Believe it not, online cosmetics sales are booming and are expected to hit $13.8 billion by the end of the year and is projected to reach $20.7 billion by 2028.

This is an industry dominated by major competitors, yet up-and-coming, independent cosmetics brands like Youthforia or Merit Beauty, are successfully making a dent. A recent McKinsey article expects that this is a trend we will continue to see. Given the mammoth market, how can you optimize your current cosmetics collection and innovate new products to ensure your brand’s dominance?

Know that your consumers have a captive audience actively seeking recommendations before completing their beauty purchase. Between the lines, you’ll discover nuggets of suggestions for improving everything from your packaging to the actual product. More than that, you’ll find ways to innovate and create based on what your consumers want. This will explore how cosmetics brands can use online review analytics to take their product offerings to the next level.

Breaking Down Category Reviews

A starting point in understanding where to optimize cosmetics products offerings is to dive into the topics. We will start with the “Wishlist” topic, which aggregates what cosmetics consumers want.

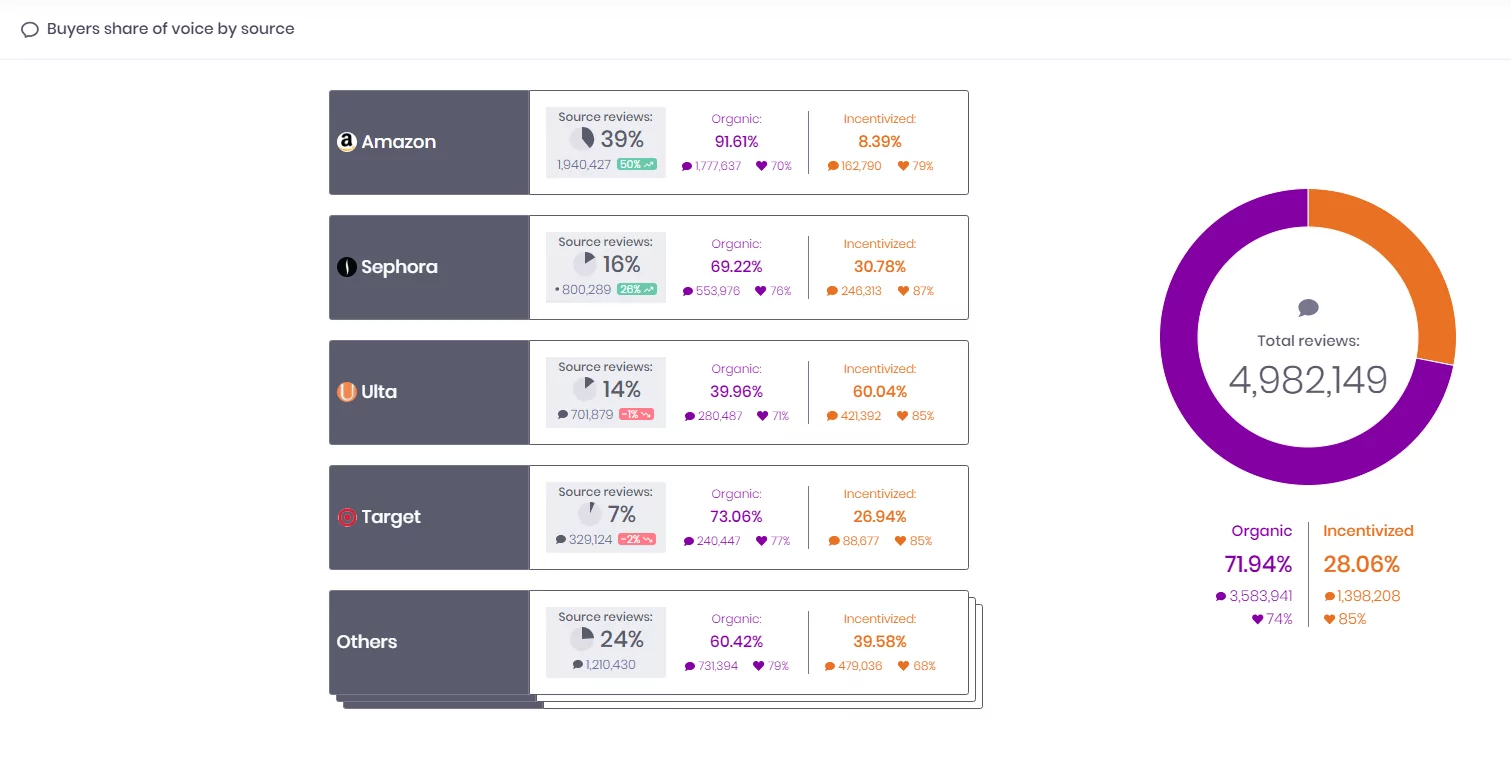

However, as you can see, cosmetics is one of the most incentivized industries out there, nearing 30%, and we see that Ulta is the most incentivized channel. For this exercise, we looked at the overall “Wishlist” topic and then filtered for organic and incentivized reviews. The filtering can help you prioritize your decision-making when optimizing your products.

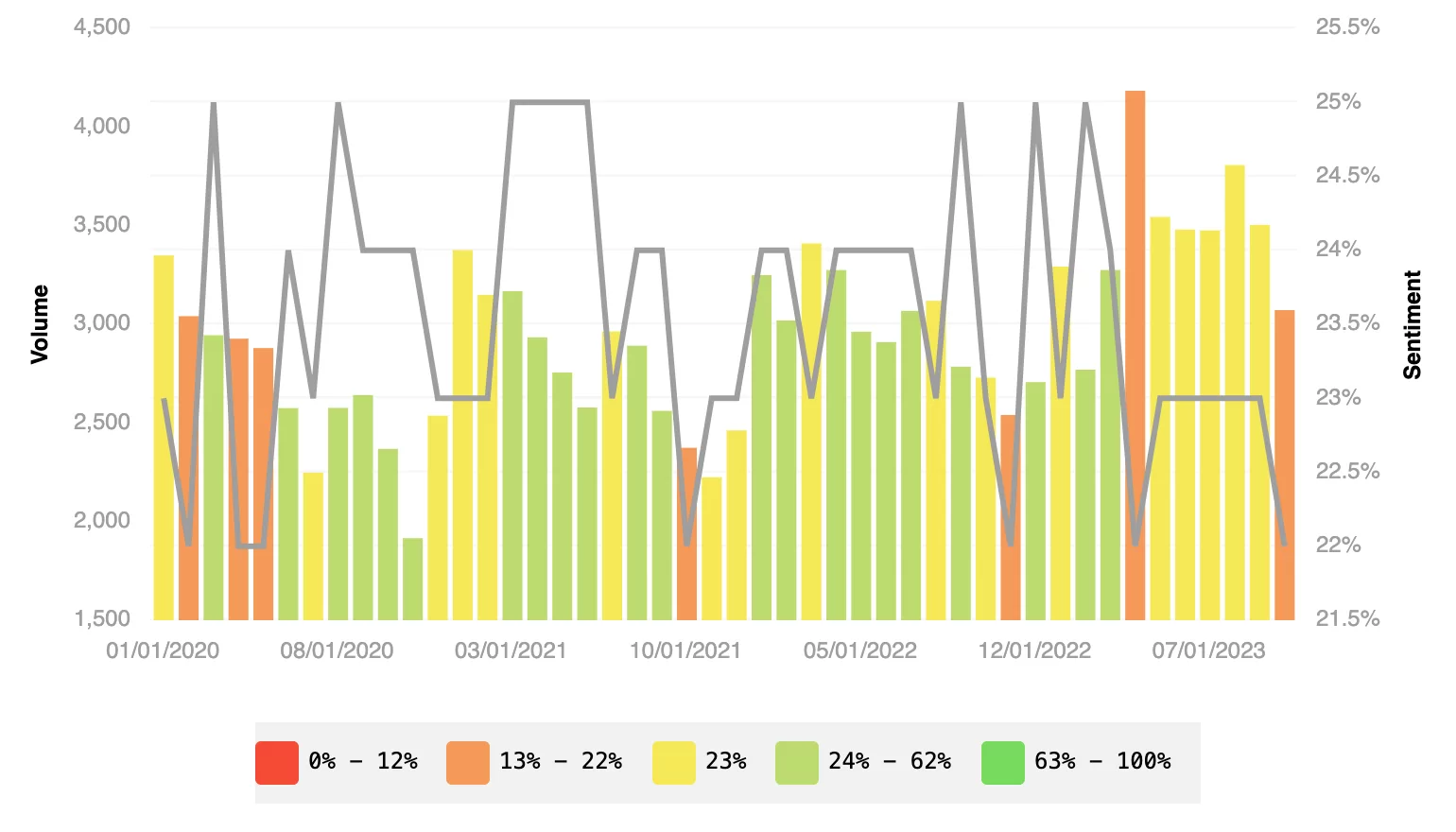

Wishlist: Organic & Incentivized

Cosmetics consumers desire a holistic beauty experience, emphasizing light cooling and hydration in lip products with a preference for a refreshing texture. Diversity is key, as they express a wish to explore different shades and formulas within a brand. Nostalgia influences their preferences, urging the revival of discontinued shades. A call for well-crafted shade descriptions aligns with their need for informed choices. Variety extends to both shades and sizes, prompting a request for more options and larger packaging. However, concerns arise regarding the functionality of packaging and applicators, highlighting areas for improvement in the consumer experience. These insights serve as valuable guidance for brands adapting to evolving consumer expectations in the cosmetics industry.

Wishlist: Organic Only

Organic reviews express a desire to explore a broader spectrum of shades, with a specific request for intensified pigmentation in certain colors. Longevity is a crucial factor for these consumers, who seek products that endure on their skin throughout the day, emphasizing the importance of sustained performance. Additionally, there’s a discernible preference for fragrance-free options among some users, reflecting the growing awareness and consideration for sensitivities. As brands navigate the organic beauty landscape, addressing these nuanced preferences for color variety, extended wear, and fragrance alternatives becomes instrumental in meeting the diverse expectations of organic product aficionados.

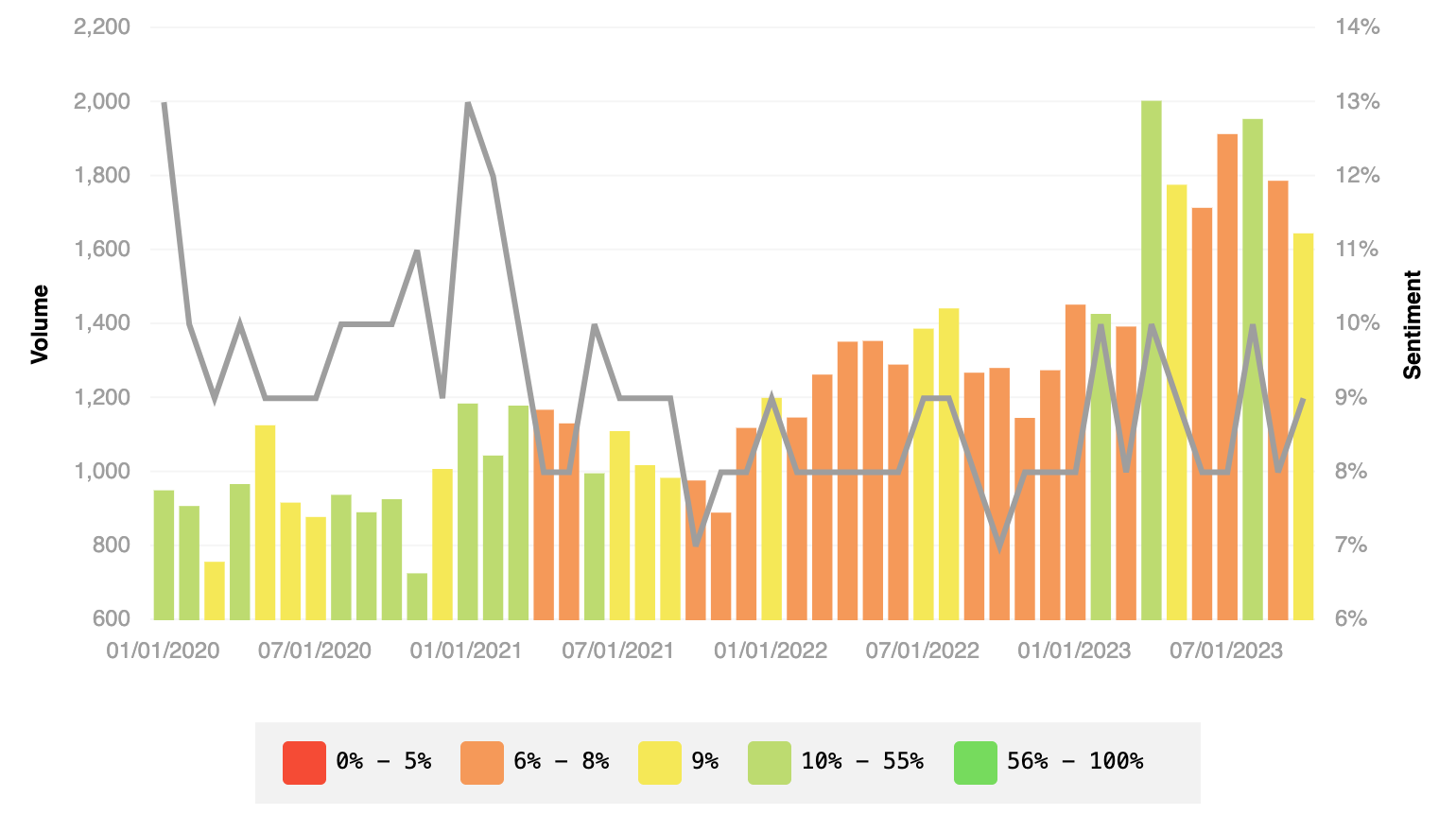

Wishlist: Incentivized only

Now we shift to incentivized reviews where a distinct wishlist emerges, emphasizing the need for enhanced accessibility and stock levels to meet the demands of eager consumers. There’s a specific desire for a dedicated brush tailored for concealer application, reflecting a nuanced expectation for precision in makeup application. Ease of use is paramount, as consumers express a wish for improved blending capabilities, underscoring the importance of a seamless and effortless application process. Furthermore, the call for more neutral and muted shades speaks to the evolving preferences for versatile color palettes that cater to diverse skin tones and occasions. These insights from consumers collectively highlight the importance of addressing availability concerns, providing specialized tools, improving product usability, and expanding shade ranges to create a more inclusive and satisfying experience for makeup enthusiasts.

Besides your consumers’ wishlist, another equally important topic is “Defects,” which outlines everything that was problematic with your product.

Product Defect: Total reviews and organic reviews only

In this case, the totality of reviews and organic reviews touched on the same defect issues. The cosmetics industry, despite its allure, is not without its challenges, as discerning consumers often encounter various product defects. From a broken can to the lack of a pump, and from leaking pipettes to loose and broken packaging, the issues span a spectrum of concerns. Broken straws and damaged lip containers further contribute to the array of challenges faced by consumers. The frustration extends to defective misters and leaking bottles, highlighting the need for improved product quality control. In a market driven by aesthetics and functionality, addressing these diverse defects is crucial for cosmetics brands to uphold their reputation and meet the expectations of their discerning clientele.

Product Defect: Incentivized Reviews Only

Now we isolated defects identified by incentivized reviews. They highlight a spectrum of product defects that have left consumers dissatisfied. Instances of broken brush tips, blush sticks, and highlighters underscore concerns about the fragility of these beauty essentials. The issue extends to eye shadow palettes, where breakage seems to be a recurring problem. Leaking products and malfunctioning pump dispensers add to the list of grievances, introducing an element of inconvenience for users. Furthermore, damaged packaging amplifies the challenges faced by consumers, emphasizing the need for cosmetics brands to prioritize durability and functionality in their product design and manufacturing processes.

Through the “Wishlist” and “Defects” topics, we’re able to see the range of consumer desires and pain points that can be addressed in any upcoming cosmetics roadmap. Do the same exercise for your own brand to further pinpoint your own consumer pain points and wishlist. Understanding consumer behavior across the cosmetics category and your brand allows you to enhance current product offerings and to remove any obstacles that may impact customer satisfaction.

Benchmarking: Your Cosmetics Brands Position

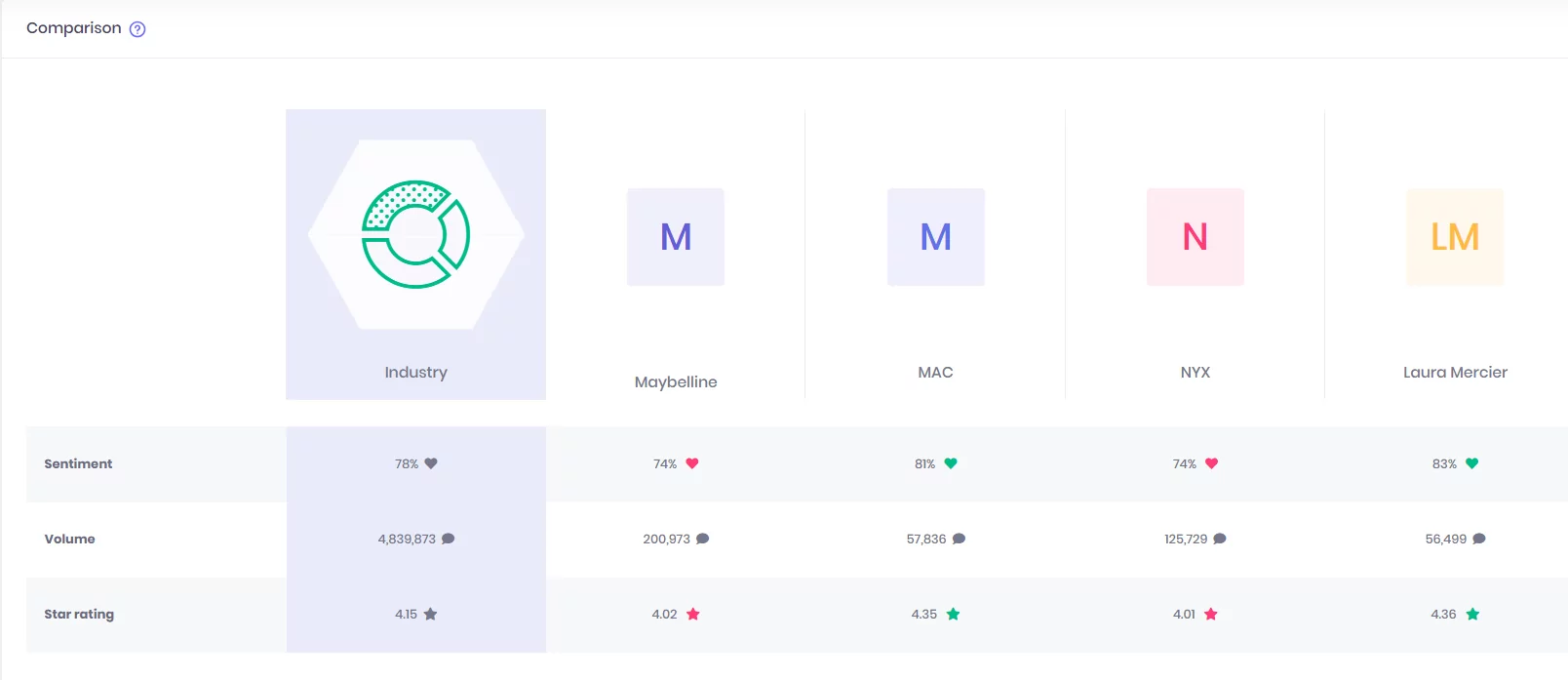

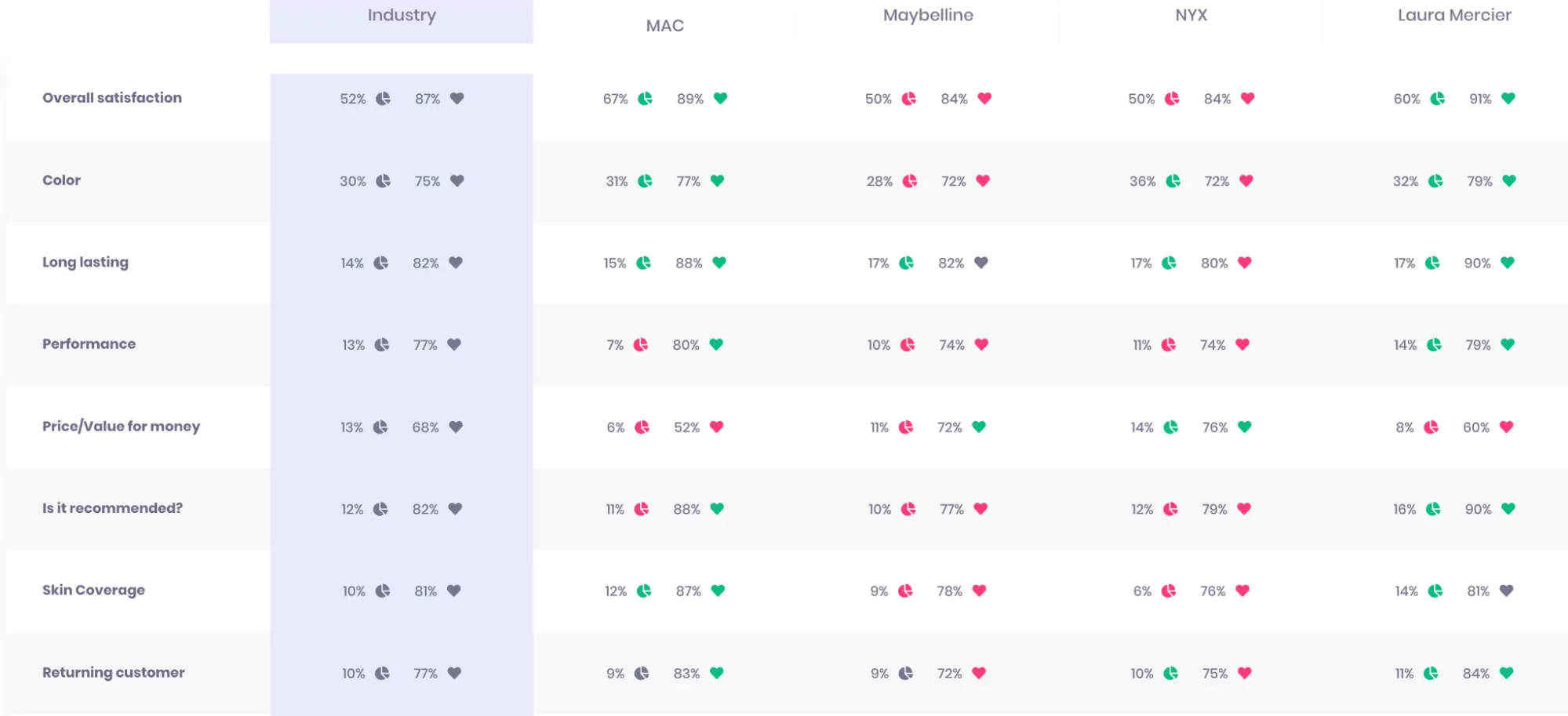

The power of Revuze’s category-level data is the ability to understand the entire cosmetics industry. What better way to develop products than to understand how your products measure up to competitors. As with the topic example, benchmarking can be done for all reviews or filtered for organic or incentivized reviews. Here we see the position of four major cosmetics brands in terms of discussion volume and consumer sentiment compared to the industry.

You have the ability to get very granular with the benchmarking. Here we can see the discussion volume of a range of topics and their consumer sentiment for the brands and across the industry. How does your brand measure up with the competition? What product areas can you optimize to ensure an improved iteration of your product? These are just a couple of questions that can help you prioritize your cosmetics product roadmap.

SWOT Analysis

To better understand opportunities to overtake the competition and areas for improvement, delve into the SWOT Analysis. In this example, we’re continuing with our four brands to better gauge where to put resources.

If you’re looking to optimize your cosmetics collection, delve into the weaknesses and threats section of the chart. The most prominent weaknesses are: “Waterproof,” “Spreadability,” “Color,” “Stickiness,” and “Cleansing & Removing.” Empowered with this knowledge, how can these areas be improved in your open cosmetics collection?

Similarly, in looking at the threats, “Performance,” “Skin Coverage,” “Results,” “Texture,” and “Hydration” emerge. What steps can you take with your line of cosmetics to ensure you maintain your competitive edge?

Product innovation is just as important as optimization. Dive into the opportunities section to identify white space areas. Here the “Smell” and “Price/Value for Money” topics stand out. How can you change your products’ pricepoint to surpass your competitors? How can you innovate better-smelling cosmetics to dominate the category?

Conclusion

Revuze’s category-level data arms cosmetics brands with the data they need to take their products to the next level. Whether it’s optimization, the robust topic list can provide unparalleled insights into what consumers want. For our example, we delved into the “Wishlist” and “Product Defect” topics looking at the impact of organic and incentivized reviews. Similarly, comparing your standing with your key rivals will help you identify their weaknesses and ways to make your products shine. Finally, take advantage of generative AI-powered SWOT analysis to both improve and innovate your cosmetics collection so you can dominate the industry. To learn more about how Revuze can help take your cosmetics products up a notch, click here.

All

Articles

All

Articles Email

Analytics

Email

Analytics

Agencies

Insights

Agencies

Insights