Getting Inside the Heads of Your Customers: The Ultimate Guide to Gathering Consumer Insights

Getting inside the heads of customers is essential to the success of any business. With so many innovative market research tools available today, it’s not too difficult to gain consumer insights that can fuel data-driven strategies for any business.

Yet, not all market research tools are created equal. Each tool has its time and place, and collecting valuable consumer insights depends on your ability to find the right mix for your needs. This process begins with knowing who in your organization benefits from getting in the heads of the customers:

- Consumer Insights Pros: Success depends on understanding and communicating internally about market trends, competitor behavior, consumer sentiment toward product features, buying drivers and more.

- Product Managers and R&D: The need for continuous, agile innovation requires product development and iteration based on consumer demand and competitive forces.

- Consumer Services and QA: Understanding customer expectations makes it easier to resolve call center support calls quickly, minimize returns, and maximize positive experiences. All of these stakeholders put the customer at the center of what they do. By generating real, tangible consumer insights, you’re able to report to business leaders about customer preferences and push their organizations toward widespread customer-centric operations.

The challenge is to identify which tools to rely on and when to use them. If you’re looking to get inside the heads of your customers, the following outlines a comprehensive toolset to choose from:

- Surveys

- Focus Groups

- Market Research Consultants

- Sentiment Analysis

- AI-Based Analytics

Once you know how to get the most out of each of these market research tools, you’ll be able to gain actionable insights from your customers and consistently drive results for your business. Surveys are one of the most traditional market research tools available to you. Just because surveys aren’t the most technically-advanced solution in the consumer insights toolbox doesn’t mean they can’t bring value to your business.

However, it’s important to have the right strategy before investing in surveys for a particular consumer insights project. When surveys were all product managers had for consumer insights, it was easy enough to put a few questions together, collect answers, and move forward with the results. But now, we can be more selective with when (and how) we put surveys to work.

4 Steps to Survey Tool Success

One of the potential weaknesses of surveys for market research is that it can be difficult to get the granular, accurate consumer insights that will inform smart, data-driven business decisions. You can mitigate this weakness by setting yourself up for success from the start. The following 4 steps will help you do just that.

Step 1: Plan Strategically

Given that there are so many market research tools available to you, surveys only make sense when you can satisfy two key requirements:

First of all, you must know your target audience. Having a strong, relevant sample audience for surveys is essential for getting the most valuable consumer insights. Before considering surveys, you have to segment your target audience and ensure you’ll be asking the right people the right questions for your project.

Secondly, you must have a well-defined problem and goal. Surveys shouldn’t be used for exploratory market research. Without clearly defined goals and problems, your survey results will be unfocused and deliver unclear insights. Rather than simply asking high-level questions about what features customers might want to see next, surveys should ask specific questions about ideas you’re planning to bring to market. These two requirements will inform every step of the survey process. They form the strategic foundation that you need to ensure your market research investments are spent wisely.

Step 2: Choose the Right Survey Questions

There’s so much flexibility when it comes to creating survey questions, and that can be both a blessing and a curse. Subtle mistakes when choosing questions can limit the insights you gain from the entire survey process. To avoid asking leading questions, leaving too much room for interpretation, or forcing respondents to answer in absolutes, you need to lean on your target audience research. The more you know about your audience, the easier it will be to ask the right questions.

Every survey is unique, but it’s typically best to include a variety of questions. Don’t make everything a rating scale. Add multiple choice, rank order, closed-ended, open-ended, and other types of questions to create diversity in responses. When it comes time to write the questions themselves, keep your goals in mind. Brainstorm any and every question that could possibly lead to the insights you need. Once you have a long list of possible questions, you can start putting the survey together with the best combination.

Step 3: Reaching Your Target Audience

If your survey is meant for existing customers, you have direct access to the right target audience. However, if you’re trying to reach a new audience or launch a new product, it’s not quite as easy to get your survey in the right hands.

In many cases, it’s best to work with a market research firm like Nielsen or Westat to take advantage of their resources and access to a deep pool or consumer respondents. By working with these consultants, you don’t have to worry about spending your own time and money trying to compile a quality list of target consumers.

That approach comes with its own challenges, though. One thing to be wary of when working with a consultant is the fact that they’re incentivized to generate answers. If you have a particularly difficult target audience to reach, that incentive can lead to inaccurate results due to a lack of diversity in respondents.

Whichever approach you choose, it’s important not to cut corners. Take the time to compile a strong list of respondents before you try to gather results.

Step 4: Analyzing Survey Results

Immediately after you’ve finished the collection process, it’s time to analyze results. This is where all the hard work pays off and you get the consumer insights you were looking for from the start.

First, you need a structured plan for analyzing the different types of questions in your survey. Then, you need to decide whether you’re going to manually assess open-ended questions or use text analytics tools to do it automatically. Manually analyzing your survey results allows you to take advantage of your industry experience to interpret responses and the insights they point to. But it takes a lot of time to go through every response. Automated text analytics increases accuracy and saves you time. However, if you don’t have the in-house expertise to put these tools to work, you might be better off enlisting lower-level employees and students to interpret survey responses.

Generating Valuable Consumer Insights With Focus Groups

Much like surveys, focus groups are age-old market research tools that can deliver valuable consumer insights when used properly. However, focus groups can be one of the most difficult market research tools to leverage. You need to be entirely sure that a focus group is your best approach or else you could end up with results that were available from other research tools. Focus groups are most valuable when you’re trying to work through a problem with your product. A survey might tell you that customers are unhappy with a certain feature, but you might not be ready to eliminate it altogether. With a focus group discussion, you could reveal insights into slight changes that could significantly improve customer experiences.

Think about Tide Pods as an example. In pre-launch focus groups, the idea of single-serve laundry detergent probably played well among consumers. But after long-term feedback, it became clear that the product was staining clothes and causing public safety problems. There’s no way a focus group could have surfaced those kinds of insights, which is why focus groups can’t be your only market research tool.

One Revuze customer showcased a stronger focus group use case: this vacuum manufacturer found customers continuously complaining about power cords in product reviews. In many cases, the customers struggled to roll up the cord. Instead of recalling the product, the manufacturer ran a focus group. They found that the problem was in usability as opposed to an actual product defect. And with that insight, they were able to adjust to customer expectations instead of redesigning the entire product.

Once you’ve determined that a focus group is necessary to gather consumer insights, there are a few key steps you need to take to ensure success:

- Choose a project manager/moderator with the right level of industry expertise to get the best answers from participants.

- Find location(s) for your focus group that align with the regionality of your project.

- Decide who will participate in the focus group to generate a deep discussion with diverse opinions.

- Come up with a basic set of questions to guide the focus group discussion and be sure to include open-ended questions that will spark conversation.

- Prepare internally by collecting as many consumer insights as possible with the data you have on hand. That means listening to support call recordings, reading call transcripts, scanning through product reviews, sifting through any other customer data at your disposal.

If this sounds like a long, complicated process, that’s because it can be. Many brands will outsource focus group processes to consultants because they don’t have the time or resources necessary to run their own focus groups.

Even if you hire a consultant, there’s one potential pitfall to be wary of when using focus groups as a market research tool—groupthink. Your focus group participants may have the best intentions, but all it takes is one opinionated participant to persuade others to their way of thinking, and throw off the insights you had hoped to gain.

Much like with survey-based market research, focus group success comes down to asking the right questions. It’s unlikely that participants will volunteer “off-topic” information, so you might not get all the insights you need if you fail to ask the right questions.

In the cases of both surveys and focus groups, oftentimes hiring a market research consultant will mitigate the potential pitfalls of these traditional tools, so we’ll go into that next.

Hiring a Market Research Consultant To Generate Consumer Insights

Traditionally, hiring a market research consultancy has been seen as a cure-all for consumer insights challenges. Rather than struggling with the overhead of managing surveys and focus groups internally, you could hire a consultant to use their experience and resources to get the results you needed.

Before considering market research services, you need to create a reasonable hypothesis to solve a particular problem. What’s the question you’re hoping will unlock consumer insights that can drive your business forward?

For example, if sales for a particular product are down and you can’t determine why, market research services can help. Or, if you run a campaign and fail to get as many repeat customers as expected, research services can fill in the knowledge gaps.

After deciding that a consultant can help solve your specific problem, you can start to evaluate potential partners. Do you need a global firm or a smaller provider? Should you hire a consultant that focuses on one particular geographic region because you’re expanding to that area? What level of expertise does the consultant have with your product and industry?

All of these questions and criteria will help you assess potential partners so you’re set up to get the best insights possible. However, market research consultancies are not necessarily cure-alls. When evaluating potential market research consultants, be sure to ask about:

- Survey Strategies: Does the consultant have quick access to large panels targeted to your needs? Can they bring innovative approaches to survey creation to the table? How will their outcomes differ from other consultants?

- Interview Strategies: If you need the consultant to interview customers, how do they plan to generate more insights than if you conducted the interviews yourself?

- Advanced Monitoring: Will the consultant go beyond traditional market research tools like survey tools and focus groups? Even social media monitoring has become an expectation. Pay attention to more advanced sentiment analysis as a differentiator for consultants.

- AI-Based Tools: Scaling consumer insights is essential to modern market research. The more information you can get about customer preferences, the easier it will be to maintain competitive advantages. Advanced monitoring is helpful, but AI-based tools are what scale consumer insights and further set consultants apart from the crowd.

While tapping into the experience, expertise, and resources of a market research consultant can seem attractive for any project, it’s not without disadvantages. Most notably, the cost. No matter how you approach it, hiring a market research consultant can be an expensive decision. If you haven’t taken the necessary time to focus your hypothesis and set clear goals, your ROI can suffer.

In the past, it was more worth the risk to invest in a consultant to tackle the challenges that traditional market research tools presented. Now, there’s an abundance of advanced, self-service tools that can help narrow the gap between the consumer insights you get from consultants and the ones you get from your own internal research.

Using Sentiment Analysis For Modern Market Research

If you’ve decided to hire a market research consultant, the process will likely start with a deep dive into all your relevant internal data. That means they’ll gather all necessary product reviews, social media conversations, call transcripts, and other data that could contribute to the answers you’re hoping to get from market research.

Once the consultant has collected the data necessary, they’ll take one of two approaches for initial analysis. Some consultants will take a manual approach, reading through all of the data to create a baseline of information about your problem. In other cases, consultants will use sentiment analysis tools to automate the process.

But sentiment analysis tools aren’t just for consultants. If you’re doing market research on your own, there are self-service sentiment analysis tools you can take advantage of.

Sentiment analysis tools offer an automated way to process textual data for positive and negative contextual insights. In some cases, it’s easy for an automated program to determine the sentiment behind data points. “X product is awful” is a pretty clear message.

But not every message is so easy to analyze. In many cases, you need the human capability to understand contextual information if you want to carry out sentiment analysis. However, if you want to get the most out of sentiment analysis and gain insights at scale, you have to pair the human side with the technical side.

There are two main ways that sentiment analysis tools can make this happen:

- Rules-Based Approach: Manually define positive and negative terms so the tool can use natural language processing techniques to sort sentiments accordingly.

- Automated Approach: Combine big data, machine learning, and natural language processing to create algorithms that apply human-level understanding to textual data at scale.

However, it’s important not to get too caught up in the promises of sentiment analysis vendors. The reality is that most sentiment analysis algorithms will only achieve 60% accuracy once you take away the context of a specific message. They can’t determine whether the word “long,” for example, indicates positive or negative sentiment.

To overcome inaccuracies of these tools, you’d have to feed the algorithms with many examples of subtle text. And while this kind of supervised learning can give you a small set of topics to derive consumer insights from, it will take a significant amount of time just for limited accuracy.

It’s important not to settle for sentiment analysis tools that will give you such limited accuracy. Don’t settle for a solution just because the vendor says it’s powered by artificial intelligence—dig deeper to see whether the tool uses AI to put data in the right context for more accurate consumer insights.

Taking Sentiment Analysis To The Next Level With AI Analytics

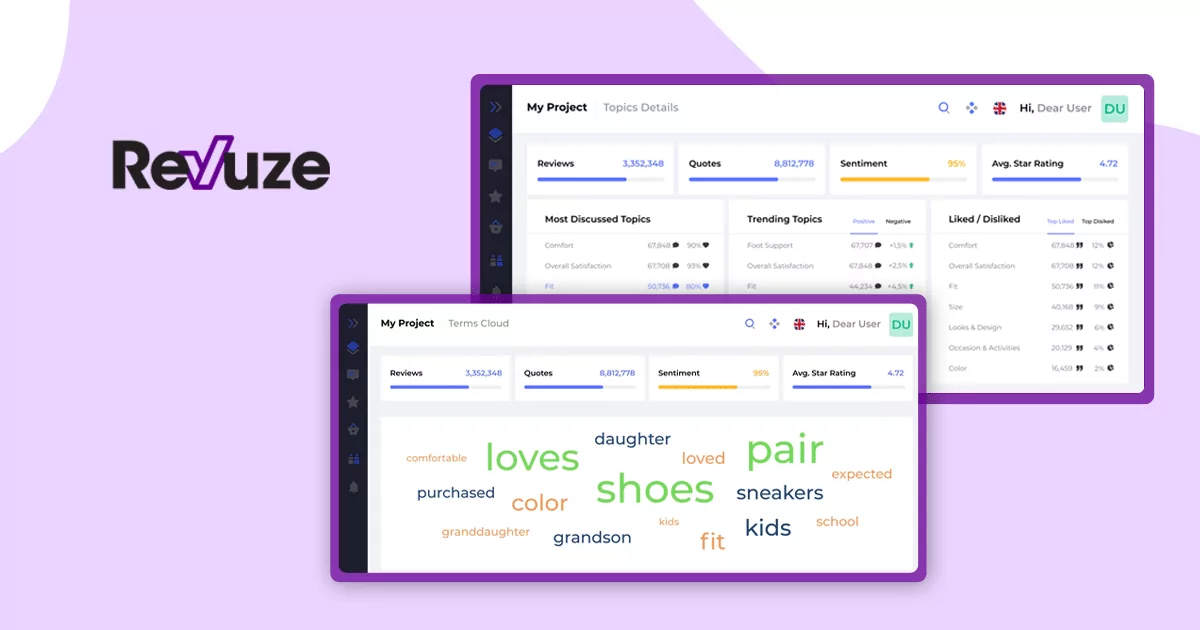

The key to getting more out of sentiment analysis is adding AI analytics as another layer of the tool. At Revuze, we call that layer “local models.” Within a few days, Revuze sentiment analysis generates local dictionaries and models with 90% accuracy, ensuring you can take advantage of consumer insights faster than with other sentiment analysis tools.

But more importantly, Revuze is able to put sentiment analysis in the right context to truly understand how consumers feel about specific aspects of your products. Rather than being limited to high-level topics like loyalty, satisfaction, and price, Revuze offers insight into granular topics like “softness” for toilet paper or “moisture strips” for razor blades.

By generating insights around 40-80 topics, Revuze sentiment analysis and AI analytics give you a wider array of consumer insights—all within a self-service package that business users can make the most of without data scientists or the help of market research consultants.

Conclusion

Getting in the heads of consumers can give you significant competitive advantages. And to gain those competitive advantages faster, consumer insights pros need to capitalize on the growing wave of self-service solutions.

The right self-service market research tools eliminate inaccuracies and speed up consumer insight generation so that you can get inside the heads of your customers more effectively.

To address the challenges and disadvantages of traditional market research tools, self-service solutions rely on:

- Automation: Relying on humans to spot patterns in customer data is slow and prone to errors. But with new data mining systems, you can automate the process and harvest insights without delay.

- Granularity: Specific roles in an organization have different consumer insights needs. That’s why high-level topics aren’t enough for modern market research. Granular data lets different users slice up consumer insights according to their specific needs.

- Accessibility: If a data scientist or IT professional has to be involved every time a business user wants to access consumer insights, you won’t get the most out of your data. Self-service market research tools have to be intuitive and autonomous to empower all users to act on valuable insights as soon as possible.

A few years ago, these characteristics would have been overly-idealistic for market research tools. But luckily, technology has advanced to the point that these kinds of consumer insights tools have become widely available.

It’s time to take advantage of self-service market research tools. And Revuze is giving business users the tools to do so. If you want to get the best possible consumer insights (without having to hire a consultant), schedule a free demo with one of Revuze’s experts.