No matter your industry, as a business professional, you are always exploring ways to expand your business and make a significant impact. One viable strategy is to introduce a new product, while other times, you might contemplate entering an entirely new market. In the latter case, numerous questions must be answered before proceeding.

The solutions you seek lie in harnessing the power of online review analytics. Why, you might ask? Because Revuze provides you with category-level data, encompassing information about your products and your competitors. This enables you to delve into topic data and perform a SWOT analysis to pinpoint opportunities to challenge dominant players. It will also help you identify categories where it’s advisable to tread cautiously, as gaining a foothold might be challenging.

This blog post will delve into the various ways in which generative AI-based online review analytics can assist you in making the strategic decision to enter a new market.

Survey the Competitive Landscape

The initial step always involves thorough research, a process akin to “knowing thy enemy.” Regardless of the category you intend to venture into, Revuze furnishes you with the precise data you require. Here, you can assess the key players, differentiating between long-standing brick-and-mortar institutions and direct-to-consumer brands that might not gain recognition until it’s too late. Consider, for instance, companies like Rascal & Friends or Dyper challenging industry giants like Huggies and Pampers or Korean cosmetic brands like Etude House and Axis-Y taking on established powerhouses like Estée Lauder and L’Oréal. These are examples of relatively unknown brands infringing on the territory of dominant players, often without initially drawing significant attention.

As you delve into the data, there are key questions that demand your attention:

- Who are the dominant players?

- Does one player hold a monopoly on the market, akin to Heinz ketchup, Kikkoman soy sauce, or Hellmann’s mayonnaise? Or is the share of discussion divided among numerous smaller players?

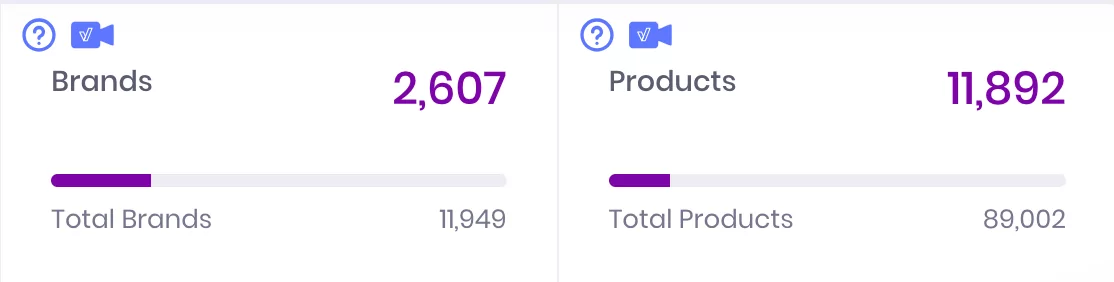

Consider the data in the condiments category, where there are over 2,500 brands and nearly 12,000 products.

Measuring Up the Competition in New Markets

So, how do you go about determining whether you can compete with a dominant player or multiple smaller ones? What metrics should you focus on? At this point, it’s crucial to evaluate both the brand and product’s share of discussion and sentiment.

In cases where a dominant player exists, is the sentiment generally high or low? If both the discussion share and sentiment are high, then it’s likely not a market worth considering for expansion. However, if the brand boasts a high share of discussion but receives low consumer sentiment, that opens up a different conversation. It presents an opportunity to understand consumer pain points and develop a superior product for success. Within just a few clicks, you can gain the insights needed to determine your course of action and start devising a strategy.

Tapping into Consumer Preferences

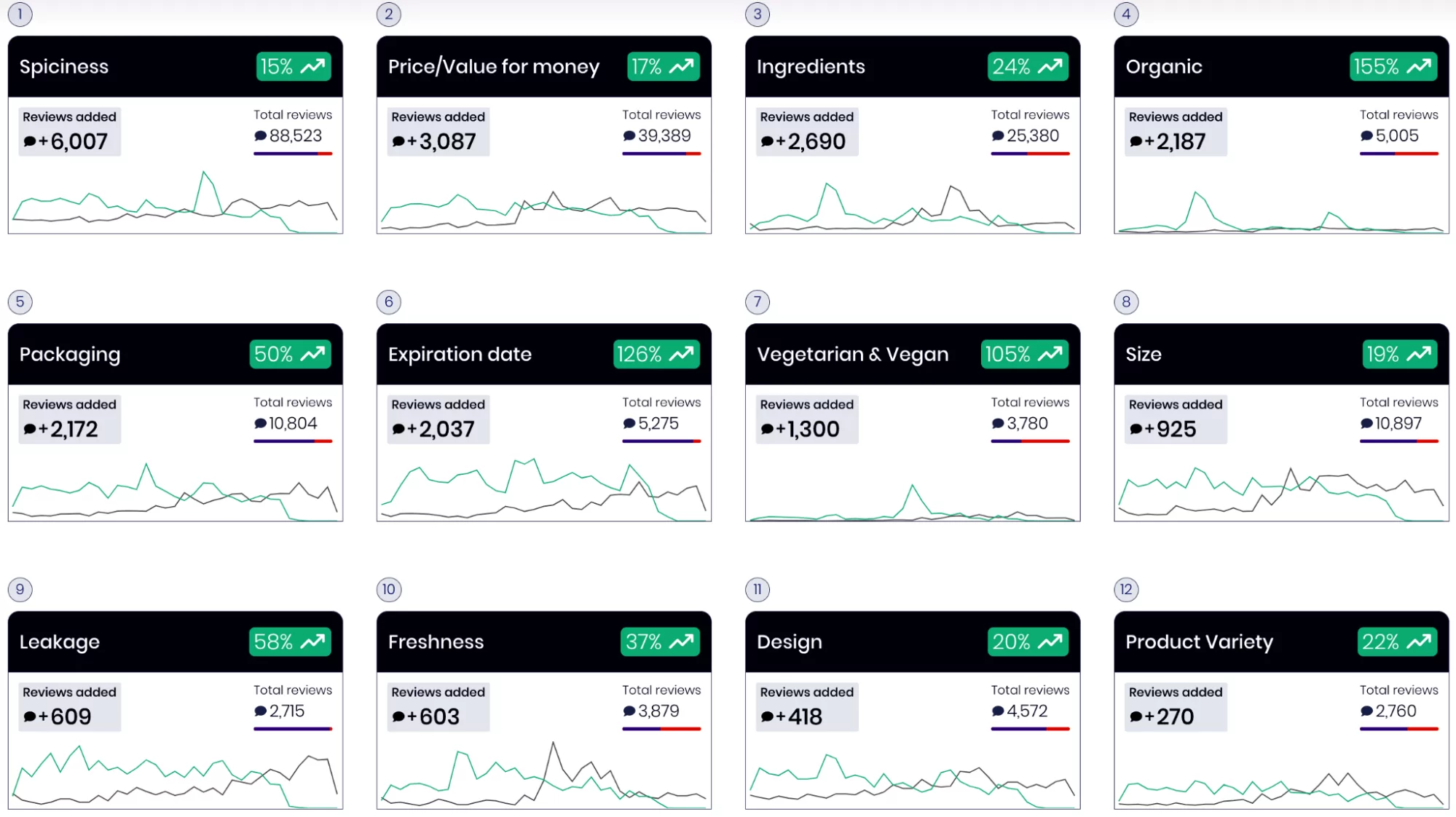

Whether the feedback is positive or negative, consumers tend to discuss the topics that matter most to them. Below are the top 12 topics that consumers prioritize within the condiment category. It not only highlights the volume of discussion for each topic but also breaks them down into organic and incentivized reviews. One noteworthy finding is the substantial increase in the share of discussion for “Spiciness,” with over 6,000 new reviews. Other crucial topics encompass “Price/Value for Money,” “Ingredients,” and “Organic.” These topics represent opportunities for your brand to innovate and create new products that cater to consumer preferences.

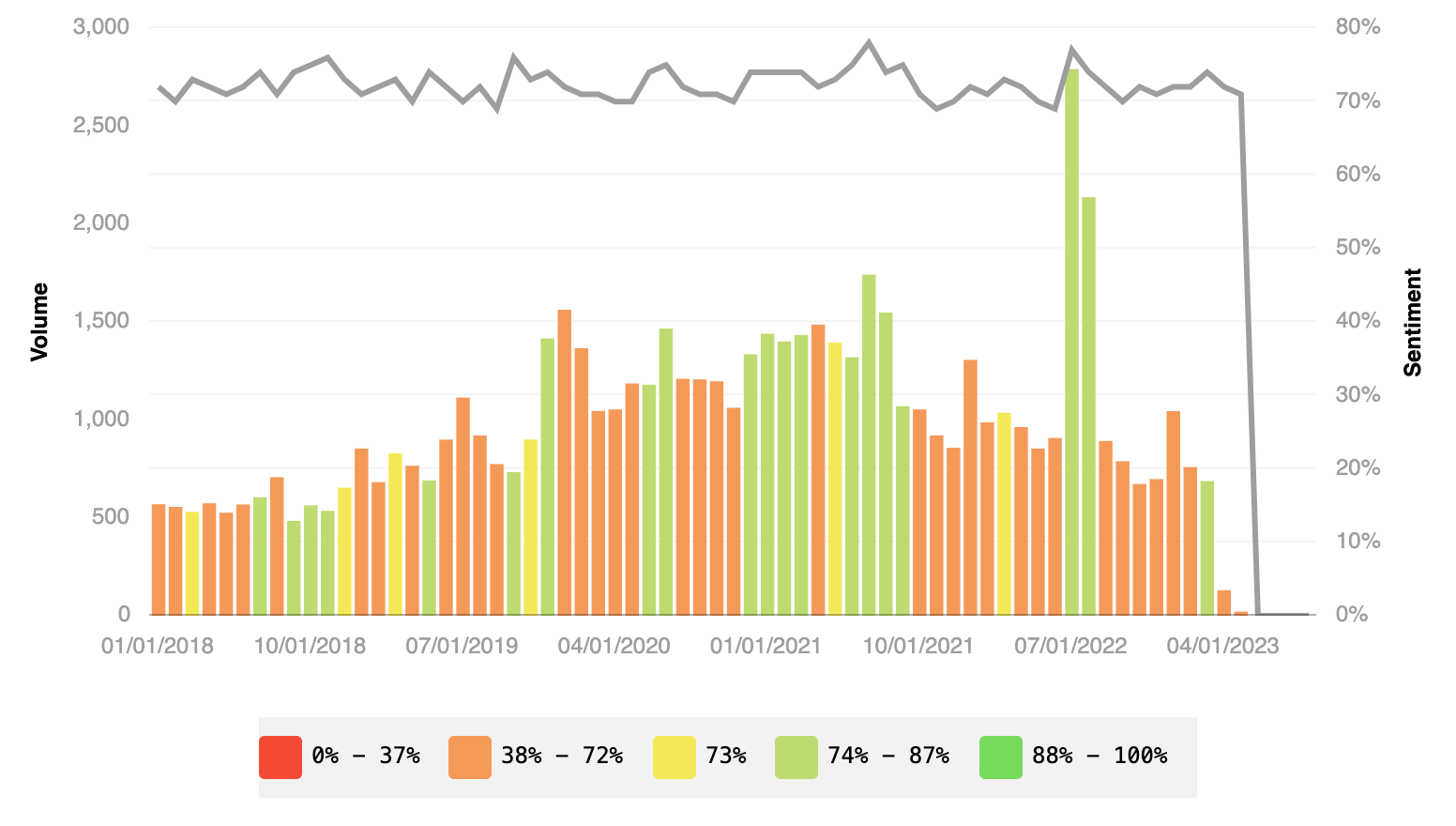

What is it that consumers value when it comes to spiciness? As shown in the chart below, the feedback about spiciness varies, with periods of both negative and positive skew.

When we delve further into the consumer opinions we can pinpoint what the spiciness issues are:

- “I’m really disappointed because it looked great but its honestly one of the most bland hot sauces I ever had.”

- “Love the yummy slight spicy kick of this spread and that it is made with avocado oil which is so much better for you!”

- “it’s not spicy and is way too garlicky, it’s more of a sweet garlic sauce.”

- It’s definitely not the same sauce as the classic Sriracha brand, more garlicky and less spicy, but still a good option during the Sriracha shortage.

This sample of consumer opinions highlights essential preferences. Consumers value spiciness, and they dislike bland condiments. Garlic is mentioned several times, and consumers don’t prefer an excessive amount of it. By considering this small data sample, we can begin to envision the new product we aim to launch in the new market.

This example demonstrates how to approach the topic of spiciness, but the same principles apply to other topics and categories. If there is negative sentiment around the “Ingredients” topic, it may present an opportunity to introduce an all-natural product without artificial sweeteners, food coloring, or MSG. Shifting to the fragrance category, “Smell” emerges as the most important topic. Consumer feedback guides your decision-making, helping you identify preferred and disliked aromas, allowing for the launch of a new fragrance line in response to market demand.

Measuring Your Success

After conducting thorough research to determine the markets in which you can succeed, you launch your new product portfolio. Now, you want to gauge if you’ve reached your target market. This is when you dive into the SWOT analysis.

For example, if you launched a new spicy condiment with organic ingredients, you need to assess how frequently these topics are mentioned when discussing your products. Benchmark your performance against other brands in the same category. If “Spiciness” comes up in 1 out of 100 reviews and “Organic” in 5 out of 100 reviews, compared to your own product receiving mentions in 10 out of 100 reviews for spiciness and 20 out of 100 for organic ingredients, it’s safe to assume you’ve found your audience. Congratulations! However, if these topics have a negative sentiment, it indicates that you’ve reached your target audience but failed to satisfy your consumers. On the other hand, if there’s no mention of these topics from verified buyers, it suggests that you’ve missed the mark, and it’s time to reevaluate your approach.

Conclusion

The power of online review analytics from verified buyers cannot be overstated when it comes to making strategic decisions, especially when venturing into new markets. With the help of generative AI-based tools like Revuze, businesses can gain invaluable insights to survey the competitive landscape, measure up the competition, tap into consumer preferences, and topple the competition. By analyzing category-level data, businesses can make informed choices on where to enter and where to steer clear, whether they’re up against dominant players or numerous smaller ones. It’s not just about identifying opportunities; it’s about understanding sentiment and consumer pain points, which can lead to better product development and strategic success. So, when it comes to taking on new markets, online review analytics is the compass that guides you toward successful market entry and business growth.

All

Articles

All

Articles Email

Analytics

Email

Analytics

Agencies

Insights

Agencies

Insights