Your beauty products are being sold on a range of online retailers. You check the numbers and for some reason you have more conversions on one channel over another. What’s driving this difference in consumer behavior and how can you pinpoint the reason?

That’s where Revuze’s online review analytics come in. The data from verified buyers is intertwined with sales and can give e-commerce managers a different perspective as to why one channel has more success than another.

This blog will look at the different ways that e-commerce managers can optimize conversions.

Let’s Dive In: Category Insights for Cosmetics

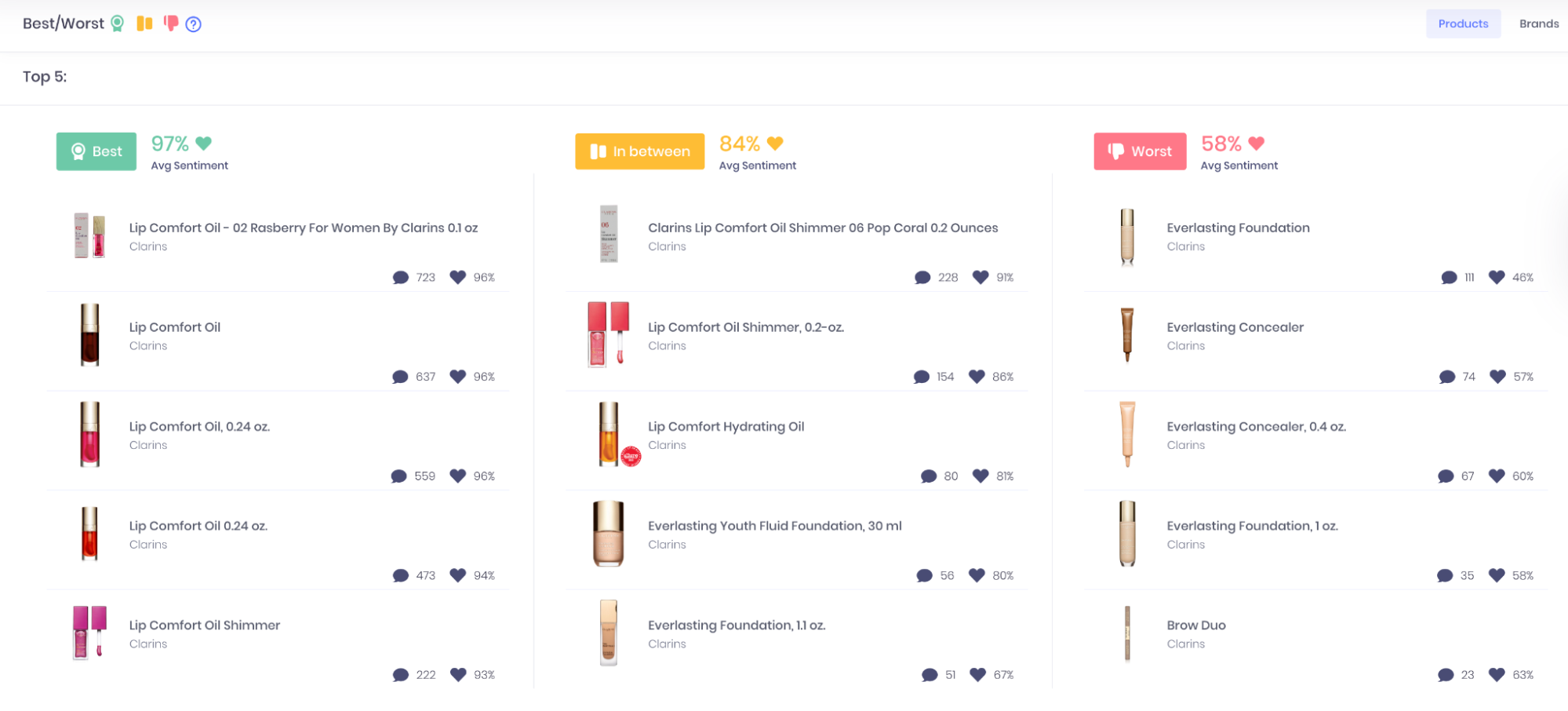

Revuze’s category insights empower brands to compare the overall consumer sentiment for brands and for specific topics. As you can see from the screen grab below, the consumer sentiment for Clarins brand cosmetics is under the industry of all online retailers except for Walmart and Nordstrom. What created this disparity in consumer sentiment? What might be the driving force impacting sales?

For our example, we will focus on Nordstrom and Bloomingdale’s, two retail channels for Clarins. It has a 81% consumer sentiment on Bloomingdale’s, which is well below the industry average, whereas on Nordstrom, it’s 88%, above the industry average. Beyond their online presence, both retailers also have brick and mortar stores where they sell Clarins’ products as well.

Comparing PDP Pages

The product description page is one of the first ways that consumers get acquainted with your product. The first aspect they encounter is the product visual. For this exercise, we selected the Clarins Lip Comfort Oil which emerged as one of its top products in the Best and Worst dashboard.

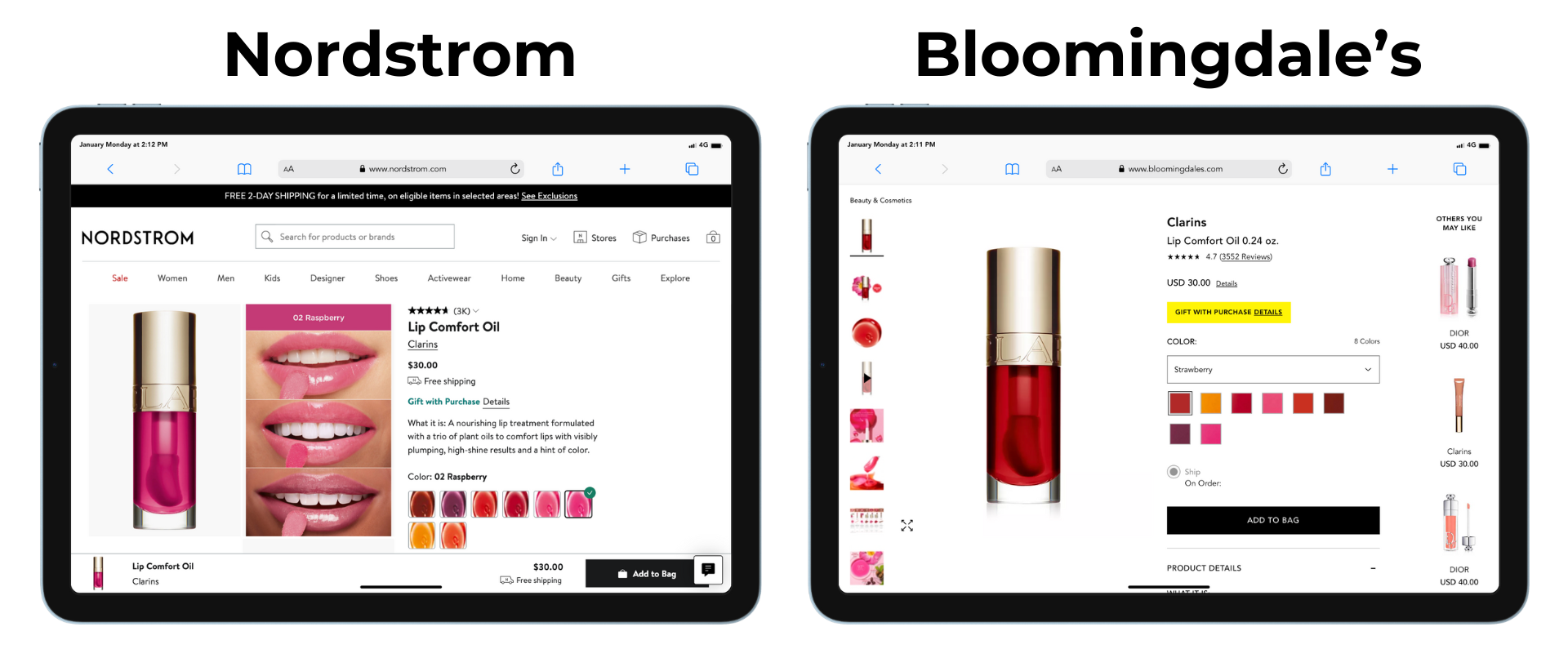

The PDP on Nordstrom has two bold product visuals, one highlighting the product and another focusing on lips, highlighting the product benefit. There are more photos and videos doing the same as you scroll down the page. Bloomingdale’s has a rotating clickable product carousel but the images are not dealing with the benefit as much. Also note that Bloomingdale’s putting forth competing products from Dior.

Note that the product is being sold for the same price point on both sites.

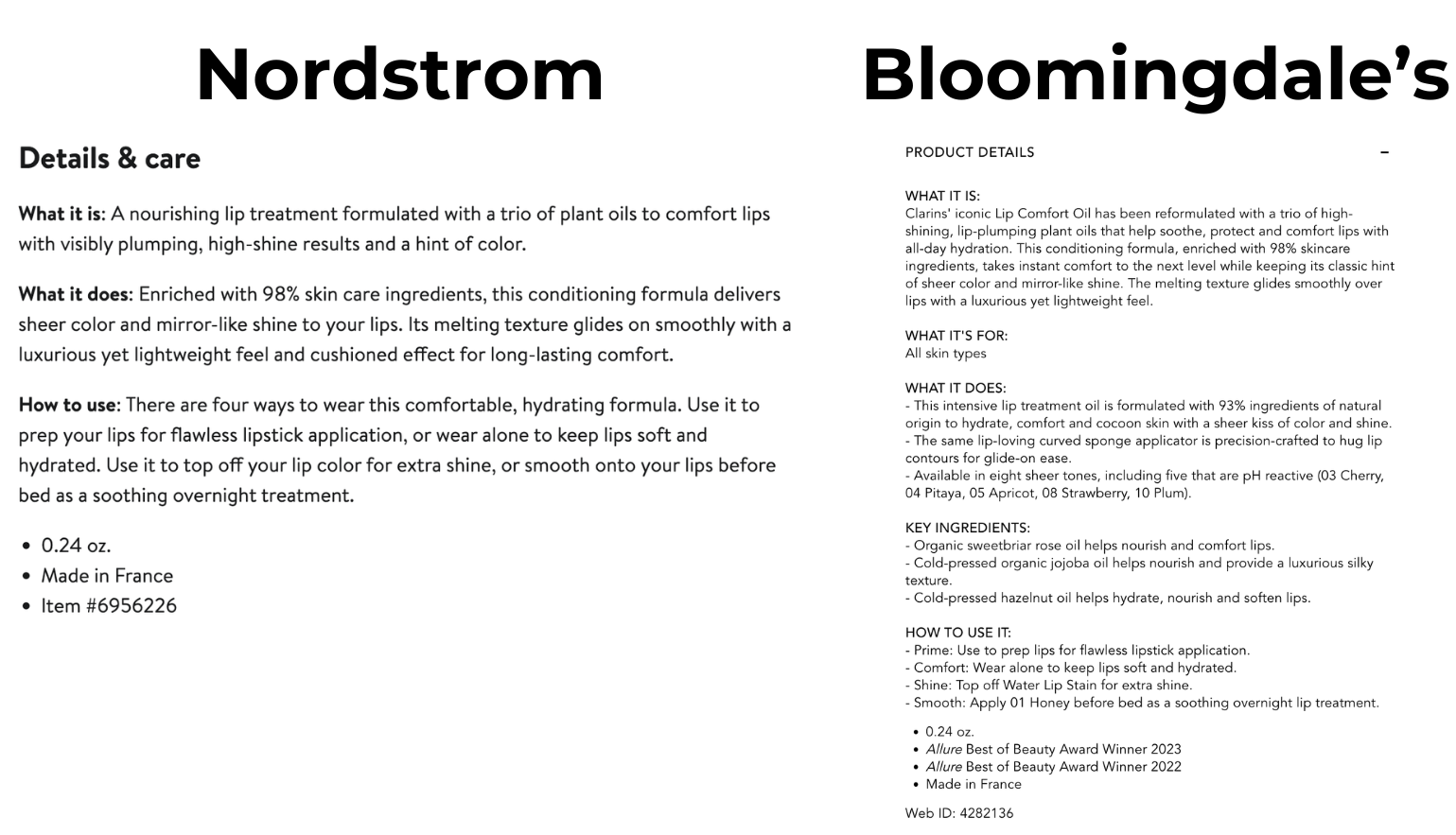

As you continue to scroll through the pages, you’ll find the product details as well. Bloomingdale’s focuses more on the ingredients while once again Nordstrom is about the benefit. Interestingly, Nordstrom doesn’t mention that this is an award-winning product.

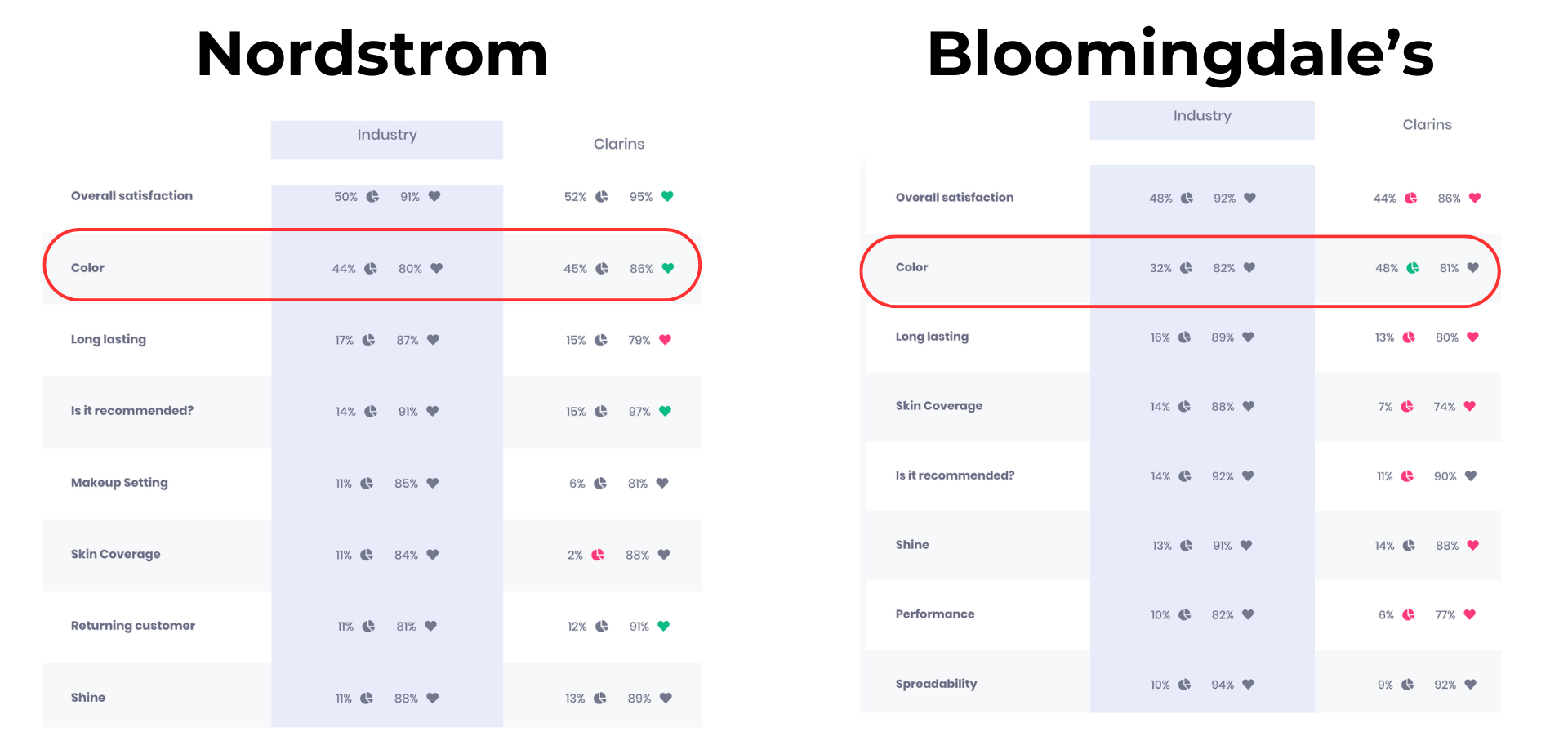

Get Granular: Consumer Sentiment By Topic

Earlier, we looked at the discussion volume and consumer sentiment. We can drill down even further to assess the consumer sentiment for each product topic. This visual below only shows a subset of the 60+ topics but quickly highlights areas where Clarins is thriving on Nordstrom as opposed to Bloomingdale’s. For the most part, Clarins ranks better on Nordstrom on most topics but “Color” stands out. Clarins exceeds the industry average by 6% on Nordstrom. Bloomingdale’s is interesting because the share of discussion is significantly higher around the topic, but the sentiment is one point below the industry average, almost neutral. What can account for these differences?

Clarins: Color Topic

To understand what verified buyers think about Clarins, we generated a topic summary for the consumer sentiment around “Color” of their foundation product on each e-commerce channel.

Nordstrom: Color

Clarins cosmetics receives mixed feedback regarding their lip oils’ color aspects. On the plus side, customers appreciate the sheer tint provided, noting the natural and universally flattering colors, along with the oils’ moisturizing benefits and the convenience of the attractive packaging. On the other hand, there are concerns over the limited color range and disappointment over the discontinuation of popular shades like rose gold. Additionally, some customers find that the actual color of the product doesn’t match what’s shown in the tube, and there are inconsistencies in color between different tubes of the same shade.

Bloomingdale’s: Color

Shifting our focus to Bloomingdale’s consumer reviews on lip gloss, the feedback reveals a positive reception overall. Customers are pleased with the sheer and natural-looking color of the lip gloss and its hydrating formula, which keeps lips moisturized. The variety of shades available is appreciated, and the customer service team receives commendation for assisting in shade selection. However, some customers note the color can be fainter than desired, and there are mixed opinions on the accuracy of the color representation. Despite these minor concerns, many customers express a keen interest in trying additional colors and shades available in the lip gloss range.

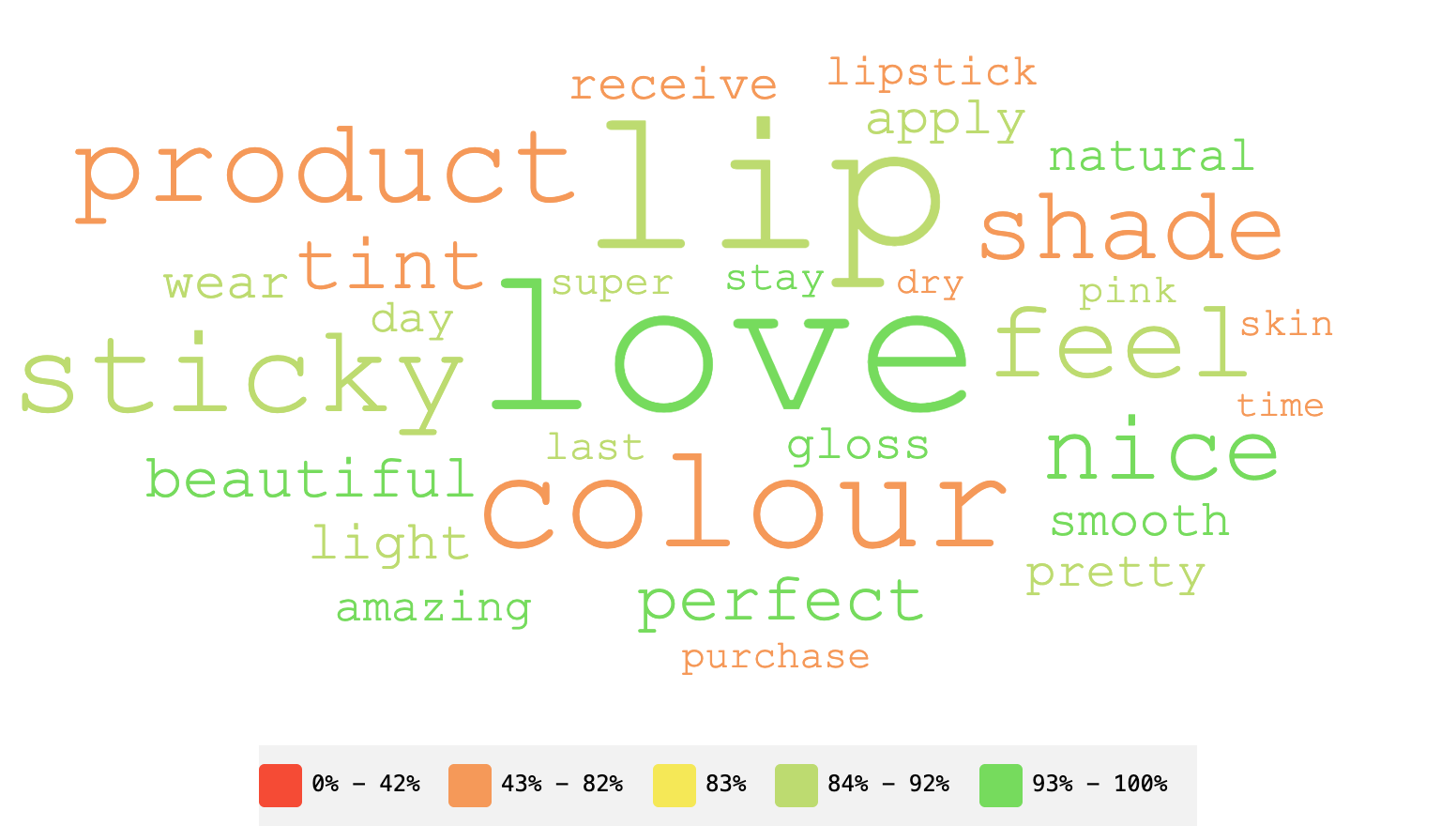

Despite the consumer sentiment variations between the two channels, the feedback from verified buyers is consistent for each online retailer. So now we can look at the term cloud for the color topic for both sources. These are words that can be used to upgrade PDP for the lip oil to ensure alignment with consumers and words to optimize the media channel.

Optimizing Your Media Channels

In looking at both channels, there seems to be some recognition on the part of Clarins which is heavily investing in promotion on Bloomingdale’s site with bold banners like the one below. Nordstrom doesn’t offer this nor sponsorship opportunities.

That said, if we look at some of the channels, we see many missed opportunities. For instance, they also do not make any effort to optimize their presence with a branded page on Amazon when they only have 338 reviews! Similarly, they are not sponsoring products on Sephora, but have a branded page on Ulta. Both Sephora and Ulta are dedicated beauty channels where Clarins’ consumer sentiment is below the industry benchmark.

Considering the range of channels and the below average consumer sentiment Clarins should consider reassessing their digital media strategy in favor of one that covers all the bases.

Conclusion

Revuze’s online review analytics has revealed crucial insights into consumer sentiment across different online retail channels, with Clarins experiencing varying levels of sentiment between Nordstrom and Bloomingdale’s. These findings underscore the significance of visual product representation and benefit emphasis on product description pages (PDPs) and highlight areas of strength, such as the “Color” topic, on Nordstrom. However, there remain untapped opportunities for Clarins in optimizing their digital media strategy, including platforms like Amazon and Sephora, where they currently lag in consumer sentiment. To sum it up, Revuze’s AI provides essential tools for brands like Clarins to refine their digital strategies and maximize their success in the competitive cosmetics market. Learn more about how Revuze can help strengthen your e-commerce strategies here.

All

Articles

All

Articles Email

Analytics

Email

Analytics

Agencies

Insights

Agencies

Insights