The Body Shop was founded by Anita Roddick in the late 1970s and started from humble beginnings with a single store in Brighton, UK. It was a brand that broke ground with its agenda–ethical consumerism, emphasizing no animal-testing. It quickly evolved into a global phenomenon known for its unique array of skincare products. For many years, it was the go-to brand for lotions, hand creams, and more. It was even a popular brand for gifts for any occasion.

The brand’s star shined bright for many years with both a brick and mortar as well as a Direct-to-Consumer presence. However, the company started to take a turn in the early 2000s due to financial mismanagement. It changed hands numerous times being purchased by L’Oreal, followed by Natura and most recently by Aurelius. Last week, The Body Shop announced that it would be closing half of its stores in the UK.

As the future of this beloved brand remains in limbo, we will take a deep dive into what story consumers have to tell. Does The Body Shop have a chance of making a comeback or is this the nail in the coffin? Let’s explore the data now.

Consumer Sentiment and The Body Shop

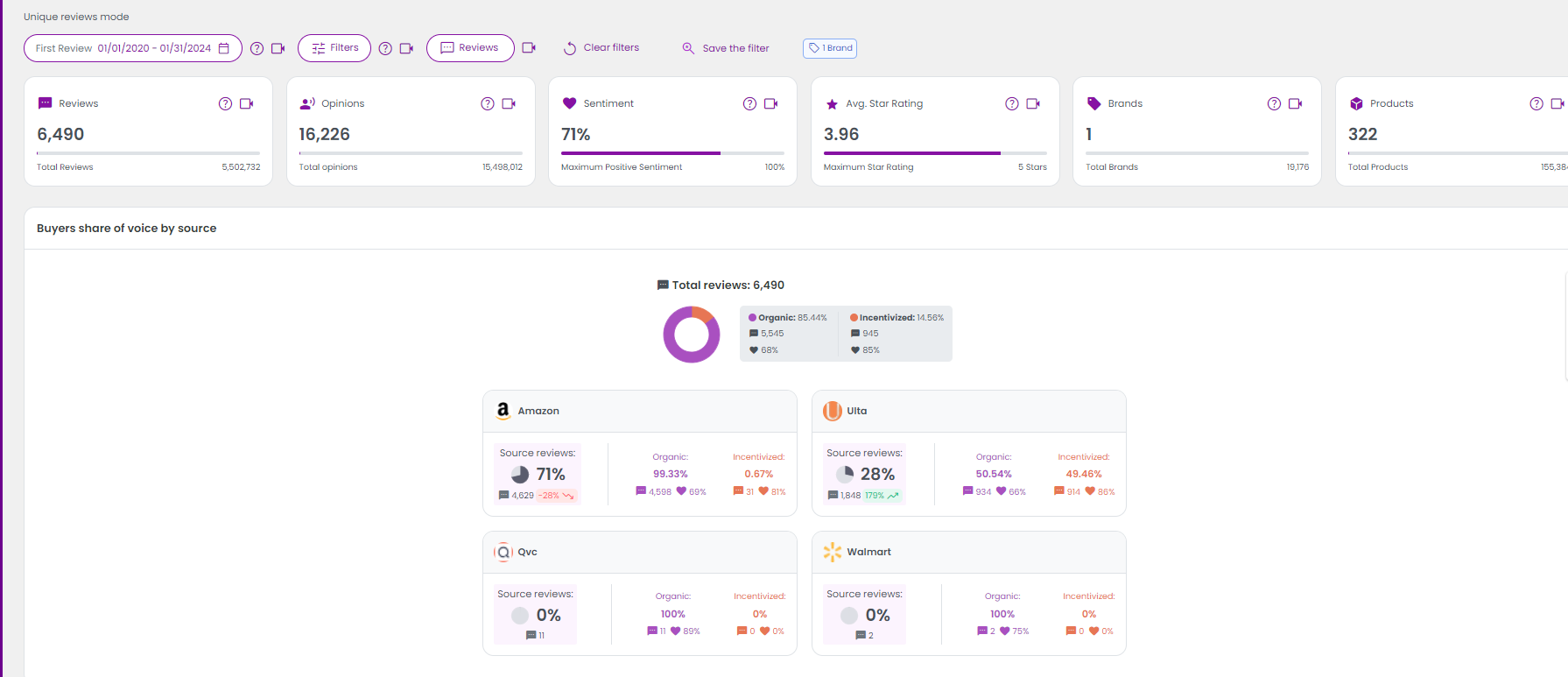

When we look at the reviews from the past four years, The Body Shop has an average sentiment of 71% when considering both organic and incentivized reviews. Ulta is their most incentivized channel at 49%. If we remove incentivized reviews from the mix, their consumer sentiment slightly dips to 68%

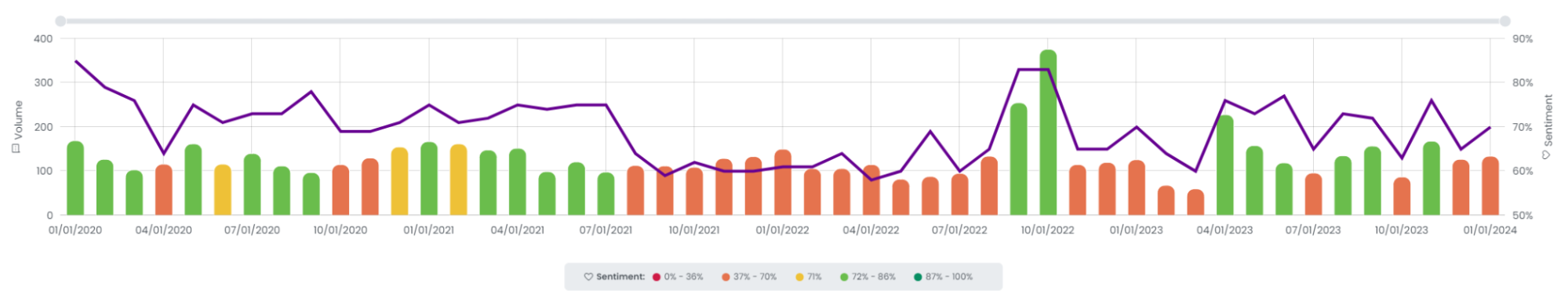

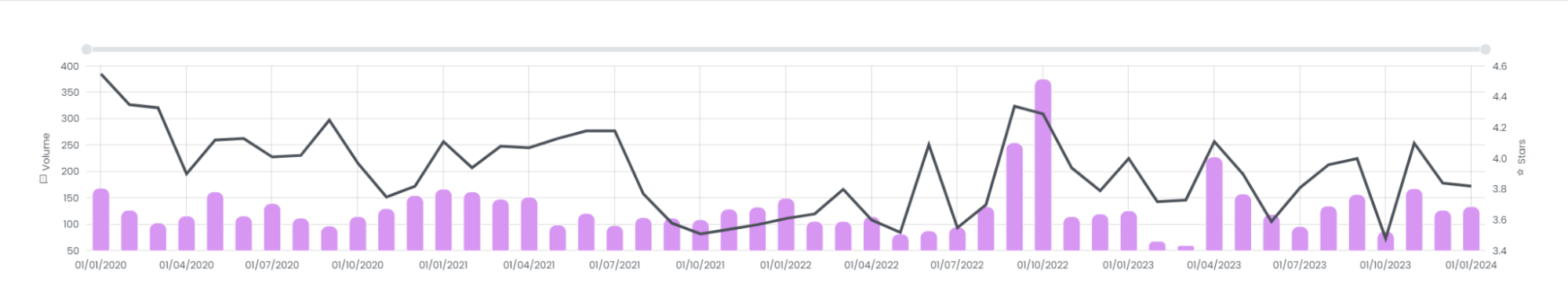

When we look at the brand overtime, we see that the graph is punctuated with some positive peaks, most notably in October 2022. However, overall the graph depicts a brand that’s not on the top of minds of consumers and doesn’t meet expectations.

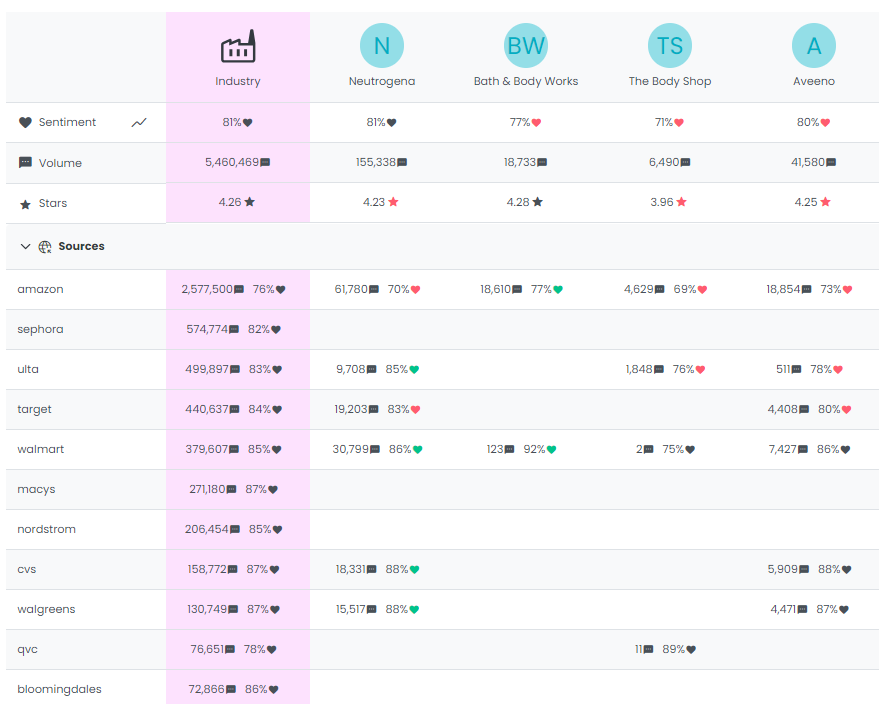

When we compare The Body Shop to similar brands we see how the brand is struggling. The brand is far below the industry benchmark for similar skincare brands which is 81% and 4.26 stars. What’s also telling is the low share of voice when compared to other similar brands – a mere 6,490 reviews. This indicates that consumers aren’t even discussing the brand, and that it’s not relatively top of mind.

Star Rating Drivers and The Body Shop

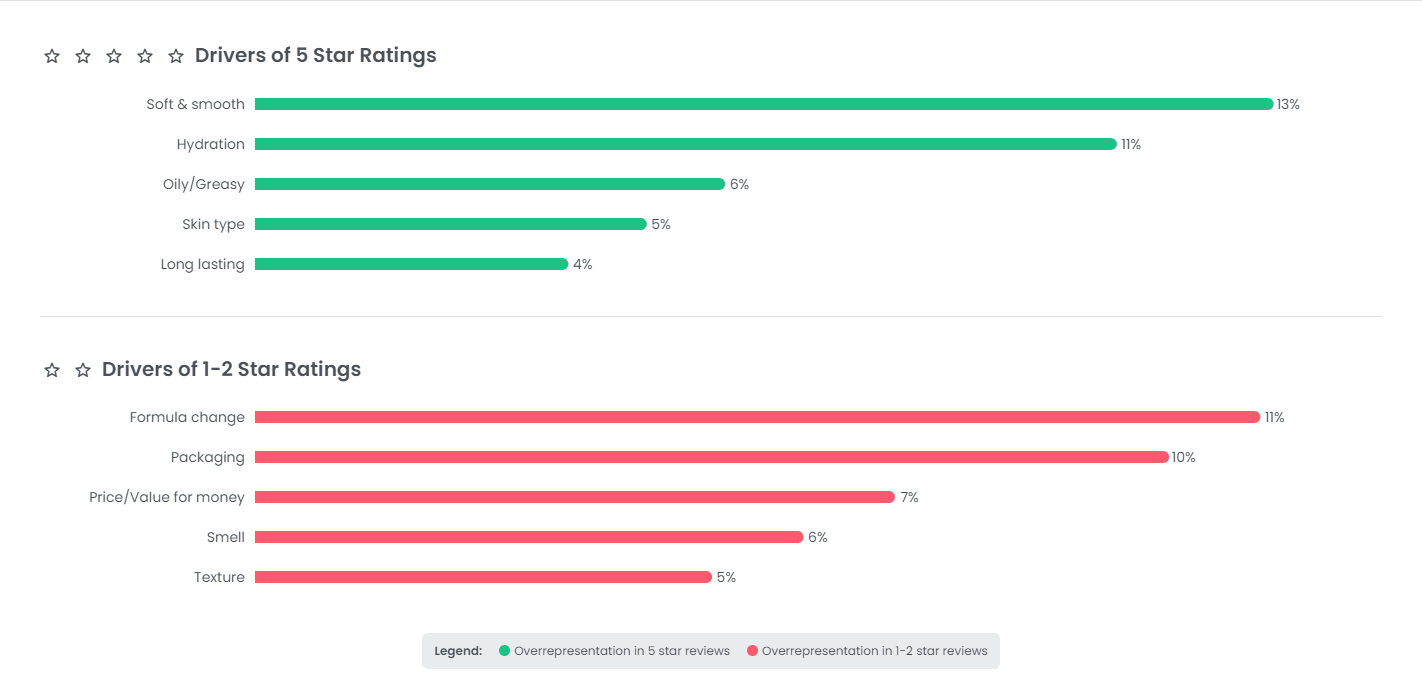

When we look at the star rating drivers, we begin to get a clearer picture of what is impacting consumers’ opinion of the brand. When it comes to five star ratings, the brand excels at products that have the following aspects: Soft & Smooth, Hydration, Oil/Greasy, Skin Type, and Long Lasting. However, those drivers aren’t enough to lift their sentiment. Formula change and packaging are the leading reasons for one or two star ratings, followed by price/value for money, smell, and texture.

When we look at the graph below which looks at the brand’s star rating over time, it closely mirrors the overall brand’s sentiment trend.

Formula Change

Formula change emerged as the top driver for both one- and two-star reviews. We took a closer look at what consumers had to say about the topic. Consumers conveyed concerns regarding the latest formula of The Body Shop’s skincare cosmetics. Notably, the updated version emits a strong baby powder scent, a departure from the beloved original fragrance, and lacks the expected durability. The facial scrub texture is described as thick and waxy, missing the essential granules that contribute to its exfoliating properties. Moreover, the reformulation has compromised its moisturizing effect, resulting in a tacky sensation and challenging application. These changes have led to disappointment among users, who feel that the new formula does not live up to the high standards previously set by The Body Shop’s skincare line.

Packaging

Now let’s dive into what The Body Shop consumers had to say about packaging. Many raised several issues regarding the packaging of their skincare cosmetics, leading to negative experiences and overall dissatisfaction. For instance, they reported receiving products in damaged packaging that resulted in leakage, compromising the integrity and usability of the contents. A significant concern highlighted is the absence of safety seals or tamper-proof features, with products often arriving without any outer or inner seals. These packaging shortcomings have not only raised questions about the product’s safety and hygiene, but have also contributed to a decline in consumer trust and satisfaction with The Body Shop brand.

Opportunities to Become a More Consumer-Centric Brand

The Body Shop is at a unique juncture in its company lifecycle. They have an opportunity to stay relevant by listening to their customers and going back to the drawing board with their product line.

Consumers have a clear wishlist for future Body Shop products, emphasizing both functionality and quality. There’s a strong desire to retain the pump feature on gels for convenience, alongside calls for the return of beloved old products and formulas. Additionally, there’s a demand for more user-friendly packaging, such as droppers, to facilitate easier product extraction from jars. Size matters too, with consumers wanting larger containers that offer more product for their money. Consistency is key, as there’s a hope that The Body Shop will maintain their formulas and scents without discontinuing popular products. Variety also ranks high on the wishlist, with requests for new scents and product variations. Lastly, a cleaner, more natural ingredient list with fewer unnecessary additives is a significant consumer demand, reflecting a growing trend towards health-conscious and environmentally friendly beauty products which was their raison d’etre from the beginning.

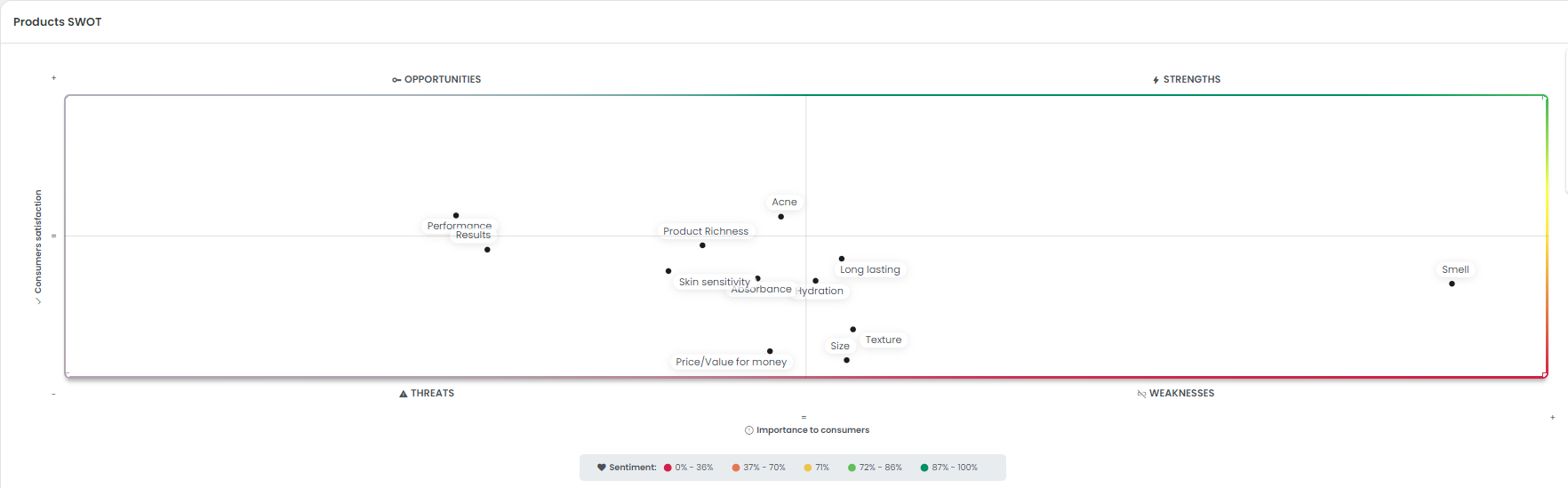

The SWOT analysis paints a sobering picture, notably lacking in highlighted strengths. We see that there are many obstacles in their future as they strive to be more relevant to their consumers. Among their core weaknesses are: Smell, Long Lasting, Hydration, Size, and Texture. Further threats include: Results, Product Richness, Skin Sensitivity, Absorbance, and Price/Value for Money.

Conclusion

Though The Body Shop’s current situation is due to financial mismanagement, the insights from consumer reviews tell a parallel story. It demonstrates that it’s a brand that lost touch with its core audience by not listening to consumer feedback. The brand declined because their product offering didn’t meet consumer expectations. The brand has a chance to rise from the ashes and rebuild its reputation starting with a product line that makes consumer feedback at the heart of everything they do. Innovation should be spurred forward using the feedback to achieve product-market fit.

All

Articles

All

Articles Email

Analytics

Email

Analytics

Agencies

Insights

Agencies

Insights