Who hasn’t worked an all-nighter and grabbed a Red Bull? The energy drink brand owned the market for quite a long time with its creative campaigns and select product mentions. However in 2002, Monster Energy launched their own beverage line and caught up from behind to take a third of the energy drink market, the #2 position.

As Monster competes for the top spot, how can Red Bull protect its market share and maintain its coveted role as the king of energy drinks?

This blog will delve into the rivalry between these two industry leaders and identify areas where Red Bull can gain an edge, drawing insights from online review analytics provided by two key online e-tailers: Amazon and Walmart.

The Story the Reviews Tell

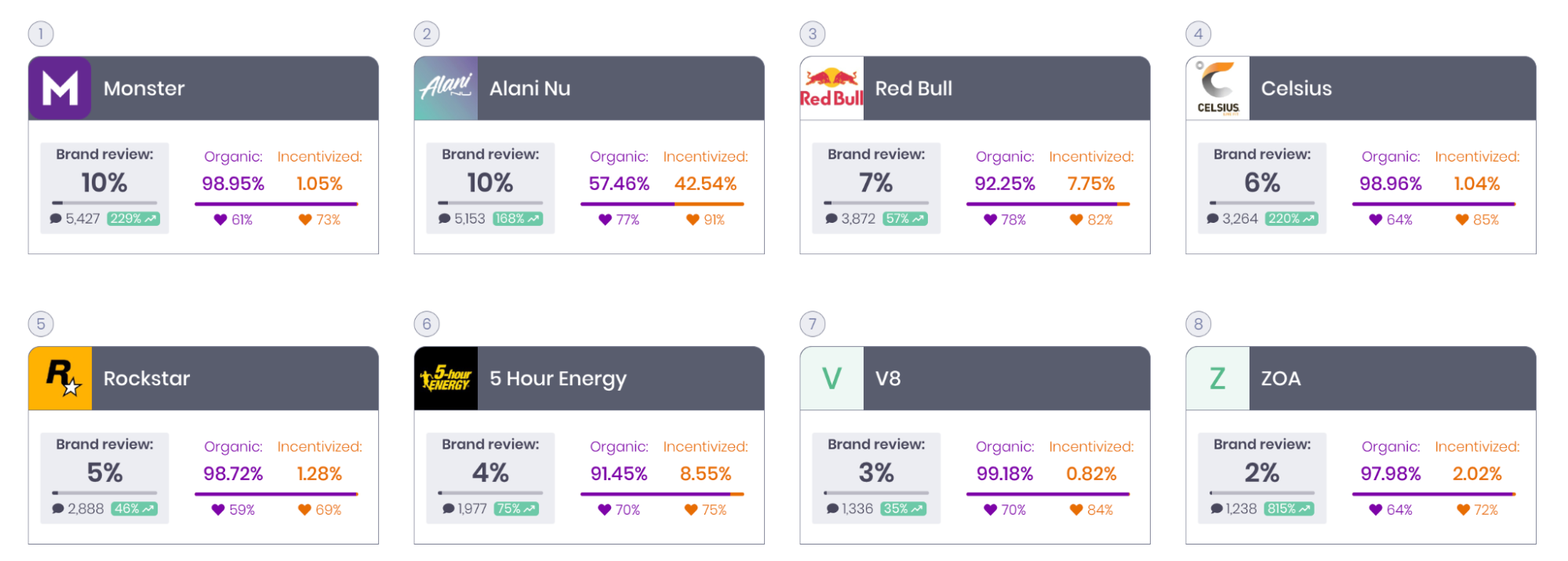

When we examine market share, we observe that Monster Energy’s share of voice surpasses that of Red Bull, with 5,427 reviews compared to Red Bull’s 3,872. When we break down these reviews into organic and incentivized categories, a noteworthy distinction emerges. An overwhelming 98.95% of Monster’s reviews are organic, with a consumer sentiment of 61%, rising to 73% for incentivized reviews. It’s crucial to note that incentivized reviews tend to skew more positively. Red Bull, conversely, garners more incentivized reviews, at 7.75%, with a consumer sentiment of 82%. However, consumer sentiment from organic reviews stands at 78%.

Monster’s Marketing Strategy

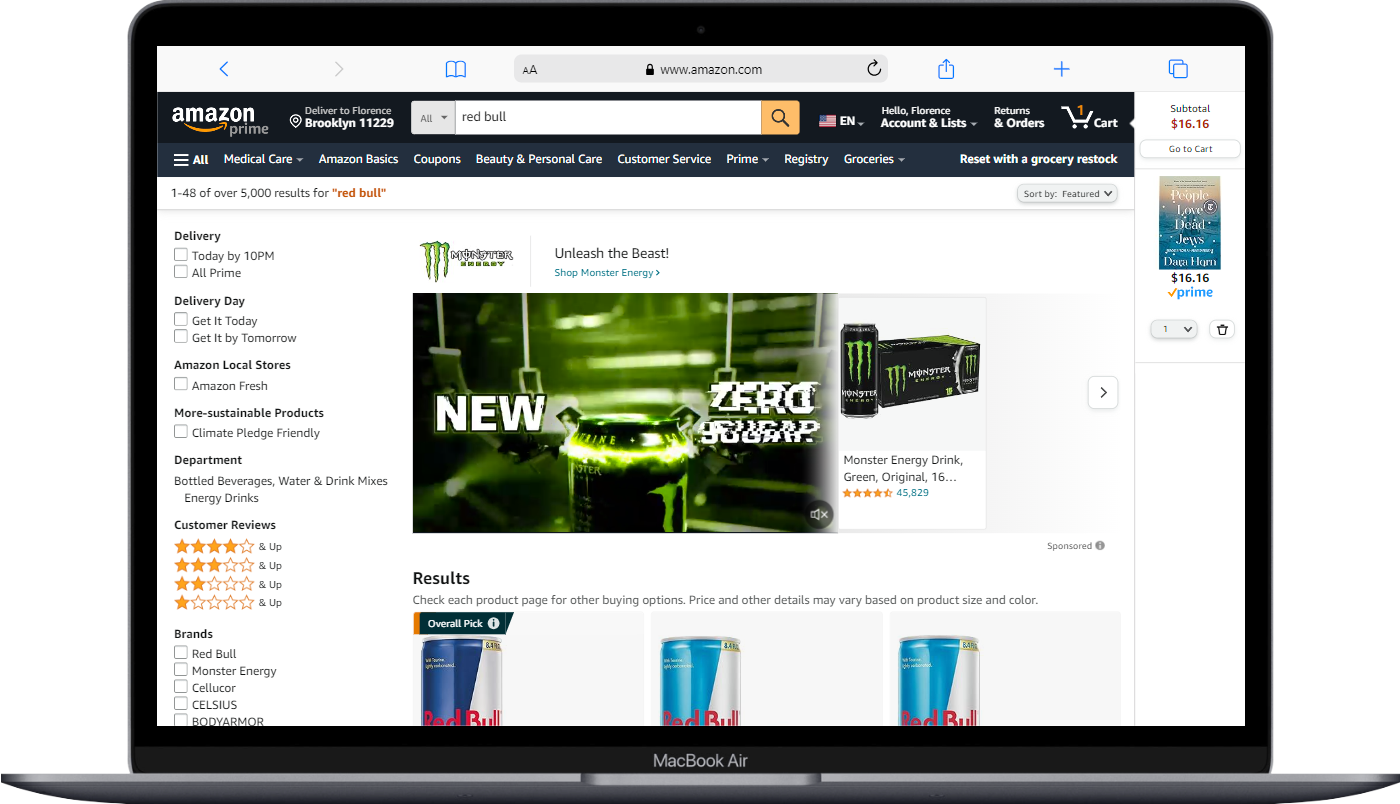

It’s no secret that Monster aims to dethrone Red Bull, as evident from their aggressive marketing tactics. When you search for Red Bull on Amazon, users are served with a Monster Energy campaign complete with a video, static sponsored spots, and a link to their branded Amazon store. Similarly, when you search for Monster Energy, you also get a Monster banner campaign on the search engine results page.

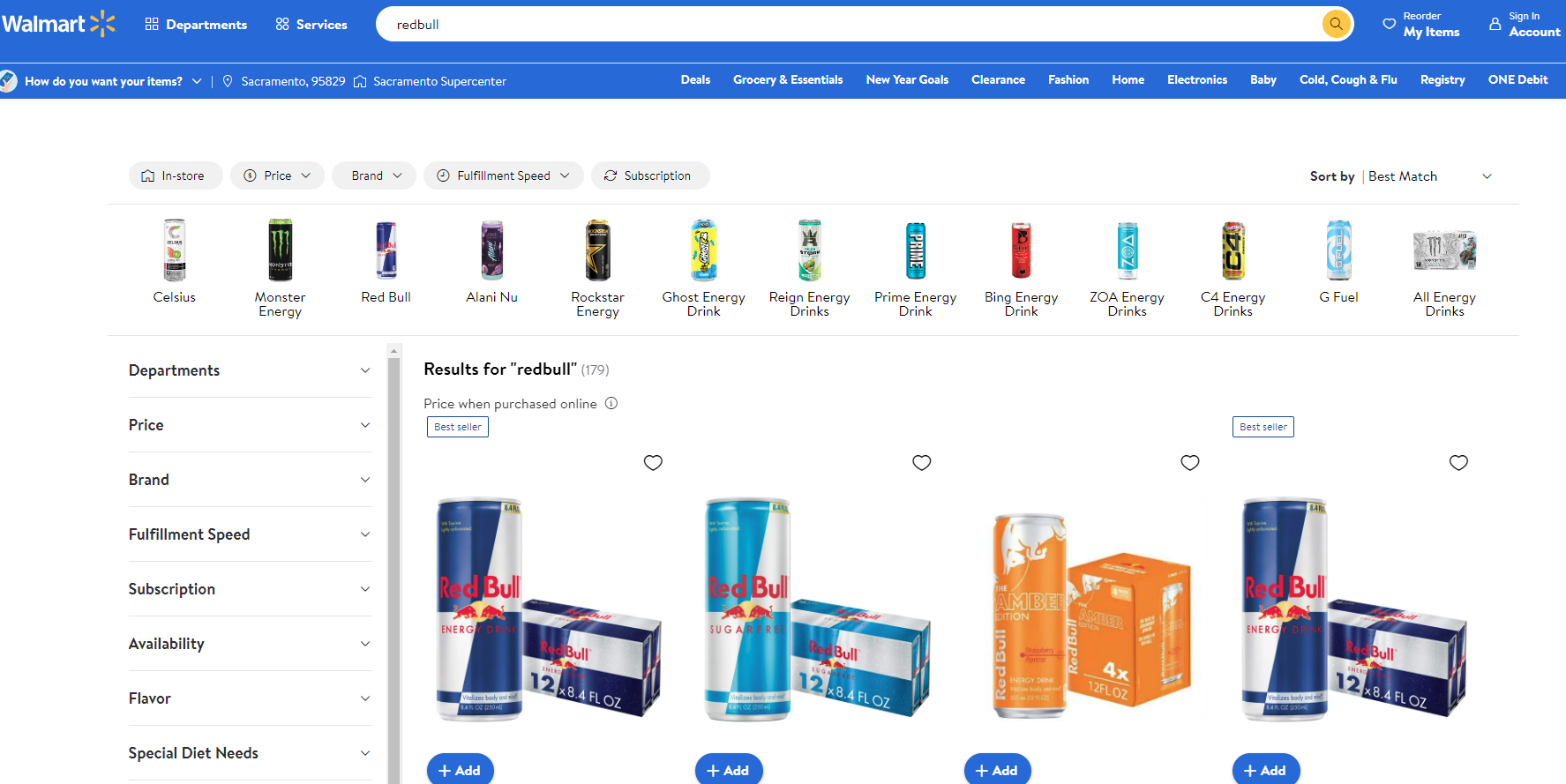

On Walmart, Red Bull doesn’t seem to allocate additional budget to make their product stand out. The search engine results page instead displays Red Bull products, while Walmart highlights similar competing brands.

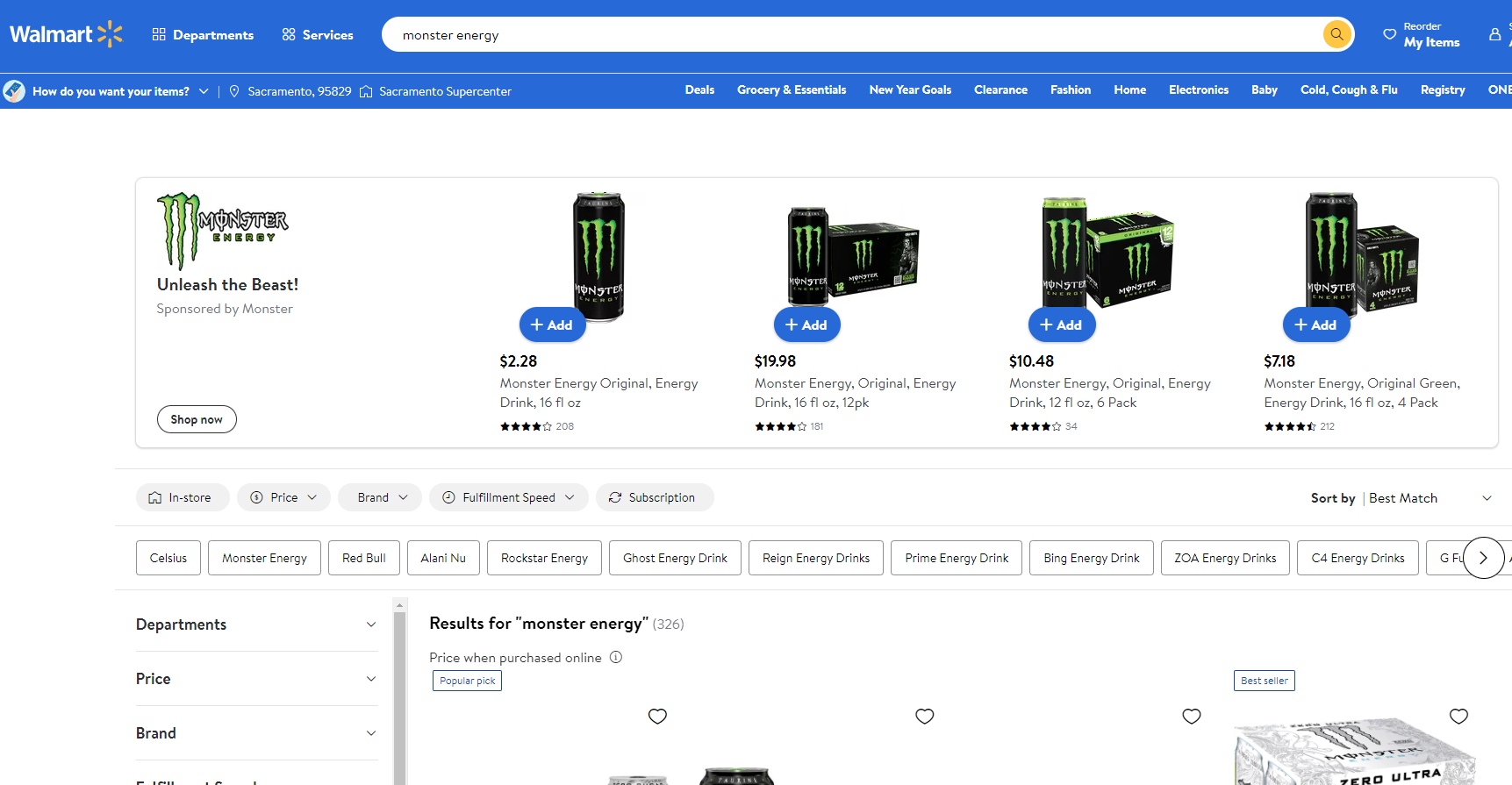

In contrast, Monster Energy leaves no room for customers to stray, boldly pushing a sponsorship banner that enables consumers to purchase their products instantly.

What’s Driving Ratings for the Energy Drink Category

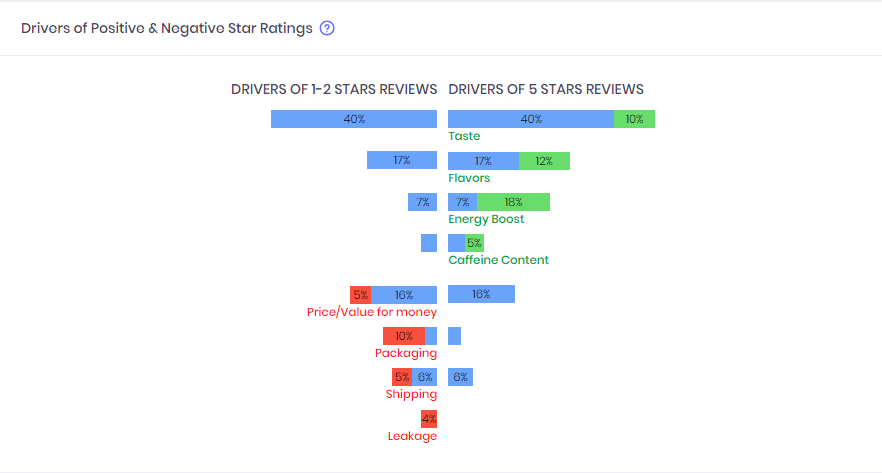

Now that we have a grasp of the Energy Drink category landscape, let’s delve into consumer behavior. A logical starting point is to examine the factors driving five-star ratings. The “Taste” category significantly stands out across the entire category.

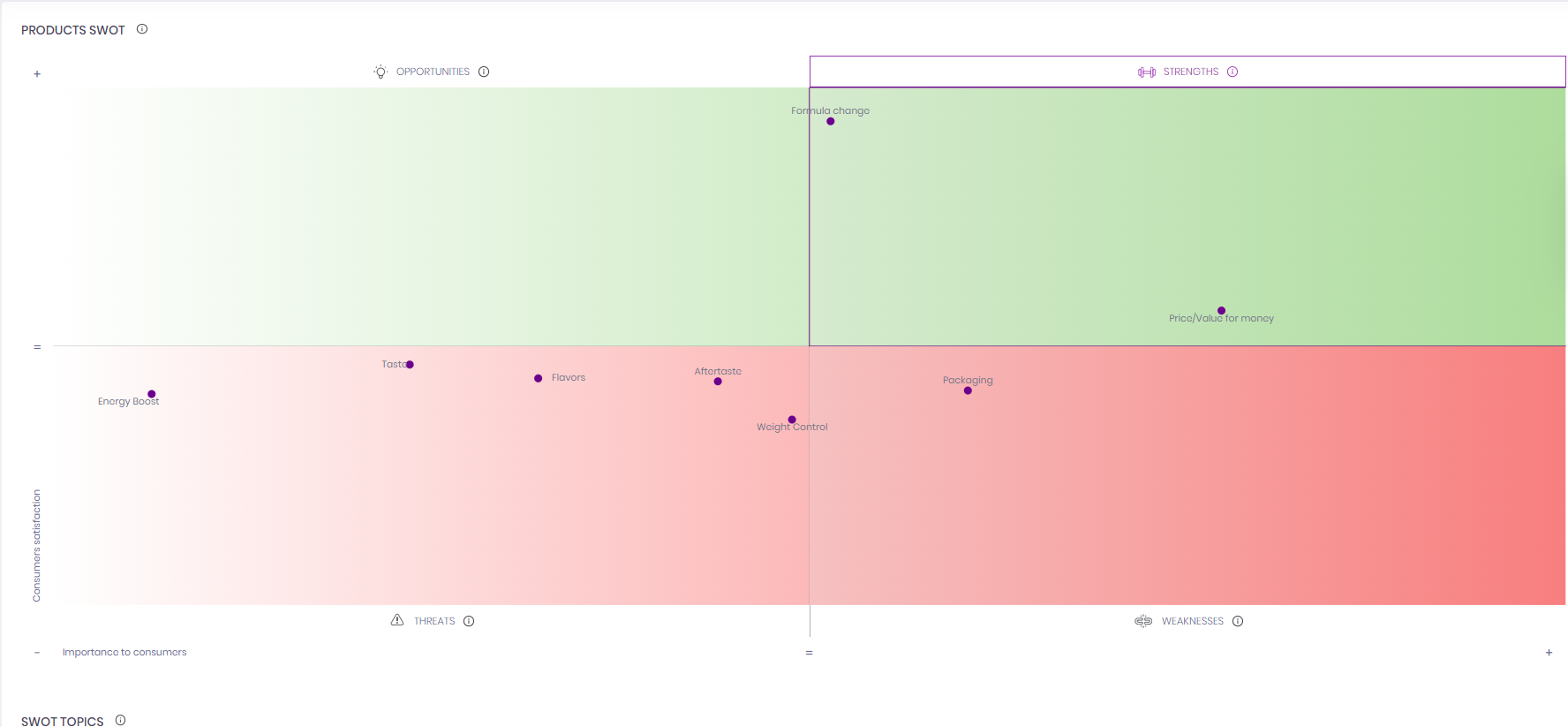

Red Bull SWOT

When examining Red Bull’s SWOT analysis, it becomes apparent that “Taste” is indeed a major strength for the brand. Additionally, “Flavors” prominently feature in the SWOT. The other two key drivers, “Energy Boost” and “Caffeine Content,” present areas of opportunity for Red Bull. Interestingly, a topic not identified as a driver but correlating with “Flavors” is “Seasonality,” which overindexes by 581%. Red Bull strategically releases seasonal flavors such as Winter Edition Pear Cinnamon Energy, Summer Edition Juneberry Energy, Watermelon Energy Drink.

One reviewer writes, “It provides the same energy boost you expect from Red Bull, with a burst of summer in every sip.” Another says, “It will be a sad day when they faze this winter edition out I would gladly drink it year round.”

Monster Energy SWOT

Turning our attention to Monster Energy’s SWOT analysis, it paints a different picture of the brand. Its only strengths are “Formula Change” and “Price/Value for Money,” with no meaningful opportunities to speak of. In general, Monster Energy beverage cans contain 16 ounces, in contrast to Red Bull’s 8.4 or 12 ounces. Intriguingly, Monster Energy drinks overindex on the “Price/Value for Money” aspect by 46%.

One consumer writes, “For the price point of about $1 a piece and being sugar free these are awesome.” Another says, “Price has risen, but still a good deal.”

A close examination of their SWOT reveals that the major drivers for five-star ratings, such as “Taste,” “Flavors,” and “Energy Boost,” are all listed as threats for the brand.

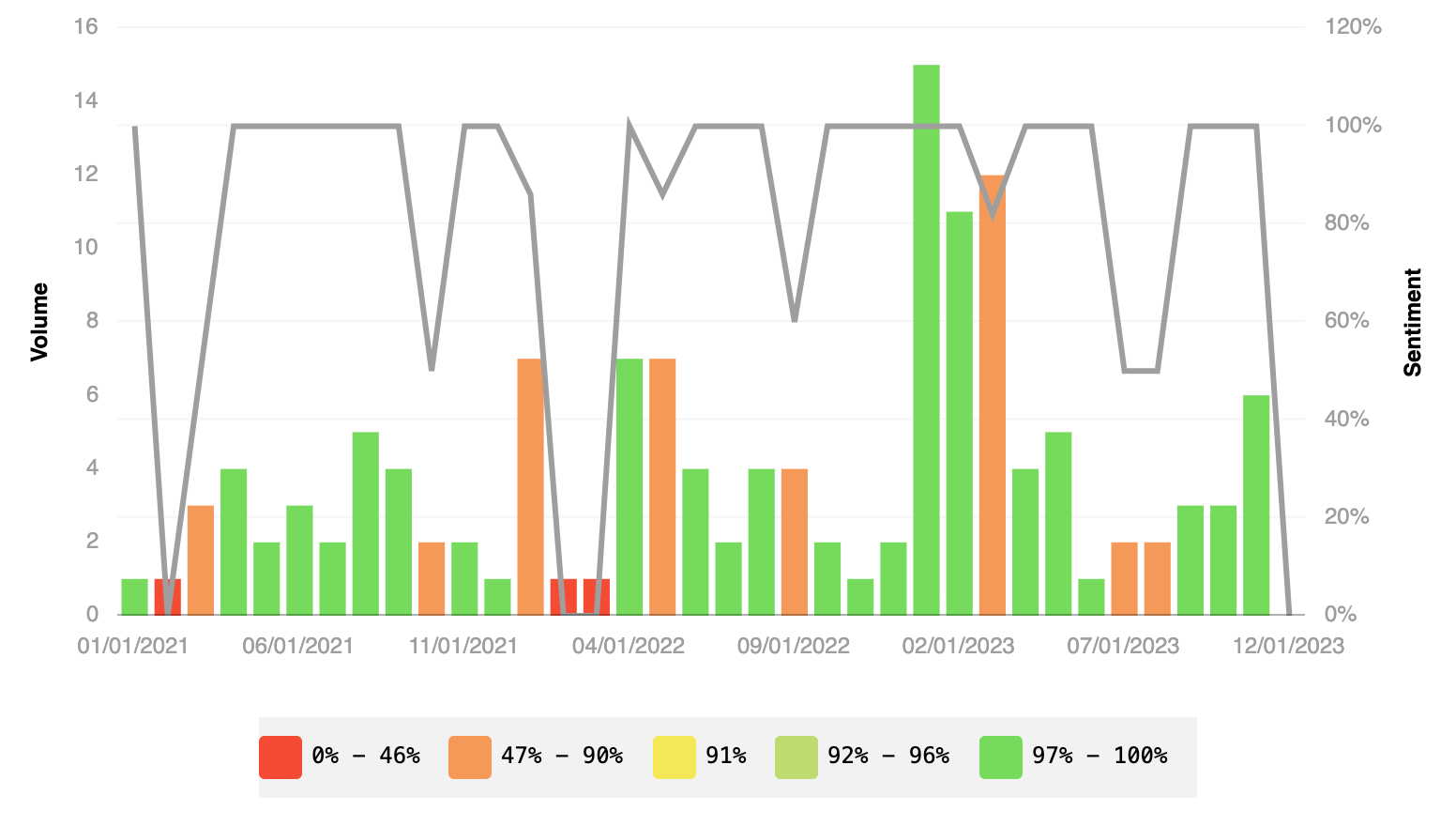

A Closer Look at Red Bull & Seasonality

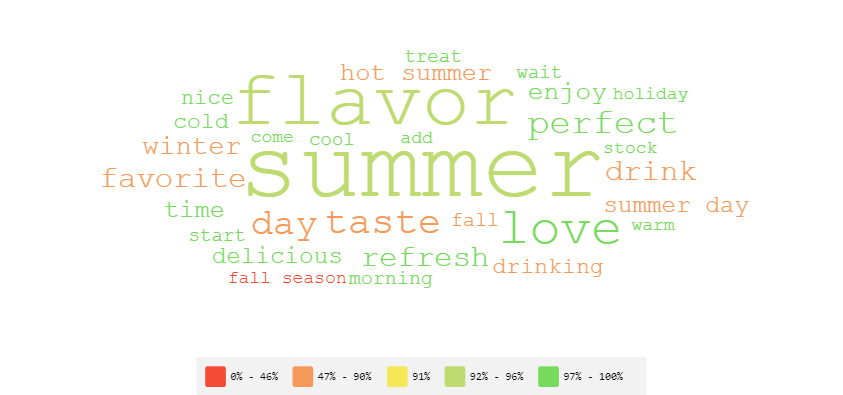

Below, we observe the trend for “Seasonality” topics related to Red Bull, which spikes in January 2023. Given the positive sentiment for it, it’s no wonder that the topic overindexed. Upon closer analysis, we find that consumer feedback centers around Red Bull’s Strawberry Apricot flavored energy drink. One consumer writes: “This Red Bull flavor is like all the flavors of summer crammed into a can.”

Beyond the trends depicted in the graph, the language used by consumers is notably positive. Words like “Summer,” “Flavor,” “Refresh,” and “Delicious” prominently appear in the word cloud, reflecting positive sentiment from consumers.

The Bottom Line

So, what is propelling Monster Energy’s success? It’s evident that Red Bull’s product characteristics are more highly valued than Monster’s. In fact, the SWOT analysis highlights that Monster has opportunities to innovate and optimize its current product offerings. Consumers do appreciate that they get more value for their money with Monster.

However, when it comes to “Taste” and “Flavor,” Red Bull emerges as the winner. The significant difference lies in their investment in different marketing channels. Whether it’s on Amazon or Walmart, Monster outshines Red Bull with bold banners and videos, compensating for any shortcomings in its product.

Conclusion

In the ever-intense competition between Red Bull and Monster Energy for the top spot in the energy drink market, both brands have distinct strengths and areas for improvement. Red Bull’s exceptional taste and flavor offerings have garnered a loyal following, but its marketing efforts may need a boost to match the aggressive campaigns of Monster Energy. Monster, on the other hand, excels in marketing, with a focus on value for money and larger can sizes, but it could improve its product characteristics, particularly in taste and flavor. The battle continues, and only time will reveal which brand will emerge as the ultimate leader in the energy drink industry. To learn more about how Revuze’s online review analytics can keep your brand on top, click here.

All

Articles

All

Articles Email

Analytics

Email

Analytics

Agencies

Insights

Agencies

Insights