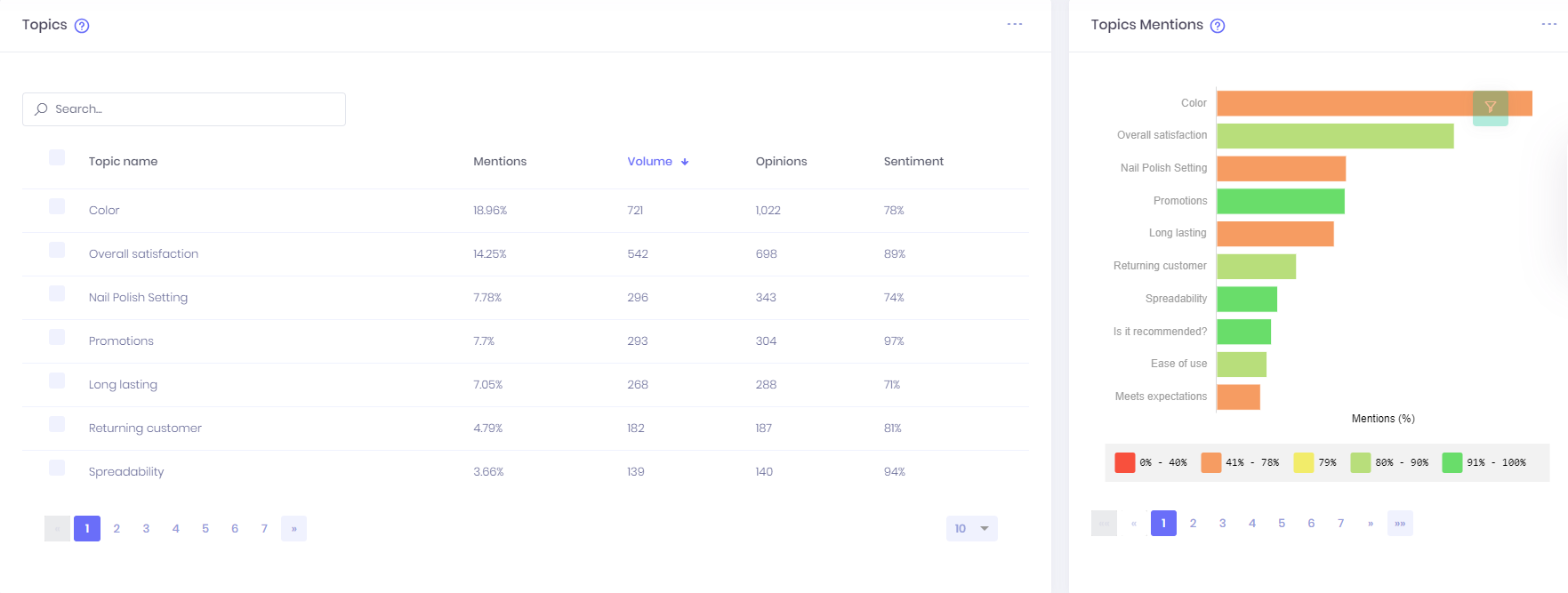

One of the most important Revuze dashboards is actually the product catalog, allowing you to randomly click on each product. Delve into individual SKUs and view a complete analysis created by our generative AI engine. Here you see a snapshot of the topics around the product including share of discussion and sentiment. From there, dive into the individual reviews to get a sense of consumers’ psyche. It’s a great way to monitor product launches and immediately identify consumers’ frustrations and fix them quickly.

The power is in your hands. From here you can filter between organic and incentivized reviews, hone in one a particular topic, and do keyword searches. Benchmark your product against the competition and perform a SWOT analysis. It’s a great way to identify white space opportunities to develop new products.

You never know where the data will take you!

Conclusion

In today’s fast-paced business landscape, harnessing data from category, brand, and SKU levels is pivotal for companies seeking to remain competitive and agile. This multi-dimensional insight empowers businesses to make informed decisions, optimize strategies, and swiftly adapt to changing consumer preferences. With access to a wealth of consumer feedback, companies can confidently navigate market shifts, strengthen their brand positioning, and unlock new growth opportunities. In the age of data-driven decision-making, staying ahead of the curve hinges on understanding consumer sentiments at every level, from the broad category landscape down to individual product SKUs. To learn more about how you can benefit from Revuze’s consumer insights powered by generative AI, click here.

All

Articles

All

Articles Email

Analytics

Email

Analytics

Agencies

Insights

Agencies

Insights